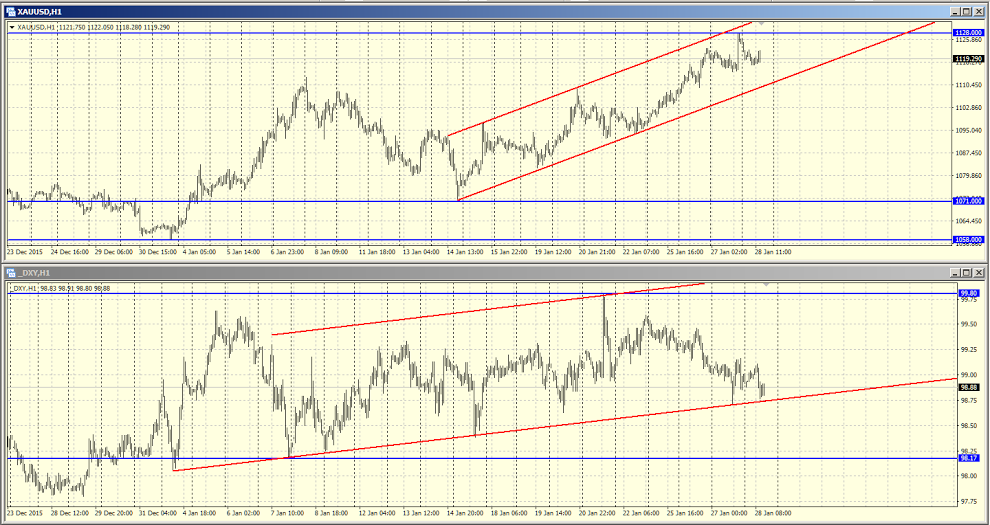

From the beginning of the year there has been some anti-synchronisation between gold and the dollar, which usually have a strong negative correlation: as the dollar rises, the general rule is that gold falls and vice-versa. However, since the beginning of the year, the DXY and gold have developed a positive correlation by both being in upward channels. Although, if we take a shorter time frame on the graph, we can this golden dollar rule not being broken; since the start of this week, a rise in gold has meant a fall for the dollar.

The DXY dollar index is in a horizontal channel between 98.17 and 99.80. The range is an upward heading one, inside of which the dollar has dropped from the upper limit, testing the lower limit of the channel over the last week. If the bottom of the channel is broken, the DXY could head for 98.17, a value which it was at on 7th January.

The last Fed meeting didn’t have any real effect on the dollar. The US regulator did as expected and left rates unchanged, signalling a rise of anxiety regarding high volatility on global financial markets and a slowing of economic growth worldwide. The announcement which accompanied the Fed’s decision kicked up worries that the central bank will raise rates at its next meeting which is set to take place on 15-16th March. The likelihood of a rise in the rates at this next meeting is assessed at 25% by the futures market.

The intention to lift rates that was made clear in December was based on the fact that the Fed expects to see further strengthening of the US economy. However, judging by their recent announcement, they aren’t so sure about it. The regulator noted in its press release that the “Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.”

This statement caught the attention of the markets which were looking to spot any signal of Fed uncertainty. At the December session they had expressed certitude that the labor market was improving and that inflation would rise to their 2% target level. Now the FOMC are beginning to wonder whether they need to reassess their inflation forecasts and drop them, along with those of economic growth and employment at their next meeting.

Another reliable indicator for their incertitude comes from the Fed declining to assess the risks which threaten the economy and its prospects. The central bank officials usually give the markets something to orient their actions on, indicating whether the risks are balanced, in favor of inflation, or whether there is a good chance of economic growth. This time they gave no assessment and this happens very rarely. The last time they didn’t do so was in September of 2007, smack bang before the beginning of the financial crisis.

Meanwhile, there’s hardly cause for alarm as the Fed bosses still forecast the US economy to continue its moderate growth, with job creation and gradual inflation at a comfortable 2%.

A slowing of Chinese growth and instability on the world’s stock and commodity markets could be temporary just as it could be a sign of long term problems. Doubts about this have been tormenting the Federal Reserve since August of last year when the fall of Chinese stock indices and a devaluation of the yuan led to world markets feeling the pain. Back then by the way, they didn’t bother upping their interest rates. When the markets calmed down a little, the rates were lifted and now the turbulence on the market has returned it has put the US central bank in a difficult position, once again forcing them to assess threats to the economy.

In December the Fed forecasted a 0.25% hike in rates four times this year, but their most recent market assessment puts the number of rises at a lesser amount. If the central bank followed its initial plan, the rate should rise to 1.375% by the year’s end. Futures markets reckon that it will be 0.605% at the end of 2016, meaning that the rate will be lifted just once this year, but this is hardly a sure thing.

As for gold, without waiting for any tightening of US monetary policy it has decided to rise, lifting from $1,071 to $1,128 for a troy ounce in the last couple of weeks. This is its highest price level since November of last year. Theoretically, on the medium-term horizon we could see a revival of prices to around $1,190 which is a maximum from the middle of October last year. However, our long-term forecast remains as it was: depending on the Fed’s actions and dollar growth, gold, despite its “eternal value,” will continue to fall.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.