![]()

Yesterday we looked at gold and pointed to the fact that it hasn’t found much safe haven demand despite all the on-going geopolitical risks. What’s more, the strengthening of the US dollar and the resilience of the stock market has further discouraged demand for yellow metal. But gold is not the only metal struggling. Silver, platinum and copper have all come under pressure too. Other commodities such as crude oil have also failed to respond positively to the deteriorating geopolitical tensions, with both Brent and WTI contracts falling viciously since the start of the summer. However there has been at least one commodity that has bucked this trend: palladium (until today).

Palladium has been rising strongly of late and yesterday touched a fresh 13-and-a-half year high when it climbed to above $910 per troy ounce. It has been boosted, above all, by concerns over potential supply disruptions from Russia, the world’s biggest producer of platinum, due to the country’s involvement in the crisis in Ukraine. If Russia’s palladium exports were to be restricted then it would exacerbate the already large palladium deficit. However we don’t think this would be the case. As palladium is mainly used for catalytic converters in automobiles, any restrictions of the metal could increase the cost for Europe’s carmakers. Clearly this would not be in anyone’s interest. Therefore, I think palladium may be overpriced and overbought.

In fact palladium could not defend itself from the pressure excreted by the rallying US dollar today: it has dropped by more than $25 or 2.8% to $880 from its opening price of $908. It has underperformed all of the commodities mentioned above, as well as stocks and most FX pairs. So, why has it performed this badly? We think it may be because of the one-way speculation that has been on-going for weeks now, and today’s sell-off is probably caused by speculators closing some of those long positions.

Bets from hedge funds and other financial speculators on rallying palladium prices have been increasing for weeks now. In the week to 26 August, net long positions had climbed by a further 560 to 24,600 contracts – just below the record level achieved in April 2013. If the situation in Ukraine improves now, or otherwise speculators continue to book profit on their longs, then we could see a crude-style sell-off in palladium prices over the coming days and weeks.

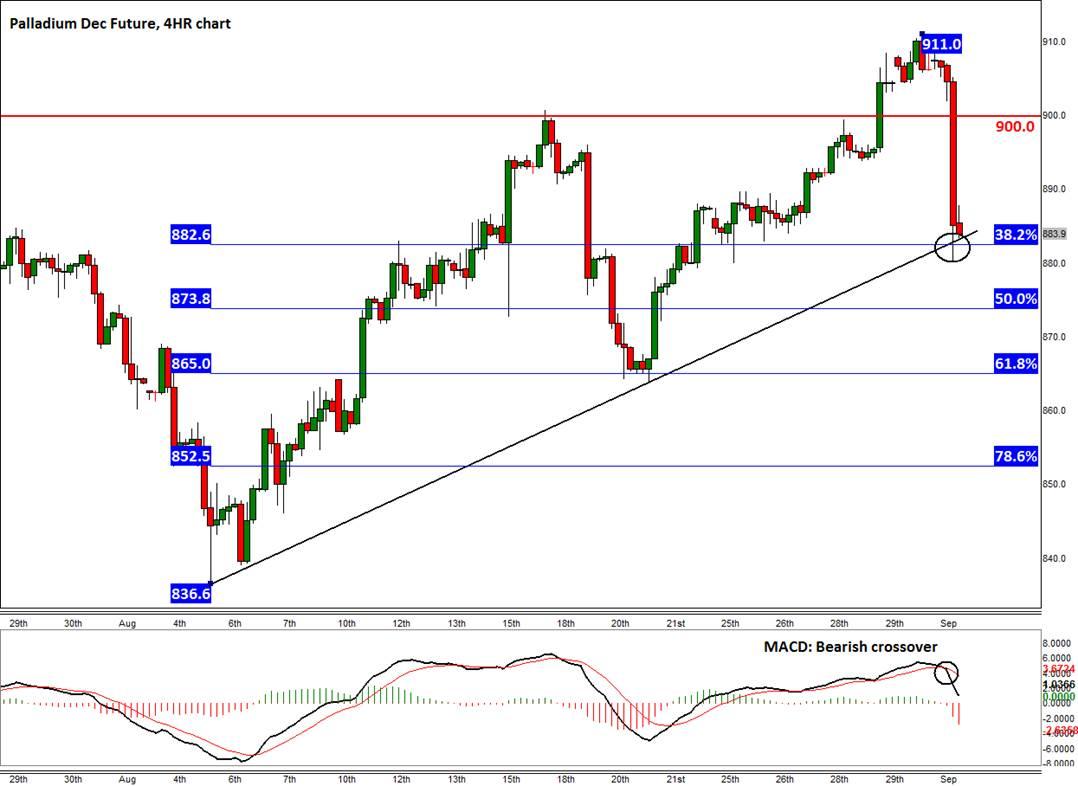

As the 4-hour chart of the December contract shows, the metal is currently trying to break below the $882 support level. This level ties in with a bullish trend line and also the 38.2% Fibonacci retracement level of the up move from the August low. If it breaks below here then the 61.8% Fibonacci retracement level at $865 could be the next stop. Further downside targets are $852 (78.6%), $836 and $800. A potential break below $800 could even reverse the long-term trend. On the upside, the next level of resistance is at $900, followed by $910 and then the December 2000 peak of $959.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

_20140902162600.png)