-

An apparent shift in UK polls over the weekend has the market judging the odds of a Brexit significantly lower this week, which has induced a steep rally/squeeze in sterling pairs that has reversed a significant portion of the losses suffered by sterling in recent weeks.

-

Other risk‐correlated currencies jumped on the enormous positive shift in risk sentiment, with commodity currencies regaining significant ground and even contending with local highs against the US dollar.

-

The euro has been caught a bit in the middle, somewhat stronger aginst the US dollar, but with less conviction as the focus is on more traditional risk‐correlated currencies.

-

Gold has generally been a loser today after previously gaining a significant bid on the spike in Brexit fears prior to this recent relief, though there may be a residual bid if US data continues to worsen and the market starts to mull quantitative easing version four from the Fed rather than the timing of the next hike. A launch of helicopter money from the Bank of Japan may be another issue on precious traders' minds.

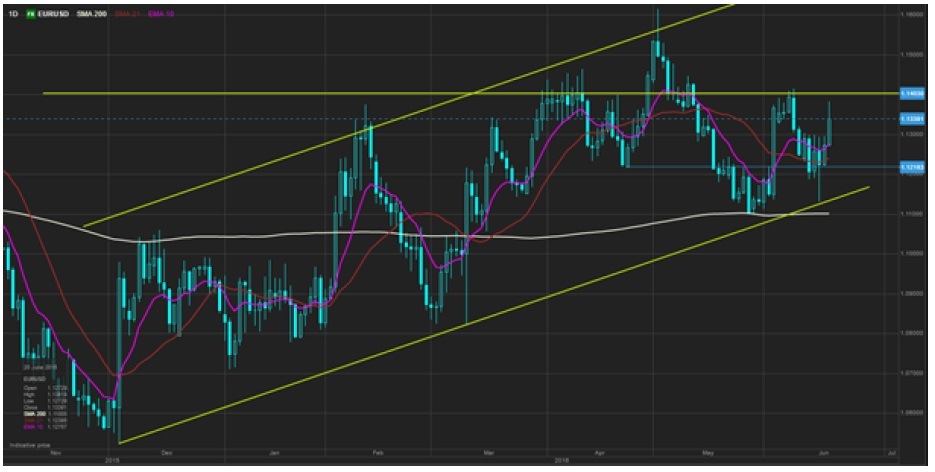

EURUSD

EURUSD came up short just south of 1.1400, the key resistance area ahead of the 1.1500 level and higher. We'll know the lay of the land post UK‐referendum here, with likely far less upside potential on a Bremain vote than downside potential on a Brexit vote, particularly as the latter has been priced back out again.

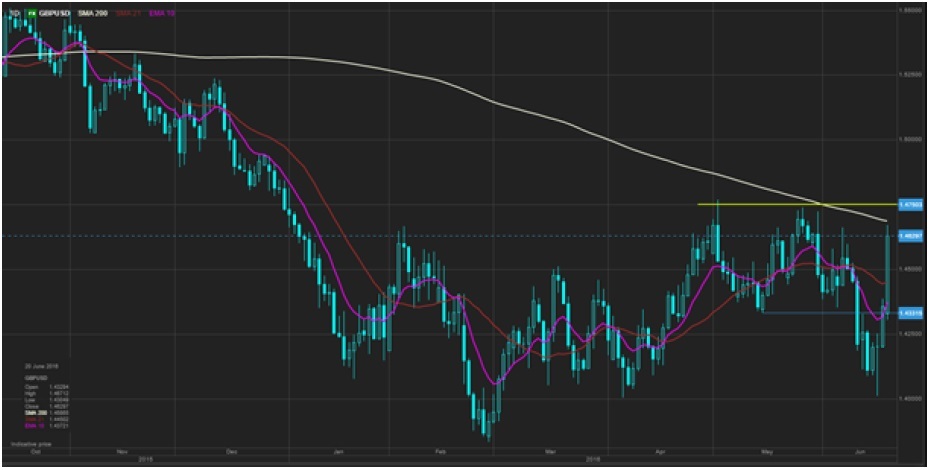

GBPUSD

A tremendous squeeze on the apparent momentum shift in polls in favour of Bremain, but are bulls bold enough to squeeze through the 1.4750 and 200‐day moving average area before we even know the outcome of Thursday's vote?

AUDUSD

The resurgence in risk appetite has AUDUSD pushing on the highs for the cycle again after the downside pivot zone attempt below 0.7300 failed. With such momentum, we could see carry through to new local highs, with 0.7570 the next technical level of note (61.8% Fibo retracment), but as with every risk‐correlated pair, we'll need to see the Brexit result and immediate reaction here to get a firmer read on directional potential.

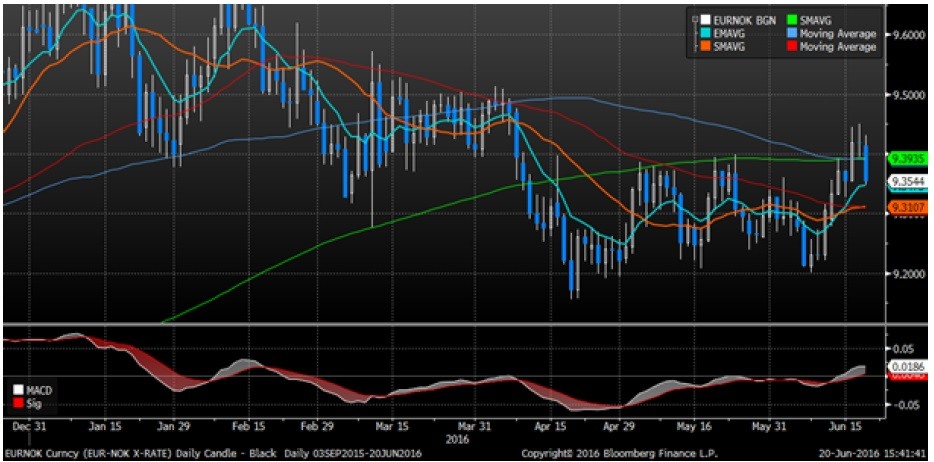

EURNOK

As with other small currencies, the NOK picking up strength against the most liquid currencies and now we have a compelling evening star candlestick formation today that is mae more compelling by its occurence beyond the previous 9.40 range highs and straddling the 200‐day moving average. But no currency pair can escape the risk of the UK referendum vote on Thursday, so it remains difficult to draw firm conclusions, but this is a classic bearish technical development.

-

Have you taken part in Saxo Bank's Brexit poll?

-

What do you think will be the outcome of Thursday's pivotal vote?

-

Vote now in Saxo's Brexit poll on our dedicated Brexit pages

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.