![]()

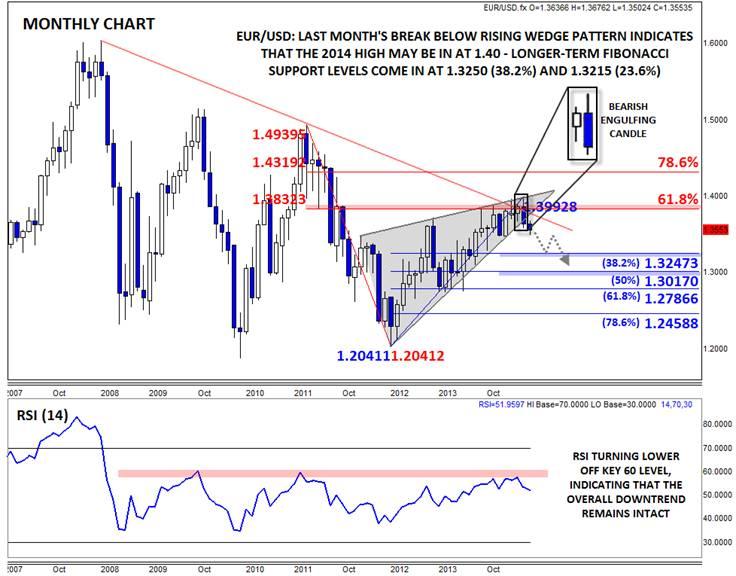

Given all the recent excitement surrounding the EURUSD, traders have been hyper-focused on trading the day-by-day and hour-by-hour swings. However, when high-impact, unprecedented developments come into play (and I’d definitely consider a major central bank opting for a negative deposit rate for the first time in history to be a massive event), it’s important to take a step back and look at a long-term chart. The monthly chart shows a number of bearish technical indications that suggest the EURUSD may have put in a major top around 1.40, and that the pair may generally fall for the rest of the year.

The first pattern that pops out after even a cursory look at the EURUSD’s monthly chart is the 2.5-year rising wedge pattern. Despite the seemingly bullish name, this price action pattern shows that buyers are struggling to push the price higher on each subsequent swing. It is a classic sign of waning buying pressure and points to a big drop once the lower trend line is broken.

While a single pattern alone could easily be shrugged off by euro bulls, the confluence of other bearish technical signs augur for more caution. For one, last month’s high came in directly at converging resistance from a six-year bearish trend line and the 61.8% Fibonacci retracement of the 2011-12 drop. In addition, the pair put in a clear Bearish Engulfing Candle* last month; this formation indicates a strong shift from buying to selling pressure and is often seen at major tops in the market. Finally, the EURUSD’s monthly RSI stalled out and is turning lower off the “60†level, keeping the indicator in bearish territory.

This rare confluence of bearish technical signs indicates that we may have seen the EURUSD’s 2014 high at 1.40 last month, and that rates may continue lower in the second half of the year. To the downside, patient traders may want to watch the Fibonacci retracements of the 2-year rally as possible targets, including 1.3250 (38.2%) and 1.3015 (50%). Of course, any outlook (and especially one so long-term in nature) should always be subject to revision; in this case, we’d have to seriously reconsider the long-term bearish outlook if rates bounce back toward 1.39.

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.