Introduction

Golden week in Asia and Ascension Day in Europe leads to a day of holiday in many countries globally, and thus lower currency market turnover ensues. The USD saw some renewed weakness yesterday during NY trading after a poorer than expected ADP employment report printed, perhaps giving an indication for the NFP figure tomorrow in the states. 200k is the estimated figure for change in non-farm payrolls for April, compared to the 215k number in March.

Asian Session

Retail sales figures in Australia proved better than expected at 0.4% MoM for March. This buoyed AUD, which has gained 0.61% versus US dollar and 0.59% against the euro. The Caixin services PMI figure out of China may have dampened AUD buying somewhat, with that figure coming in at 51.8 as opposed to 52.6 expected and 52.2 last.

Despite a poor publication of crude oil stocks data by the EIA in NY yesterday, WTI crude oil futures trade towards the US$45 mark. This has buoyed commodity currencies a touch, with USD/MYR holding above the 4.00 mark as a result.

Political difficulties in Turkey between President Recep Tayyip Erdogan and Prime Minister Ahmet Davutoglu are likely to lead to one or both of these leaders stepping down from their post. As a result, Turkish Lira lost close to 4% in late afternoon trading yesterday against the greenback. The pair climbed to a high of 2.9763 and has stabilised a touch overnight to stand at the current 2.9240 level now.

The day ahead in Europe and NY

Cable trades just above the 1.4500 figure as London begins to trade, ahead of house price data released by Halifax building society today and a services PMI number released at 09:30 BST. Sterling took a hit yesterday after the construction PMI number printed lower than anticipated.

In the states later, the weekly initial jobless claims data will be released. After the EIA released crude oil stocks data yesterday, natural gas inventory info. will be published today.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1489 | +0.02% | 1.1494 | 1.1482 |

| USDJPY | 107.06 | +0.14% | 107.21 | 106.89 |

| GBPUSD | 1.4511 | +0.11% | 1.4529 | 1.4495 |

| AUDUSD | 0.7505 | +0.60% | 0.7514 | 0.7453 |

| NZDUSD | 0.6902 | +0.30% | 0.6912 | 0.6872 |

| USDCHF | 0.9583 | -0.06% | 0.9585 | 0.9569 |

| EURGBP | 0.7915 | +0.12% | 0.7926 | 0.7905 |

| EURCHF | 1.1000 | -0.10% | 1.1009 | 1.0996 |

| USDCAD | 1.2835 | +0.26% | 1.2873 | 1.2814 |

| USDCNH | 6.5118 | +0.08% | 6.5212 | 6.5091 |

FXO

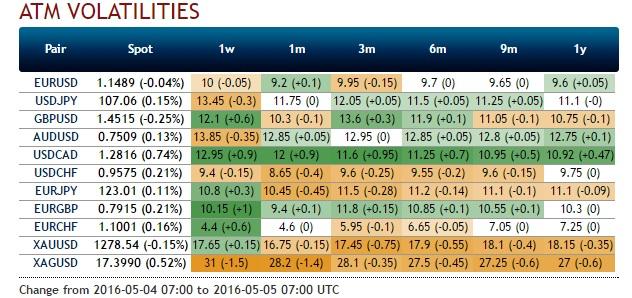

Overnight EUR/USD strikes do not trade at particularly high levels compared to some other pre-NFP dates. A 1.1500 strike currently stands in the inter-dealer brokers with a mid. volatility of 17.5%. Some large expiries, in the region of one billion, are rolling off today at the New York cut-off time of 3pm BST. Strikes are at the 101475 and 1.1500 levels.

Sentiment within the currency options space has taken a further shift regarding USD/JPY. 89% of traders within the bank are now long puts and/or short calls, a shift of 6% over the last 24 hours.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.