Market Brief

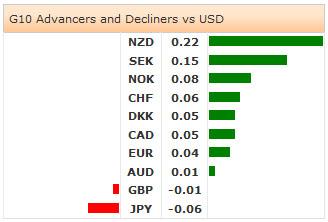

The US earnings season started with Alcoa posting better-than-expected result in the second quarter. USD will remain under pressure today with Fed minutes due at 18:00 GMT; we do not expect any surprises. Fed’s Lacker and Kocherlakota sounded cautious in their comments yesterday; the dovish tone is however broadly priced in. USD retraces post-NFP gains walking towards Fed minutes.

NZD/USD tests fresh highs this week, European traders brought the pair to 0.8818 as soon as they stepped in. The pair trades in the mid-range of its uptrend channel building since mid-June. Comments from RBNZ’s McDermott confirmed the hawkish policy outlook; a daily close above 0.8770 should keep the bias on the upside. The key resistance stands at 0.8843 (August 2011 high). AUD/NZD extends weakness to 1.0660 (July support), a breakout below this level will shift the focus to 1.0649 (May low), 1.0540 (March support), then 1.0493 (2014 low, lower levels since end-2005).

USD/CNY dropped aggressively to three month lows (6.1933) as US-China talks started in Beijing on numerous issues from cybersecurity to Asian maritime disputes. The Chinese consumer price inflation accelerated at the slower pace of 2.3% in June (vs. 2.4% exp. & 2.5% last), the producer prices contracted by -1.1% (vs. -1.0% exp. & -1.4% last) pulling the factory-gate prices at lowest levels in more than 2 years. The Chinese inflation remains way below PBOC’s 3.5% official target, thus giving flexibility for more monetary stimulus. We expect resistance to Yuan strength at 6.1803 (Fibo 61.8% on Jan-April rally).

USD/JPY and JPY crosses were better bid after a difficult New York session. USD/JPY retreated to 101.45 in Tokyo as USD continued retracing last week’s post-NFP gains. Trend and momentum indicators remain flat, resistance is eyed at 101.84/102.02 (200-dma / daily Ichimoku cloud base), then 102.47 (cloud top). All depends on global USD appetite pre-Fed minutes. EUR/JPY is still hovering around its 21-dma. The 50-dma (139.25) crossed 200-dma (139.30) on the downside, technically favoring the short-side of the play.

EUR/USD extends gains to 1.3631 on broad-based USD weakness. The pair has broken its 200-dma post-NFP/Draghi on Thursday July 3rd; the key resistance is naturally at this level. The MACD (12, 26) is still marginally positive and ready to favor the upside if 1.3572/76 (MACD pivot / July 7th low) support holds. The ECB President Draghi will speak in London today (18:30 GMT), we do not expect any surprises out of this lecture.

The Cable recovers losses on heavy disappointment due to May production data released in London yesterday. GBP/USD steadily paired losses to hit 1.7147 in London open. Technically, GBP/USD tests June-July uptrend base, with trend and momentum indicators still favoring the upside. The critical resistances are placed at 1.7180 (year high), 1.7259 (30-day upper BB), then 1.7332 (50% retracement on 2008 decline). On the downside, bids should come into play at 1.7000/41 (optionality/21-dma). The two-day BoE meeting starts today, the verdict is due tomorrow. We expect no changes from the BoE meeting.

All eyes are on the Fed minutes from June 17-18th meeting. No surprises are expected. The economic calendar of the day: Swedish June Unemployment, HUK Halifax June House Prices m/m & 3m/y, Spanish May House Transactions, US July 4th MBA Mortgage Applications, Canadian June Housing Starts.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.