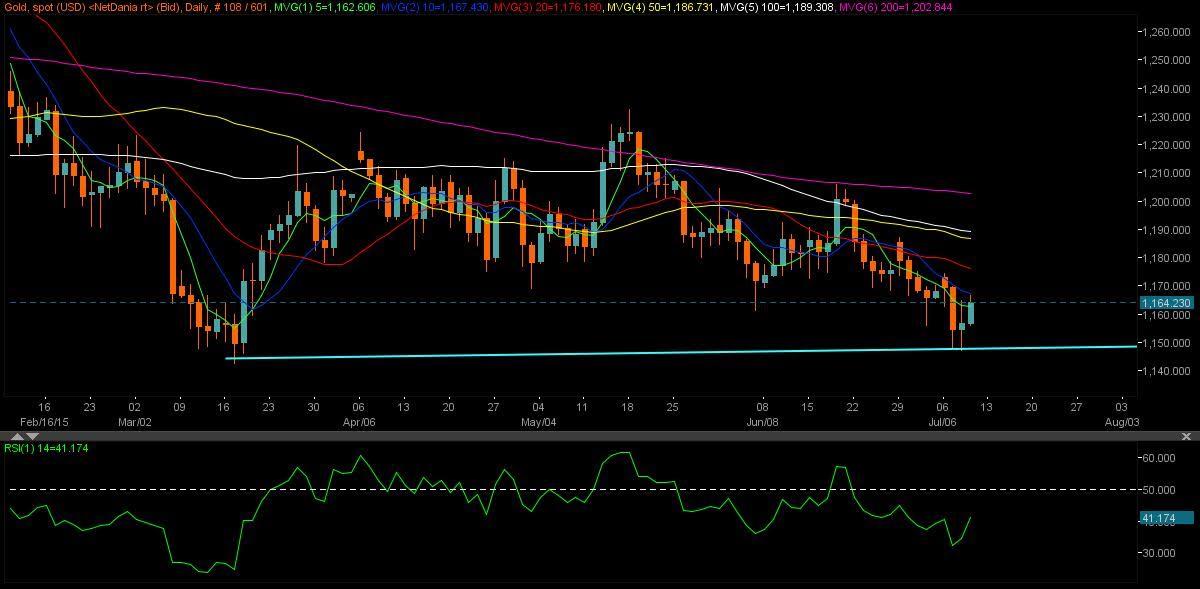

XAU/USD pair – Daily Chart

Gold prices in terms of US dollar (XAU/USD) stalled its recent downside momentum and posed a weak recovery on Wednesday. The pair swung between gains and losses and finally ended the day higher at 1156.70. Gold prices dropped to fresh four month lows of 1147.16, although failed to breach the strong trend line support. XAU/USD bounced-off lows and swung higher to 1164.68 before retreating below 1160 at close.

XAU/USD extends its recovery for the second straight session today as the USD bulls took a back seat amid re-emergence of risk-on trades as Chinese stocks stabilize on the latest government measures while traders also anticipate a Greek deal to be struck soon. At the moment, XAU/USD trades around 1164 levels, having posted session highs at 1166.61. The pair retraced from highs as it faced major resistance at 10-DMA located at 1167.30. Moreover, the greenback is expected to remain lower on FOMC minutes released on Wednesday which reveal that the Fed appeared cautious regarding rate-hike decision.

Technically, on daily charts, the pair is expected to extend its upward moves and could rise to next resistance located around 1070 levels, beyond a break of 10-DMA placed at 1167.30. Above which doors will open up for a test of 20-DMA located at 1176.14. The daily RSI at 40.56 aims sharply higher, indicating further upside bias persists. However, a break below daily lows at 1155.93 selling pressure may intensify, pushing the pair lower towards 1150 levels.

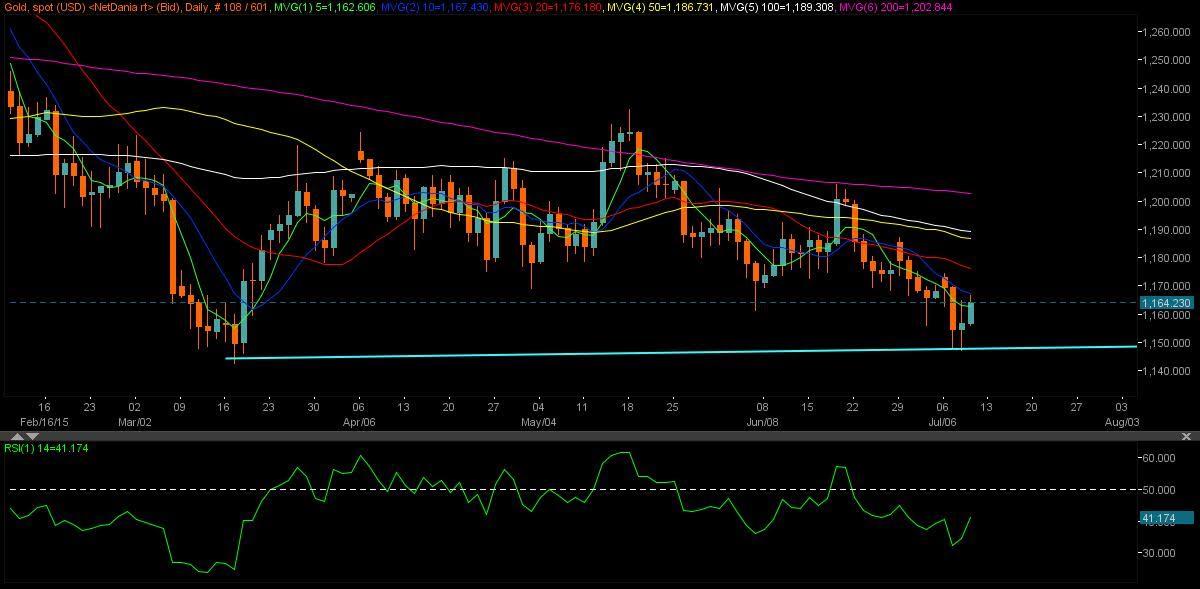

XAU/EUR pair – Daily Chart

Gold prices in terms of Euro (XAU/EUR) extends losses and finished lower on Wednesday at 1044.84, having bounced-off strong 200-DMA support located at 1041 levels. The pair declined yesterday as the shared currency climbed higher backed by renewed optimism surrounding Greece as the debt-ridden nation submitted a new ESM three-loan request to the Euro group while markets remains positive ahead of Sunday’s final make it or break it Euro Summit. The pair remained well within the triangle formation, restricted by the trend line resistance at 1054 levels.

As for today’s trade, XAU/EUR halted its 3-day decline and edged higher once again finding good support at 200-DMA located at 1041.67. However, the pair faced rejected at 1050.03 levels with 5-DMA lying there, acting as a strong resistance. The pair is expected to give back gains and fall back in red as the euro remains well bid versus the US dollar amid Greek hopes and risk-on sentiment. However, the recovery could extend up to the triangle trend line resistance located at 1053.24. The daily RSI hovers around 46 and aims higher suggesting further gains ahead. However, a failure to breach the last, XAU/EUR may rebound lower and fall back to the 200-DMA support.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs above 1.0800 as US Dollar struggles to find demand

EUR/USD extends its daily uptrend and trades in positive territory above 1.0800 in the early American session on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stretch higher.

GBP/USD advances to four-day highs near 1.2560

The broad-based upbeat mood in the risk complex now motivates GBP/USD to resume its uptrend and surpass the key 200-day SMA in the 1.2560-1.2570 band at the beginning of the week.

Gold stays on the back foot, trades below $2,350

Following the upsurge seen in the second half of the previous week, Gold stages a downward correction and trades in the red below $2,350 on Monday. Nevertheless, the benchmark 10-year US Treasury bond yield edges lower below 4.5% and allows XAU/USD to limit its losses.

Crypto market under pressure from Bitcoin

Crypto market cap on Monday stands at $2.2 trillion, down 5.2% over seven days, although it showed some growth over the weekend. Local market capitalisation peaked on March 14th, but the active decline began about a month ago.

Five fundamentals for the week: Inflation and what the Fed says about it are in focus Premium

Will inflation finally fall? That is the question for markets, battered by four consecutive worrying releases of the all-important CPI. A warm-up with PPI, speeches by key Fed officials, and also a look at the central bank's second mandate.