There have been some important movements in the FX market in the last 24 hours. GBP has moved into a new trading paradigm that could see it fall substantially lower in the coming weeks, EURUSD looks like 1.30 could be on the cards again and gold is close to 12 month lows. In sharp contrast the dollar is moving higher, and on the back of the FOMC minutes yesterday the dollar index broke above its 200-day sma at 80.95.

So is the dollar about to make its long-awaited breakout? It’s time to analyse the strength of the arguments for and against:

For a stronger dollar:

1, The shift in tone at the FOMC:

The minutes from the January meeting suggest that “many participants” expressed concerns about the “potential costs and risks” arising from further asset purchases. It was also the first time that the FOMC has suggested that open-ended QE could end or taper off before a “substantial improvement in the outlook for the labour market had occurred”. BOE governor Mervyn King said earlier this month that central bankers had to run up an increasingly steep hill when it came to the economic effectiveness of QE. It looks like the FOMC may be running out of puff. Since QE is considered dollar negative, signs the Fed is losing its enthusiasm for asset purchases should be dollar positive in the medium-term.

2, Relative monetary stances:

The sharp decline in GBPUSD has been driven by a toxic mix of a more dovish than expected BOE and a less dovish than expected Fed. The BOE minutes, also released yesterday, sent the pound on its way down yesterday as the market digested news that two other MPC members joined David Miles in voting for more QE. The fact that no extra QE has been implemented and Governor King is still being out-voted didn’t seem to matter; neither did the fact the Fed is still embarking on open-ended QE although there is a debate about its effectiveness. The market wanted another reason to sell sterling, and this could see it fall below the key psychological 1.50 level in the coming months.

3, Relative growth stance:

The US economy may not be going like the clappers, but at least it’s not looking as pathetic as the Eurozone recovery. The PMI data for February showed that the so-called 2013 ”recovery” may have stalled already, only two months into the start of the year. The manufacturing survey reading dropped to 47.8 from 47.9 in January, and the service sector also fell to 47.3 from 47.8 last month. Even Germany saw a pullback from January’s highs, even though its survey readings continue to make the French economy look more and more like a periphery. This increases the uncertainty of future ECB policy. Mario Drgahi hinted at his concern about deflation at the February ECB meeting, which the market took to mean a rate cut. We know that a cut is unlikely to sit well with the Bundesbank; however, if the growth outlook continues to weaken then we could see a rate cut sometime in Q2, when the ECB’s expectation for a sustained economic recovery in the second half of the year looks less likely. The next ECB staff economic projections will be presented at the March ECB meeting, if these revise down the growth and inflation forecasts sharply then the market might sniff a rate cut is coming, which could weigh on the euro even more.

But what about the arguments against a stronger dollar?

1, Treasury yields are lagging the dollar rally

10-year Treasury yields have fallen back from 2% in recent days, even with news of the Fed’s doubts about the longevity of QE-eternity. 2-year yields are still hovering around 0.25%. Right now the market seems hesitant to sell Treasuries in any great bulk, as details of how the Fed could “stop” QE remain unclear. We believe the most likely outcome is a slow, incremental end for QE3 (if or when it happens), as the Fed is unlikely to want a spike in borrowing rates as the economic environment remains extremely fragile. This could keep a lid on rates for now, which may cap dollar gains.

2, What if jobs data fails to pick up?

If Bernanke could print jobs instead of money he would be a happy man, but he can’t and that is why the future of monetary policy in the US remains uncertain even if there is some unease with the pace of balance sheet expansion at the Fed. Employment is a lagging indicator and if we get another mid-year economic malaise the labour market could continue to improve even if the economic recovery is faltering. Since full employment is one of the Fed’s mandates, it may not want to end policy support until the economy is on a firmer footing.

What does this mean for FX:

This research note is arguing that although the Fed may be debating the “efficacy and costs” of open-ended QE, the future of monetary policy in the US is highly uncertain. The Committee appears split between those who don’t want to end QE until the unemployment rate is back at 6.5%, and those who want to end it earlier. This makes the March payroll numbers particularly important. Until then we think the dollar could drift higher, although the outlook for bond yields is more nuanced, which could keep a lid on USDJPY gains in the medium term.

GBP looks particularly vulnerable as the BOE looks set to engage in more QE just as other banks are scaling their programmes down (apart from Japan, of course). The EUR is also at risk form a sell off on the back of a potential rate cut at some stage by the ECB. Interestingly, the perception of a rate cut (rather than an actual cut) could weaken the euro over the coming weeks and months making an actual cut unnecessary. Although we foresee medium-term EUR weakness towards 1.30, and potentially 1.27, the single currency could pick up again later this year.

What does this mean for stocks?

Liquidity have been their life blood, can they survive without it? Only if Treasuries start to sell off leading to the much-feted great rotation, do we believe that stocks can move to fresh all-time highs. We have spoken about the “painful” move higher in stocks recently that seems divorced from economic fundamentals, which makes us wary of a medium-term pullback. Global markets are lower post the FOMC minutes, which suggests that the markets will need a pullback to adjust to a world where even the thought of an end to QE is frightening. Thus, we wouldn’t be taking a long position in stocks right now, and instead foresee a move back towards 1,480 in the SPX 500 in the near term. Gold is failing to attract buyers right now, which is fuelling its sell off. It is starting to look oversold at $1,560, however, so it could pull-back to the $1,580 mark in the short term. We think that any pullbacks will be shallow and that the $1,540 lows from May 2012 are on the cards.

Ones to watch:

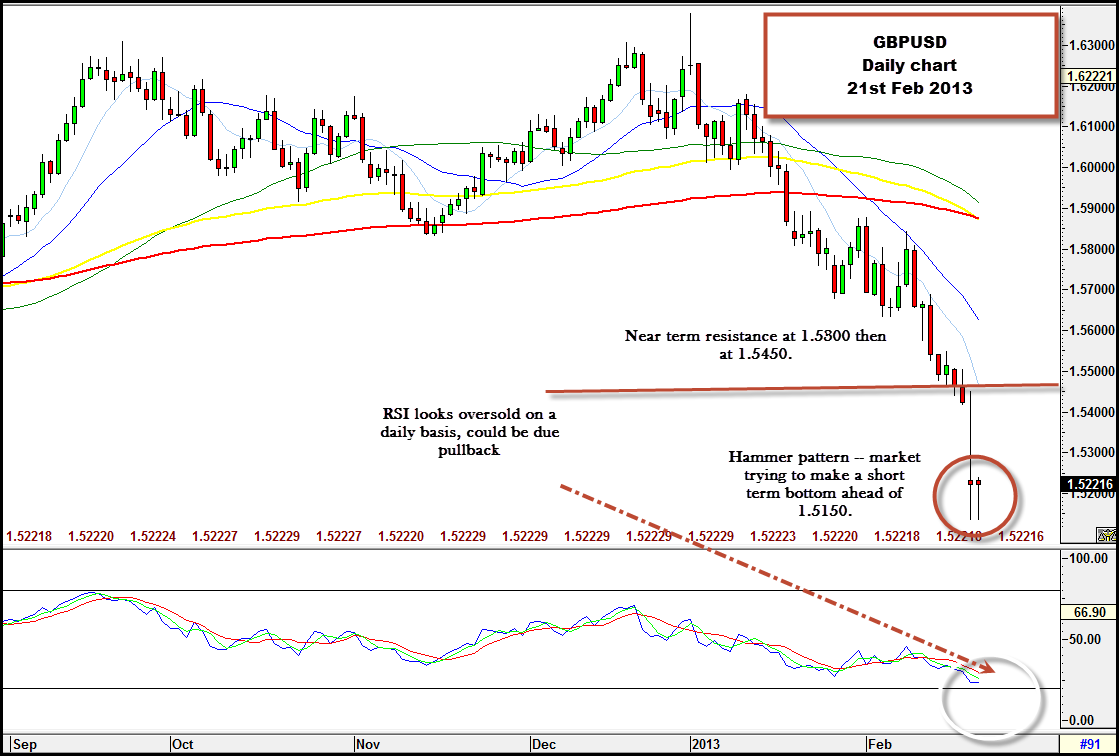

Chart 1: GBPUSD – waiting for a better level

Chart 2: EURUSD – watch where the price closes

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.