![]()

In 2007, Nassim Nicholas Taleb published his revolutionary book “The Black Swan” about the eponymous theory, which posits that rare, unpredicatble events have a massive impact and can only be rationalized after the fact. Taleb’s most iconic example of a black swan event comes from the perspective of a Thanksgiving turkey.

About this time of the year, Thanksgiving turkeys across the United States are feeling pretty lucky: they have humans who regularly give them far more food and water than needed to survive, along with regular vaccinations to protect them from any diseases or maladies. Based on past events, the turkey has no reason to believe that it will soon be slaughtered for food, abruptly ending its pampered existence. Only after the fact is it obvious that the food, water, and vaccinations were intended to fatten the turkey up and maximize its nutritional and monetary value.

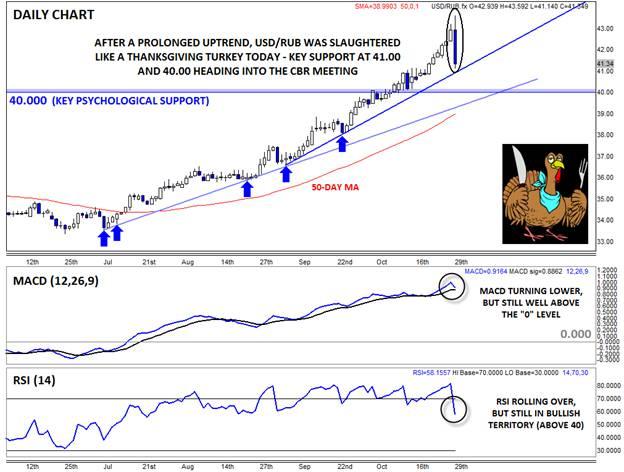

While not a true Black Swan event, USDRUB bulls feel a bit like the proverbial Thanksgiving turkey today. For months, rates have been grinding consistently higher, each day reinforcing the belief that the uptrend would continue indefinitely. Unfortunately for USDRUB bulls though, the slaughter arrived today.

Though it hasn’t been confirmed, it looks like the Russian central bank intervened in the market to buy rubles midway through today’s European session. This selloff in USDRUB was then exacerbated by fears that the central bank would reinforce the move by raising interest rates aggressively in tomorrow’s monetary policy meeting. In retrospect, it appears obvious that the Russian authorities would eventually reach their threshold for a weakening currency, though that exact “uncle” point was impossible to determine in advance.

Technical View: USDRUB

At this point, most traders may want to avoid trading USDRUB until after tomorrow’s highly unpredictable CBR meeting. That said, we can still identify the key levels and trends to watch ahead of the meeting. Despite today’s big drop, which formed a large Bearish Engulfing Candle*, USDRUB remains above support from its accelerated trend line at 41.00; even if that floor is broken, more support could emerge around key psychological support at 40.00 or the other bullish trend line at 39.40. Meanwhile, both the MACD and RSI indicators remain in bullish territory, though they look far more vulnerable than they did 24 hours ago. If the CBR fails to tighten policy dramatically, the longer-term uptrend could resume for a rally back toward the all-time high at 43.00.

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.