![]()

The S&P 500 future is pointing to a flat open on Wall Street today, following on the uninspiring sessions in Europe and Asia Pacific overnight. So far today we haven’t had any major market-moving news or data to encourage the market participants to establish any bald positions. But that could change later on with the release of some important US macroeconomic pointers. Still, with the FOMC meeting coming up next week, the markets may quickly brush off any surprises. Retail sales are expected to have bounced back 0.3% in August after a flat July. Core sales are likewise seen improving a touch. The outcome of the UoM consumer sentiment survey is expected to show some improvement to 83.2 at the start of this month from 82.5 previously. And business inventories are estimated to have risen 0.5% in July, up from 0.4% the month before.

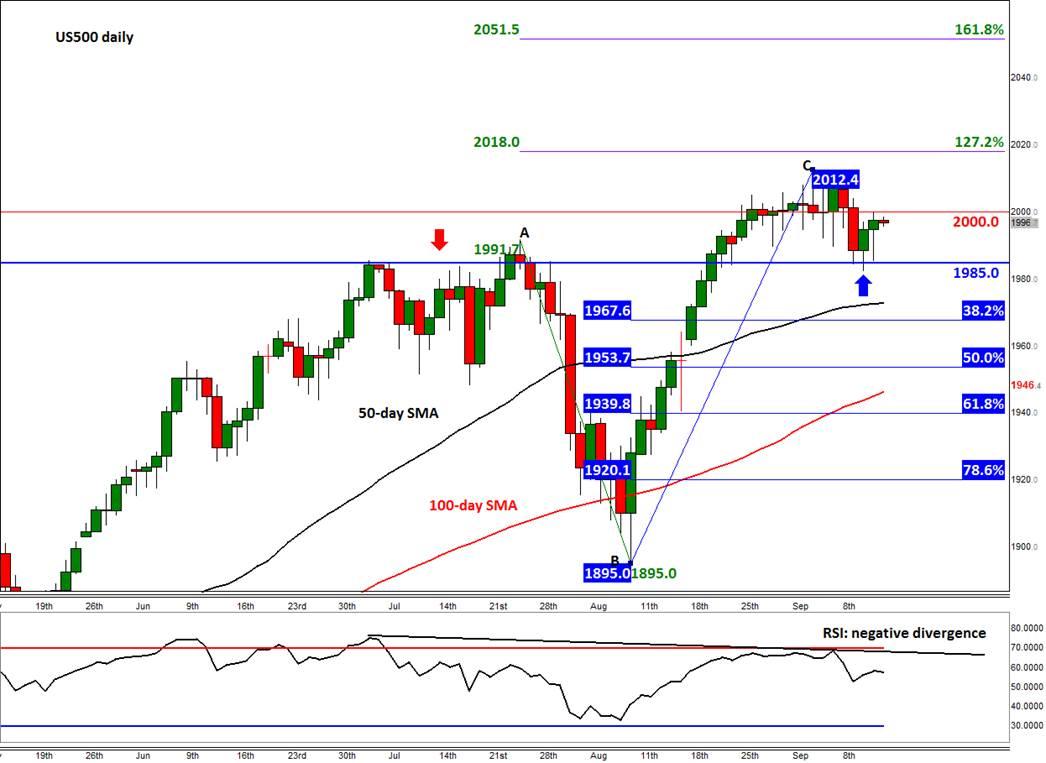

Meanwhile the technical outlook for the S&P remains bullish, as things stand. Last week, the index rallied to a fresh all-time high of 2012 before slowly pulling back from there due to the lack of any supportive fundamental stimulus. But the selling has, for now at least, stalled around the resistance-turned-support level of 1985 which is a bullish development in my view. For as long as the buyers manage to hold their ground here on a daily closing basis, the path of least resistance would remain to the upside. Today, they will need to push the index above resistance and psychological level of 2000 in order to encourage fresh buying at these elevated levels, especially with the weekend fast approaching. Failure to do so could lead to further profit-taking later in the afternoon. If and when last week’s record high is breached, the bulls may then target 2018 and possibly even 2051. These levels correspond with the 127.2 and 161.8 percent Fibonacci extension points of the corrective move we saw from July to August (i.e. the move from point A to B on the chart).

O the bears will be hoping to see the S&P break the 1985 support level, preferably on a closing basis. If they do, a move down to the 50- or even the 100-day moving averages, at 1972 and 1946, could be on the cards soon. Traders will also want to watch some of the Fibonacci levels (of the BC rally) for support, especially the 38.2 and 61.8 percent levels at 1967 and 1940 respectively. They would be encouraged by the fact that the bullish momentum appears to be fading a touch: the RSI, for example, has failed to create a higher high like the underlying index which suggests the momentum may be shifting in the bears’ favour.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.