![]()

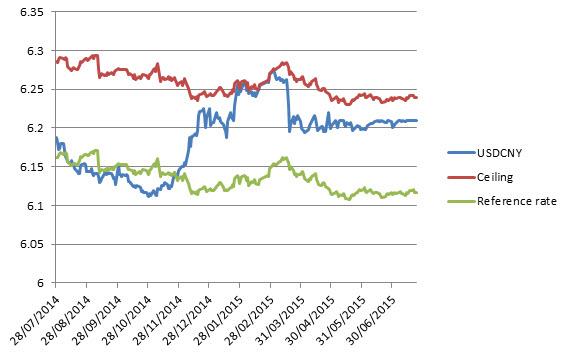

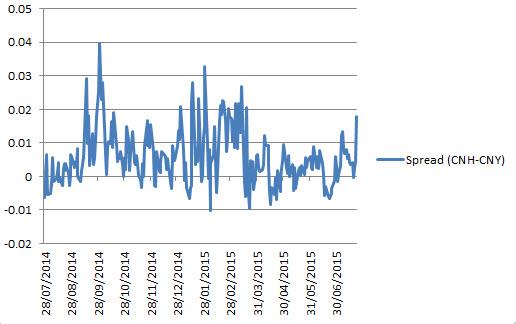

There’s some downward pressure building on the yuan ahead of this week’s meeting at the FOMC. USDCNY is hovering somewhat close to the ceiling set by the PBOC’s placement of the reference rate (see figure 1) and the spread between offshore and onshore yuan (see figure 2) is nearing levels last seen when the CNY was consistently testing the top of its trading range late in 2015/early 2015. This suggests that downward pressure on the Renminbi is building as investors prepare for the possibility of a more hawkish tone from the Fed this week.

Figure 1: USDCNY is consistently near the top of its trading band

Source: FOREX.com

Figure 2: CNY-CNH Spread

Source: FOREX.com

The downward pressure on USDCNY is understandable given a divergence of monetary policy expectations between China and the US. The former is expected to keep loosening policy as growth settles below 7% later this year and the latter is looking to raise short-term rates as the economy improves. It’s therefore not surprising that we’re seeing upward pressure build in offshore yuan, increasing the CNH-CNY spread (USDCNY gets progressively more and more illiquid near the edges of its trading range, thus it doesn’t have the same freedom to move higher even within its trading band).

There is some pressure from within Beijing to allow the yuan to depreciate by liberalising it further, as this would likely lend exporters a helping hand and help the RMB be added to the IMF’s basket of reserve currencies. However, it’s unlikely the PBOC will risk freeing CNY while it’s so freely playing with monetary policy in response to soft domestic demand and extreme volatility in the stock market.

Eyes on the FOMC

There’s a chance the market has underestimated the likelihood that the Fed will raise interest rates at its September meeting, and the bank may use this week’s meeting (a policy statement is due at 1800GMT on Wednesday) to prepare the market for such an event. During a recent speech Feb Chair Yellen seemed to be a little more hawkish than the market; a view supported by a general improvement in the economic outlook for the US. The economy is adding jobs at a healthy rate and core inflation is gaining pace (CPI excluding food and energy rose 1.8% y/y in June). Overall, we think the time is right for the Fed to prepare the market for the increased possibility of tighter monetary policy as soon as September, which could spark another significant rally in the US dollar.

Although, traders will also be close eyeing US advance GDP figures for Q2. The US economy is expected to have rebounded in Q2 after faltering in the first three months of the year. Annualised GDP is expected to jump to 2.5% q/q, with consumer spending anticipated to have increased 2.7%. The pace of growth of the US economy is a major factor in the setting of monetary policy, thus it’s very closely watched by policy makers and investors.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.