![]()

The global equity markets have come under pressure today, with European stocks taking the brunt of the sell-off. Wall Street had initially bucked the trend but here too the sentiment turned sour a few moments after the open. However the pessimism did not last too long and as we go to press, some of the US indices are back in the green while in Europe the markets have likewise bounced off their lows. There was no obvious catalyst behind the sell-off, for after all most of the companies that reported their quarterly earnings results actually did okay. Apple, for example, momentarily hit a fresh record high before pulling back slightly to trade for a time below yesterday’s low. Although the latest US economic data once again disappointed (this time it was the consumer confidence which took a hit as the CB’s closely-watched index unexpectedly dropped to 95.2 from 101.3 in March), this merely helped to lift expectations that the Fed will keep interest rates low for longer – hence the dollar fell further, helping to underpin the EUR/USD and gold among other buck-denominated assets.

As well as the corporate earnings, tomorrow’s FOMC statement will be the main focus for equity investors. As my colleague Matt Weller aptly puts it, the meeting is likely to see the Fed opt for its “oft-preached wait-and-see, data-dependent outlook.” But judging by the reaction of the FX markets, we may see a more dovish statement from the Fed than we have become accustomed to of late. To some degree, the market may be correct to expect that sort of a statement as most of the US data in Q1 have disappointed expectations. However, the Fed has a tendency to discount soft patch in data as temporary. If the Fed does that again then it may inadvertently send out a more hawkish – or less dovish – signal to the market. Thus the risk is that contrary to the growing expectations, the dollar may actually find some good support tomorrow evening, while equities may come under pressure. Perhaps it is this uncertainty that has encouraged some traders to book profit on their long equity positions, which is why the markets may have under a bit of pressure today. Whatever the reason, by the close of play tomorrow we will surely have a better idea in terms of where the stock markets may be headed in the near-term.

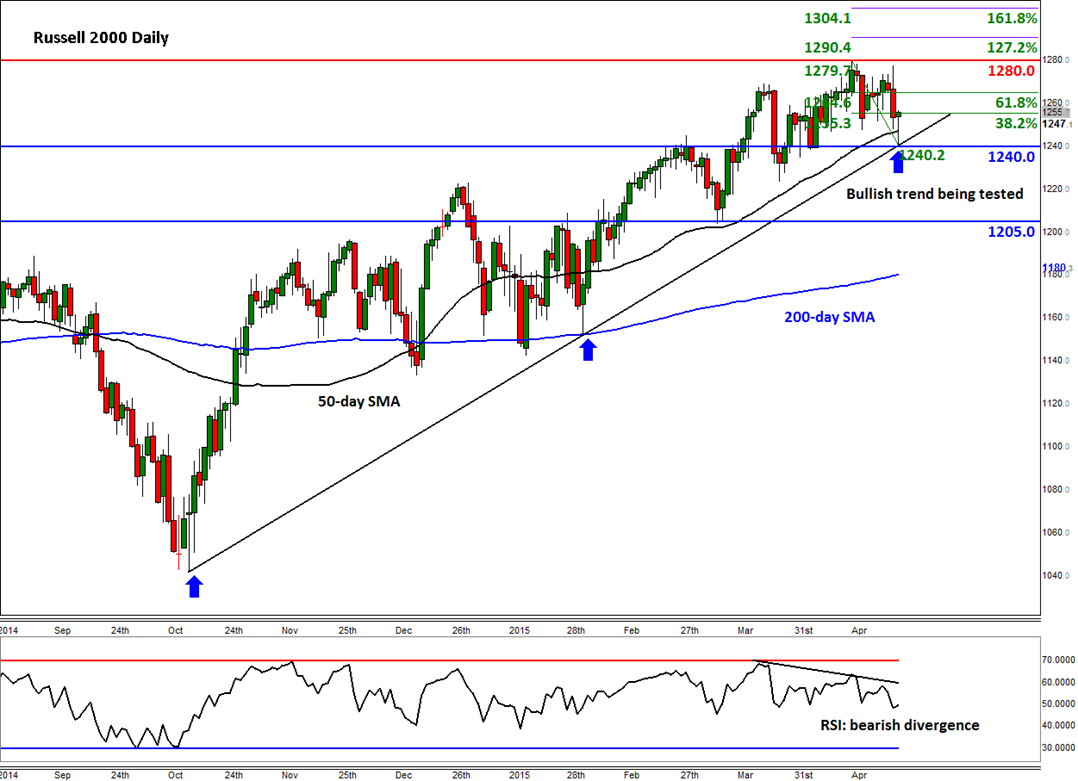

And from a technical point of view, it is also too early to make any conclusions about the recent pullback, though the S&P’s failure to hold at a fresh unchartered territory yesterday may be a sign for concern. Nevertheless, this is not the first time we have seen this sort of a market reaction, before fresh highs have been achieved. But today we are looking at the Russell 2000, which is testing a key technical area around 1240. As can be seen on the chart, this is where the 50-day moving average converges with a bullish trend line. At the time of this writing, the index has already bounced off this key level. Thus if it finishes the day around the current level of 1255 or so, it will have created a bullish looking candlestick pattern (i.e. a hammer) on the daily chart. This may then lead to further technical buying on Wednesday on realisation that the bearish momentum was not strong enough for the sellers to hold onto their bearish positions. As a result, the index may go on for a re-test of the prior high of 1280 and maybe even break through it this time before rallying towards the Fibonacci extension levels at 1290 (127.2%) and 1304 (161.8%). That at last is what the bullish speculators like myself would like to see. The bears on the other hand would like the index to finish the session below the abovementioned trend line. If seen, this will give them the confidence to increase their bets further as some of the exiting bulls rush for the exits. The bears would also point to the divergence on the RSI which suggests that the bullish momentum may be declining. If the bears win this battle they may then aim for the next support at 1205, which would not be an overly ambitious target. But as mentioned, the bulls appear to be having the upper hand at the time of this writing.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.