GROWTHACES.COM Forex Trading Strategies:

Taken Positions

EUR/USD: long at 1.0670, target 1.1000, stop-loss 1.0730, risk factor *

USD/JPY: short at 121.20, target 119.00, stop-loss 120.70, risk factor ***

AUD/USD: long at 0.7680, target 0.7900, stop-loss 0.7710, risk factor **

EUR/GBP: long at 0.7175, target 0.7375, stop-loss 0.7190, risk factor *

EUR/JPY: long at 129.00, target 132.00, stop-loss 129.00, risk factor **

EUR/CHF: long at 1.0570, target 1.0990, stop-loss 1.0400, risk factor **

Pending Orders

NZD/USD: buy at 0.7490, target 0.7700, stop-loss 0.7380, risk factor **

EUR/CAD: buy at 1.3540, target 1.3750, stop-loss 1.3440, risk factor **

EUR/USD: Eyes On Draghi Today

(stay long for 1.1000)

In the Euro zone, ECB President Mario Draghi will address a European Parliament committee today 14:30 GMT, with Greece and the progress of the ECB's quantitative easing programme sure to be high on the agenda. With officials in Brussels, Berlin and the ECB now openly acknowledging the risk that Greece could leave the euro zone, a meeting between Alexis Tsipras and Angela Merkel in Berlin on Monday will be closely watched for signs of a breakthrough or hardening of positions.

The market will focus also on today’s comments from Fed Vice Chair Stanley Fischer (15:00 GMT). Another important event this week is the release of U.S. CPI data (on Tuesday 12:30 GMT).

Euro zone PMIs (Tuesday, 9:00 GMT) will be important macroeconomic releases this week that could support our long EUR/USD position. They should post the fourth consecutive increase, confirming that the economic recovery is regaining traction. Lower oil prices and weak EUR will continue to stimulate the real economy, especially the manufacturing sector. We expect also stronger increase in German Ifo index (Wednesday, 9:00 GMT), after it rose only 0.1 point in the previous month.

On Friday markets were still digesting an unexpectedly cautious message from the Federal Reserve. The EUR/USD reached its daily high at 1.0882 on Friday but fell back to 1.0784 early in Asia. We stay EUR/USD long for 1.1000. We have raised our stop-loss to 1.0730.

Significant technical analysis' levels:

Resistance: 1.0882 (high Mar 20), 1.0920 (session high Mar 19), 1.0940 (21-dma)

Support: 1.0754 (hourly low Mar 20), 1.0714 (hourly low Mar 20), 1.0650 (hourly low Mar 20)

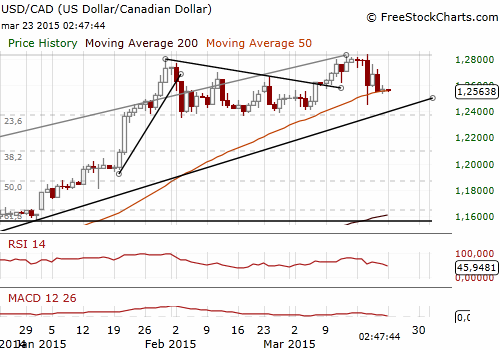

USD/CAD: Waiting For Higher Levels To Get Short

(we stay sideways)

Canada's annual inflation remained unchanged from January at 1.0% in February. Gasoline prices continue to weigh on the CPI, with prices down 21.8% yoy.

Prices rose in seven of the eight major components. Consumer prices rise were driven most by food prices (3.9% yoy) and shelter costs (1.8% yoy). Annual core inflation rate, which strips out gasoline and other volatile items, was 2.1% yoy, down slightly from 2.2% yoy in the previous month.

Canadian retail sales in January fell by 1.7% mom vs. forecast fall of 0.7% mom, the second consecutive month of decline as gasoline sales were down 8.8% mom, the biggest monthly drop since November 2008.

The Bank of Canada, which has an inflation target range of 1% to 3%, expects inflation to be below 1% for much of this year. Weakness in retail increases the risk of Q1 GDP falling below the Bank of Canada's forecast. Markets are pricing in around a 60% chance the bank will hold steady at its policy meeting in April. In our opinion the central bank will not change interest rates in April and probably at the end of this year the main rate will be still at 0.75%. Core inflation, closely watched by the central bank, is pretty close to the middle of the inflation target range.

We were looking to get short on the USD/CAD but our sell offer was placed too high and was not filled. We stay sideways now, waiting for better levels to get short again. The medium-term outlook for the USD/CAD is mixed. On the one hand we should expect stronger CAD due to diminishing expectations for rate cuts by the BOC, but on the other hand we had a dovish tilt in expectations for Fed hikes last week that may weigh on the USD.

Significant technical analysis' levels:

Resistance: 1.2723 (high Mar 20), 1.2757 (high Mar 19), 1.2800 (psychological level)

Support: 1.2507 (low Mar 19), 1.2477 (low Mar 18), 1.2457 (low Mar 6)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.