- RBNZ, PMIs in the spotlight Once again there was a decent amount of news that resulted in relatively little movement. EUR/USD had the second-smallest range of the year at 0.14% (lowest was 0.11% on April 18th). The market ignored reports that two Ukrainian fighter jets were shot down, apparently from the Russian side of the border, according to the Ukrainian government. Gold was lower despite the news. The only G10 currencies to weaken notably against the dollar were NZD (see below) and GBP, which fell yesterday on the dovish implications of the Bank of England minutes. On the other hand, AUD strengthened after the provisional HSBC/Market China manufacturing PMI for July rose to 52.0 from 50.7, beating expectations of 51.0.

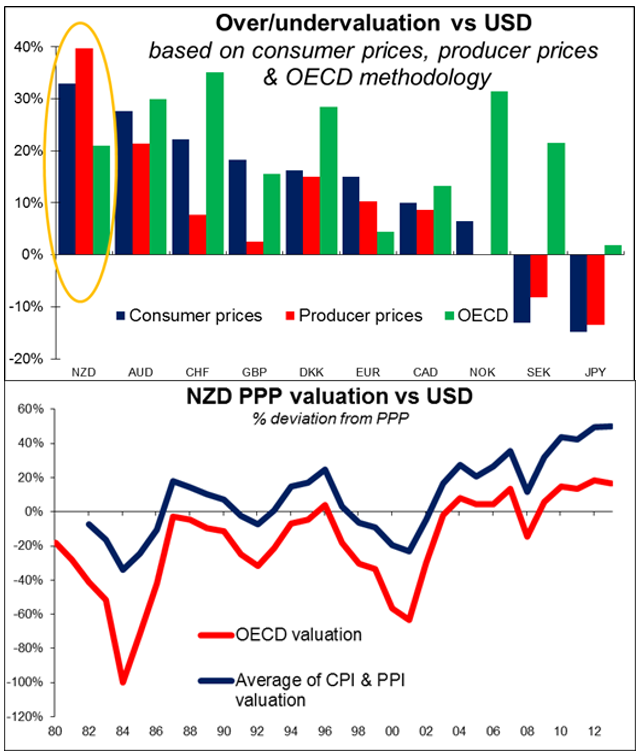

- The Reserve Bank of New Zealand (RBNZ) raised its official cash rate (OCR) by 25 bps, as was generally expected, but said it would pause for “a period of assessment before interest rates adjust further towards a more-neutral level.” In other words it will continue to hike, but first wants to see how the 100 bps of hikes so far are affecting the economy. The RBNZ had harsh words to say about its currency. "Over recent months, export prices for dairy and timber have fallen, and these will reduce primary sector incomes over the coming year. With the exchange rate yet to adjust to weakening commodity prices, the level of the New Zealand dollar is unjustified and unsustainable and there is potential for a significant fall," the RBNZ said. It’s hard to argue with their contention that the currency is overvalued; on both CPI and PPI basis it’s the most overvalued of the G10 currencies (33% and 40% overvalued vs USD, according to Bloomberg calculations). The OECD’s calculations put it in the middle of the pack, but even there it’s 21% overvalued, according to their calculations (the most overvalued on this methodology is CHF at +35%, while the yen is merely +2% overvalued). In general, currencies do tend to revert back towards their purchasing power parity (PPP) values, but it can take a long, long time. So long as the RBNZ keeps real interest rates the highest among the G10 (indeed, is the only central bank with a positive real official rate), NZD should be well supported.

- Japan’s trade balance continued to worsen. The deficit for June was JPY 1.08tn (SA), vs JPY 862bn (SA) in June. Although this was better than market estimates, the NSA figure for the trade balance was worse, giving a mixed picture. The problem was exports, which fell 2.0% yoy instead of rising 1.0% as expected, while imports were in line with estimates at +8.4% yoy. Japan’s exports are not benefitting from the weaker yen, while of course import prices have risen in line with the drop in the currency. This could be the fatal flaw in Abenomics: the weaker yen winds up reducing aggregate demand by reducing households’ purchasing power without boosting exports, thus causing further deflation! The Japan manufacturing PMI fell to 50.8 from 51.5. I remain bearish on the yen, although it’s hard to say what will be the catalyst to push it out of its recent range.

Today: The PMIs will take center stage during the European day. Eurozone’s preliminary PMIs for July will be released just after the two largest countries of the bloc, Germany and France, release their figures for the same month. Both the manufacturing and service sector PMIs for the Eurozone are expected to decline slightly, reflecting the overall slowdown in growth and economic turbulence in the region. That could add to the sense that the Eurozone’s only hope is a weaker currency and push EUR down slightly.

Sweden’s official unemployment rate for June is coming out and the forecast is for the rate to increase to 9.0% from 8.0%, consistent with the increase in the Public Employment Service (PES) unemployment rate earlier this month. The weaker labor data will most likely offset the recent promising rise in the CPI --following the shock in the unexpected official rate cut by Riksbank— of a moderate rebound in the Swedish economy and could be negative for SEK.

In the UK, retail sales excluding gasoline are expected to rise 0.3% mom, a turnaround from -0.5% mom in the previous month. That should be positive for the pound.

Later in the day, we get the US preliminary Markit manufacturing PMI for July (expected to rise) and new home sales for June (expected to fall). The initial jobless claims for the week ended 19th of July are forecast to rise marginally.

THE MARKET

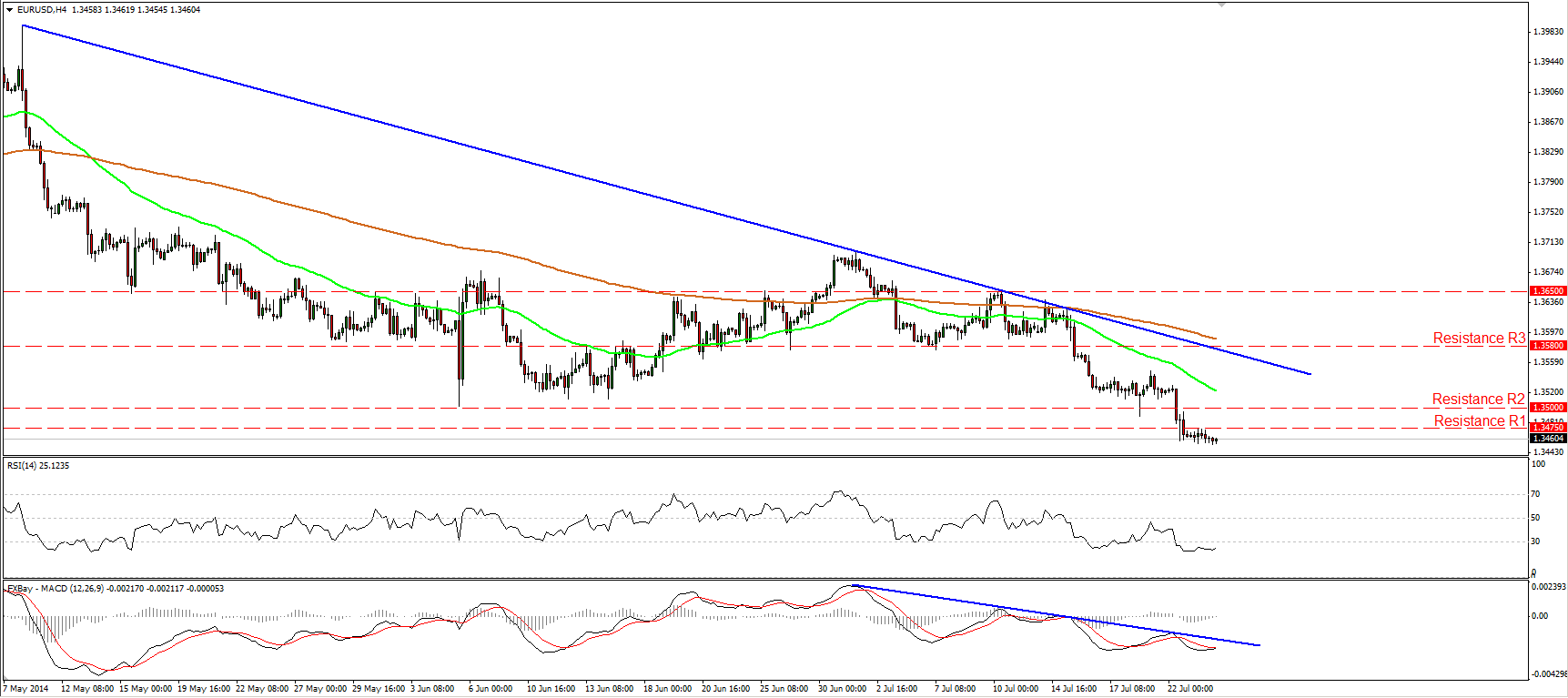

EUR/USD ahead of Eurozone’s PMIs

EUR/USD moved in a consolidative mode on Wednesday ahead of Eurozone’s preliminary PMI data for July. The rate remains slightly below the lows of February at 1.3475 (R1) with the euro-area PMIs, coming out later in the day, expected to show a modest decline. This could cause the bears to regain momentum and push the pair lower, perhaps towards the support zone of 1.3400 (S1), marked by the low of the 21st of November. As long as EUR/USD remains below both the moving averages and the 1.3500 (R2) key resistance holds, I see a negative near-term picture. On the daily chart, the 50-day moving average is still touching the 200-day one and a bearish cross in the near future will add to the negative outlook of the pair.

Support: 1.3400 (S1), 1.3300 (S2), 1.3250 (S3).

Resistance: 1.3475 (R1), 1.3500 (R2), 1.3580 (R3).

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.