The Euro has been stuck falling on the charts for some time now, and there looks to be no avail for the currency, which has had its fair share of up’s and down’s in the most recent times. Many have long predicted that the currency was overvalued – especially against the US dollar. And it would seem that now we are seeing a market correction in the face of serious action from the ECB in its effort to fight inflation.

Essentially, bad data is one key driver, but when looking at it from a fundamental level I think it’s very important to look at interest rates as well, as they act as a key driver when it comes to capital flows between various nations.

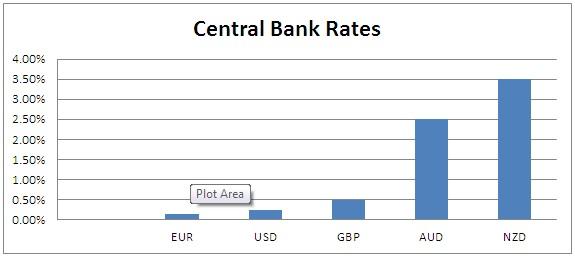

Presently the U.S (0.25%) and the UK (0.50%) are looking to raise the interest rates in their central banking systems, at the same time we have also seen other nations look at the options of lifting rates, with New Zealand currently the most aggressive of the major currencies to lift rates as it sits at 3.5%. Presently the Euro interest rate sits at 0.15%, which is a record low and gives little ability for monetary policy at that rate, but it’s currently required in order to help stoke inflation – as low interest rates lead to less people saving and more consuming, along with more business expenditure and investment.

Capital flows as a result tend to drift towards returns, and presently in the Euro-zone there is very little when it comes to fixed interest returns, so money is flowing out of the Euro-zone and into much more appealing investments for global markets.

So in the short to medium term the Euro is looking much, much weaker, and as a result, I would not be surprised to see much stronger falls on the charts.

But, when we look at the charts we can see that it defied fundamentals and rose for some time against the USD, and I believe this was in part to uncertainty in the U.S economy, which is now starting to subside as the economy picks up pace in the U.S and labour readings are much stronger (non-farm averaging 200k+). The U.S economy has a large impact, especially with its dollar. But what is key, is noting that Yellen has still been very dovish and there is no guarantee that the Euro as a result will shift lower.

So while he Euro is in free fall currently as a result of the fundamentals back at home, and there is a strong bearish channel for the most part helping to etch it lower and lower. There is also a key level that it’s about to enter which may provide some support. The 1.333-38 level is at present a level which markets like to take action and there is likely to be a lot of volatility during this period. As a result, I would expect to see some sharp pull backs on the chart and maybe even a push back up to the channel line.

With no clear sign of interest rate increases for some time yet it looks likely that the Euro will struggle in the global market; especially with the carry traders and their hunt for yield. But, what is key is that the technicals are supporting the fundamentals in pushing the Euro lower and traders should be aware of the present level we are approaching on the chart. Expect to see strong volatility on the chart as a result, and maybe even a brief push back upwards.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.