Market Brief

Euro remains under pressure, The US Equities maintained its gains

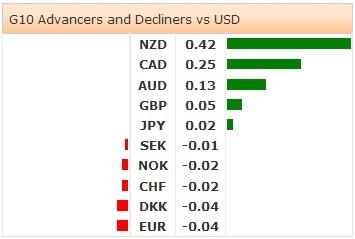

Once again, Euro remains under pressure, indicating to the fact that the fluctuations of the Euro were not considered as direct action, however Euro reacted to the USD strength as the USD gained in the last few days. The current level of Euro reflects the sociopolitical conditions in Euro Zone. Politically speaking, The Ukrainian – Russian talks in Belarus yesterday didn’t come out with a result. From economic perspective, the Euro zone economy hasn’t improved, especially the negative German figures two days earlier. Euro has been affected by Draghi’s speech, he said that the ECB will be ready to step forward and support the economy. The European stock indexes gained in the last two days , Euro retreated by -0.07% edging lower to $1.3157 today in Asia. The European equities increased yesterday, German DAX 0.82%, Swiss 0.72% and UK FTSE 0.70%. It will be important to watch the German consumer confidence survey later today, however the expectations indicate to stability. The investors must be careful as the German figures could surprise the markets, and go downside. It is important to say that the current weakness of Euro doesn’t terrify the European policymakers, but the sluggish economic performance and the high unemployment matter.

In the US, the economic figures were positive enough to lead the gains in the US equities. The US durable goods orders increased by 22.6% in July, the housing price index improved by 0.4% from 0.2% and the US consumer confidence rallied to 92.4 from 90.3 in July , the highest in six years. Generally speaking, the US economic figures excited the investors who rushed to buy the US equities, and bet on the USD strength. The US equities had massive gains in the last few sessions; S&P had a record at 2000.02 yesterday, Dow Jones 0.17% and NASDAQ 0.29%. In Japan, the Japanese government didn’t change the economic assessment saying that the Japanese economy has a moderate recovery; however Japan’s government seemed more cautious than before. The Japanese stock indexes had no major changes today, Nikkei 0.03%, Topix -0.03%, while the USDJPY remains almost stable at 104.03 today morning, as the Yen increased only by 0.2%.The foreign bond investment, and the foreign investments in the Japanese stocks will be released later today. It’s good to say that the continuous purchasing of the foreign bonds by the Japanese investors will lead to weaker Yen. Japan has now deep discussions about the current level of the sales tax, and many policy makers warned of higher tax in the next coming years. In the meantime, the Japanese banks cut mortgage rates to enhance the growth in real estate sector.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.