GBP/JPY

The dollar traded mixed against its G10 peers during the European morning Wednesday. It was higher against GBP, JPY and CHF, in that order, while it was lower against NOK and AUD and steady versus EUR, SEK, CAD and NZD.

The UK unemployment rate dropped to 6.4% in June, which by itself would be GBP-positive, but average weekly earnings shrank by 0.2% yoy, the lowest rate since 2009. The poor result is even worse if we consider that the inflation rate for the same month surged to +1.9% yoy, shrinking real wages.

Subsequently the release of the Bank of England’s quarterly inflation report captured the market’s attention. BoE Governor Mark Carney said at the press conference that the UK recovery is “on track” and that “robust growth” has taken output above the pre-crisis peak, causing the Bank to revise its forecast for growth this year up to 3.5% from 3.4%. As far as inflation is concerned, the MPC said it “is close to the MPC’s 2% target and is projected to remain close to the target in the period ahead.”

That news probably would have been GBP-positive. However the Bank reduced its forecast for wage growth:

It expects wages to rise by 1.25% in 2014, half the 2.5% pace previously forecast

The 2015 forecast was cut to 3.25% from 3.5% before

In 2016, it expects wages will rise by 4%, up from 3.75% previously

The MPC is thought to look at wage growth as a major indicator of the level of slack in the economy, much like the FOMC does. As a result, the combination of falling earnings in June and a lower forecast for earnings in the future hit the pound hard. GBP/USD was down approximately 0.50% after the press conference, fractionally above our support level of 1.6700. I think there’s a good chance the pound could continue to trade lower for the next month or so, until after the Scotland independence referendum takes place on Sep. 18th.

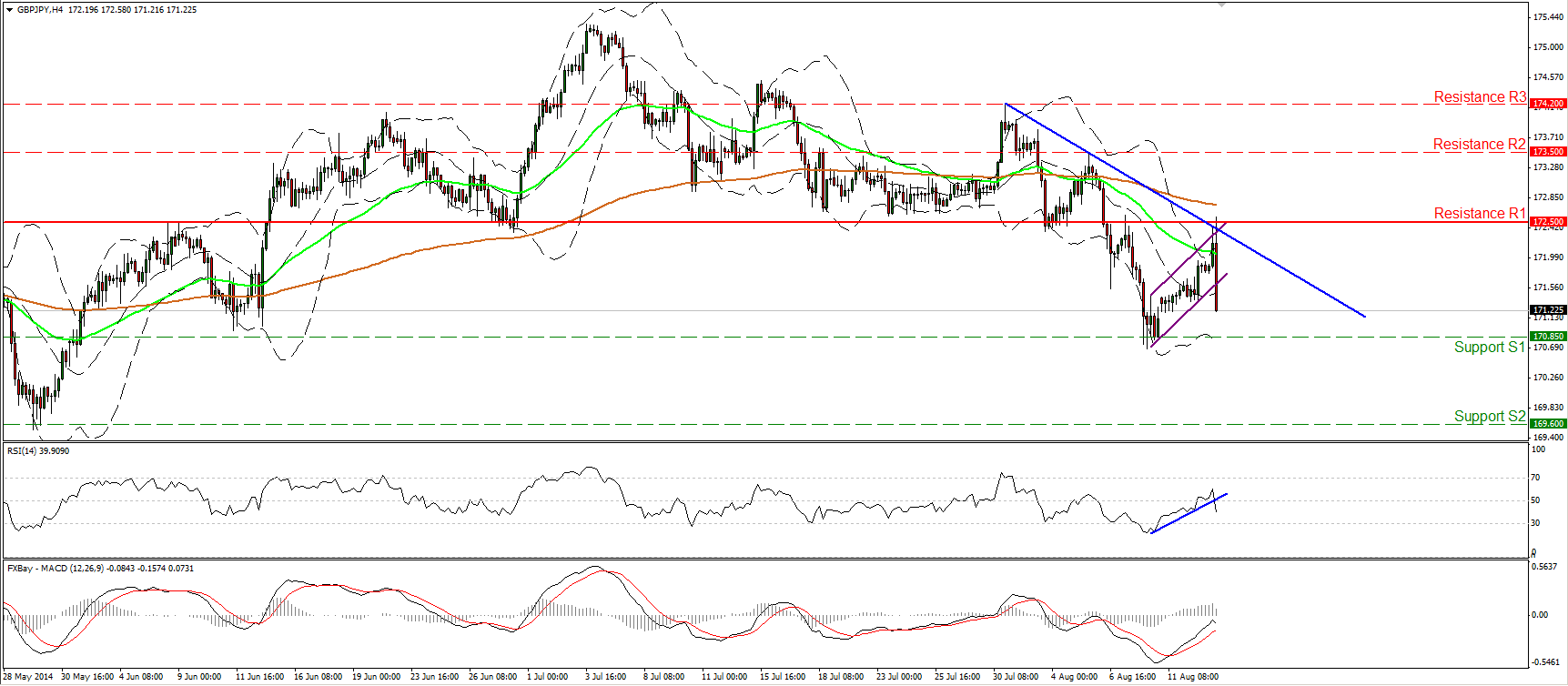

GBP/JPY signaled a possible trend reversal after falling below the crucial barrier of 172.50 (R1) (red thick horizontal line) on the 6th of August. After finding support at 170.85 (S1), the rate advanced (purple upside flag) to challenge that hurdle as a resistance this time, and today after BoE Governor Carney’s comments collapsed, breaking below the lower bound of the flag. Taking all these technical factors into account, I see a negative picture and I would expect the rate to challenge once again the support of 170.85 (S1). A clear move below that barrier could cause the bears to pull the trigger for further extensions, targeting the lows of May, near the 169.60 (S2) zone. The RSI broke its blue support line and also fell below 50, while the MACD, already negative, shows signs of topping and is likely to cross below its signal line. This enhances my view that we may experience further declines in the near future.

Support: 170.85 (S1), 169.60 (S2), 167.75 (S3)

Resistance: 172.50 (R1), 173.50 (R2), 174.20 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.