As central banks continue to grapple with the increasing risk of deteriorating global growth, some are turning towards negative rates which are likely to widen the current interest rate divide between the currencies. However, as these policies start to bite and the USD strengthens, so too does the pressure upon the US economy.

Friday’s poor US unemployment figures had a surprising impact upon world currency markets buoying the USD by around 0.5%. The unemployment report was largely expected to be a weak number given the fall in a range of metrics in the lead up to the release. However, despite the NFP result of 151k falling well below the 190k consensus, the market largely focussed upon the decline in the US Unemployment rate to 4.9%. In addition, average hourly earnings rose around 0.5% m/m, suggesting that the fall in jobs growth may just be transitional or a statistical outlier. Subsequently, the market was not convinced of any growing risk to the Fed’s lift off schedule.

However, there is increasing tightening in the global financial conditions which could impact US economic activity in the coming quarter as well as labour conditions. Subsequently, any such slow down would likely place the forecasted rate hikes to the US Federal Funds Rate at risk of being delayed, or in fact reversed. Although the market consensus is still largely in line with the Fed’s expectations setting, the risk sentiment is starting to falter and the global front end rates have subsequently fallen, as both the ECB and BoJ return to a policy of easing. What this potentially means for the US is the short term, higher repricing of rates, subsequently benefiting both the USD and GBP.

In the medium term, expect the USD to bounce back from its recent routs and continue to rise whilst the diverging monetary policies between the ECB and the Fed continue. In addition, as Japan also moves to undertake a negative interest rate policy, capital will seek yield and the outflows are partially expected to head state side. This further complicates the US Federal Reserve’s policy of interest rate normalisation as the US trade deficit grows in line with the strengthening currency, further impacting shrinking US exports.

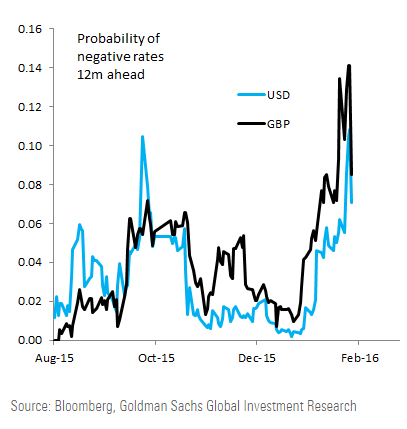

Subsequently, both the possibility of further rate hikes as well as continued strength within the US labour markets is now in question. In addition, assuming a 3-month constant OIS spread the probability of future negative rates in the US and UK has recently touched new highs. Despite this concerning indicator, market expectations still largely point towards a range of expected rate hikes throughout 2016. However given both the recent downturn in world growth, as well as upward pressure on currency valuations, this scenario seems unlikely.

Ultimately, when the market realises that rate normalisation may no longer be on the table, expect a sharp depreciation in the US Dollar, which could lead to an additional round of the currency depreciation war throughout Asia.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.