DAX futures

The dollar traded unchanged or higher against its G10 counterparts during the European morning Tuesday. It was higher against SEK, NZD, AUD, GBP and NOK, in that order, while it was unchanged against CHF, JPY, EUR and CAD.

The German ZEW survey for September fell once again, adding to evidence that the German recovery is petering out. The euro was resilient despite the fact that the expectations index declined for the ninth consecutive month, reaching its lowest level since December 2012. The current situation index also declined, adding to the growing body of evidence that the Ukraine crisis and the related sanctions on Russia have started being reflected in the survey data.

UK’s CPI slowed to 1.5% yoy in August from 1.6% yoy previously, a level last seen in May and before that, in 2009. The slowdown in inflation was in line with market consensus but kept the British pound under selling pressure ahead of the Scottish independence referendum.

Emerging markets’ recent slowdown was reinforced by the renewed softness in Chinese activity data and the possibility that the FOMC will bring forward the expected time of the first rate hike at its meeting this week. Following the unexpected decline of Chinese industrial production on Saturday, data released today showed that the country’s FDI dropped in August, missing forecasts of a moderate rebound. The weak data coming from China raises doubts about whether the nation will hit its 7.5% growth target this year.

Almost all equity markets in Asia and Europe, as well as the S&P 500 futures, were down as a result. EM stock markets for example are on their way to their ninth consecutive down day. This has serious implications for EM currencies and carry trades, as foreign investors repatriate their investments. Meanwhile in Europe, Germany’s DAX opened with a gap down and at midday is down approximately 0.3%.

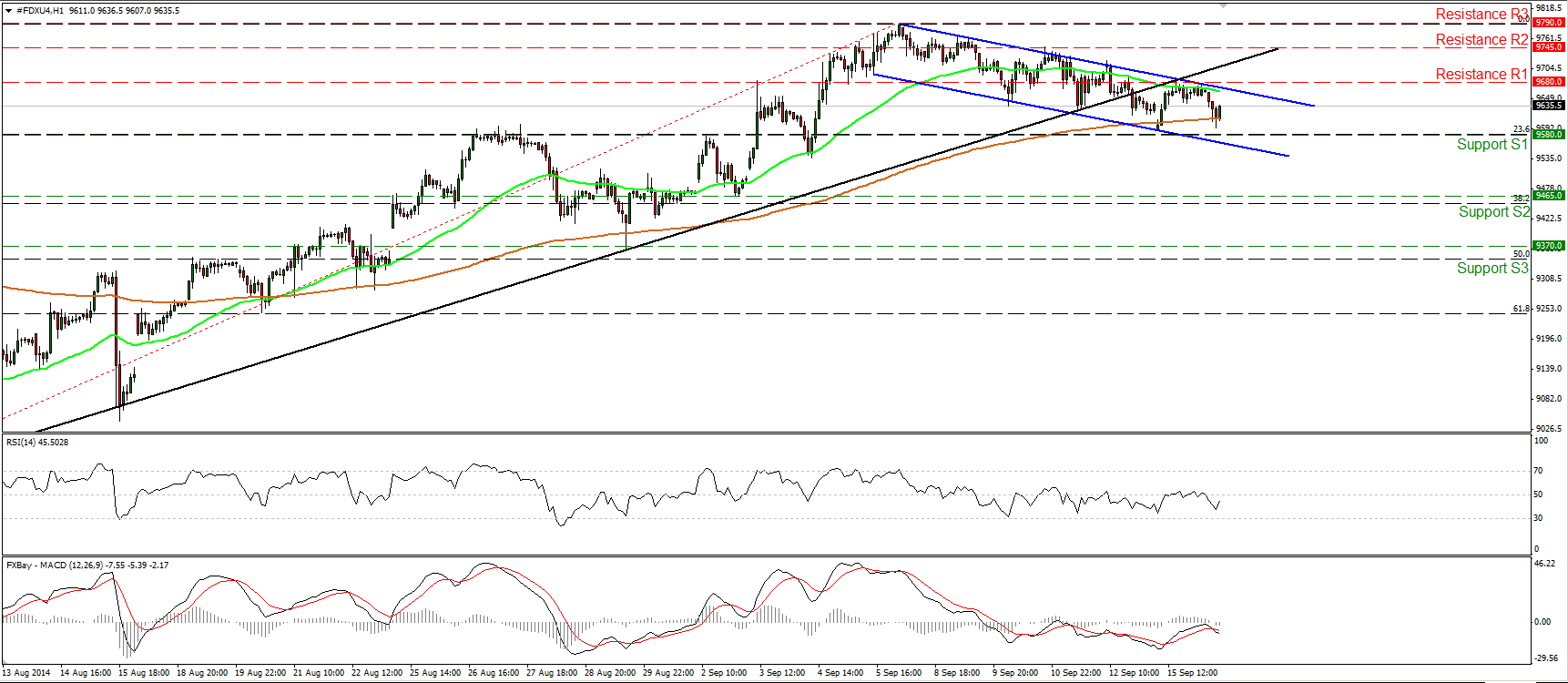

DAX futures declined after finding resistance at 9680 (R1) and the upper boundary of the blue downside channel that has been containing the price action since the 5th of September. Moreover, on the 12th of the month, the index fell below the prior uptrend line (black line), drawn from back at the low of the 8th of August. At midday in Europe, the price is trading near the 200-hour moving average and above the 23.6% retracement level of the 8th of August – 5th of September uptrend. Given the proximity to that support line, and the fact that our momentum signs are mixed, I would see a cautiously negative picture. The hourly MACD topped below its zero line and fell below its trigger, while the 14-hour RSI, although below 50, is pointing up. I would wait for a clear and decisive dip below 9580 (S1), the aforementioned retracement level, before getting more confident about the continuation of the decline. Such a move could pave the way towards the 9465 (S2), determined by the lows of the 2nd of September, marginally above the 38.2% retracement line of the prior near-term uptrend.

Support: 9580 (S1), 9465 (S2), 9370 (S3).

Resistance: 9680 (R1), 9745 (R2), 9790 (R3).

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.