![]()

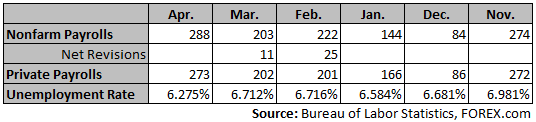

Today’s US April employment report was undoubtedly the strongest report of 2014, surprising the market with a headline print of +288K versus expectations of +218K. While the headline print was impressive, the upward revisions to the March and February readings by +11K and +25K respectively was also a positive sign – When applied to today’s April number, it brings the net amount of jobs added to 324K jobs and raised the 6-month moving average to just over 200K jobs (202.5 to be precise). More notably, this solidifies the view that ‘weather’ related distortions are now behind us, and we can look forward to a bright 2Q.

Highlights of the report:

Another shocker was the unemployment rate which decline to 6.275% (6.3% rounded vs. expectations to decline to 6.6%) – However, this was mainly attributed to a massive decline in the civilian labor force by 806K, which dropped the Participation rate by 0.4% to 62.8%…matching the level witnessed in December and October, which was the lowest reading since 1978. That said, US aggregate weekly hours for all employees continued on its upward trajectory as it rose to 100.4, which matched the March 2008 high, and continues to suggest a further potential a pickup in economic activity in 2014 – For more on why US aggregate weekly hours are so important click here. More importantly, this report affirms the Fed’s pace of tapering by $10B per meeting and suggests QE will fully come to an end in the fall of 2014.

Market response since the announcement:

USD rallied across the board – Roughly 40-60 pips

Treasuries sold off – 10 year yield is 3.5bps higher

US equities, gold and silver has nearly come back to pre-NFP levels

With the end of the week upon us don’t be surprised if pairs settle in near present levels, however with the bullish momentum built up in the dollar, namely in USDJPY, we would not be surprised if this carries over into the beginning of next week.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.