GROWTHACES.COM Trading Positions

EUR/JPY: long at 135.20, target 137.30, stop-loss 135.40

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

GBP/JPY: long at 172.00, target 175.00, stop-loss 171.00

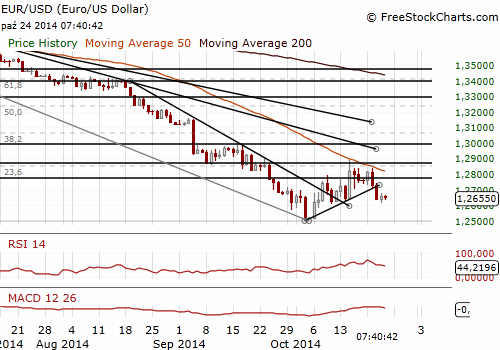

EUR/USD: The end of US QE era approaches

(we keep our sell offer at 1.2760)

The EUR/USD opened Asia at 1.2647, unchanged from Thursday and the volatility is low today. Investors are cautious ahead of the results on Sunday (11:00 GMT) of stress tests on euro zone banks. We keep our sell offer at 1.2760.

German GfK forward-looking consumer sentiment indicator rose to 8.5 in November from a revised 8.4 in October. The index picked up after slight declines in the previous two months. The structure of the index suggests consumers feel confident about their own incomes and are willing to spend more, but there are less optimistic about future economic situation.

What are the main drivers for the next week? The Federal Reserve is expected to formally announce the end of its long-term asset purchase program on Wednesday despite the recent market volatility. There has been an isolated call by St. Louis Fed President Bullard to consider delaying the end of quantitative easing.

In our opinion the FOMC’s statement will not reiterate the “considerable time” guidance. The change will be a natural consequence of ending the quantitative easing. The whole sentence: "...it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends” refers to the end of quantitative easing. If the quantitative easing ends, the sentence will need to be changed anyway.

What will the Fed propose instead of “considerable time”? It is likely that more data dependency of the future policy path will be added. The Fed may include a reference to inflation or unemployment rate, but in our opinion inflation data are slightly more important now due to rising possibility of lower inflation path (strong dollar, no inflation pressure in the Euro zone).

Investors will be focused also on inflation data in the Euro zone. The data for October will be released next Friday, and we expect headline inflation to increase slightly. Headline inflation in September amounted to 0.3% yoy and our forecast for October is 0.4% yoy, mainly as a consequence of weaker EUR.

Significant technical analysis' levels:

Resistance: 1.2676 (high Oct 23), 1.2689 (21-dma), 1.2728 (10-dma)

Support: 1.2614 (low Oct 23), 1.2605 (low Oct 10), 1.2583 (low Oct 7)

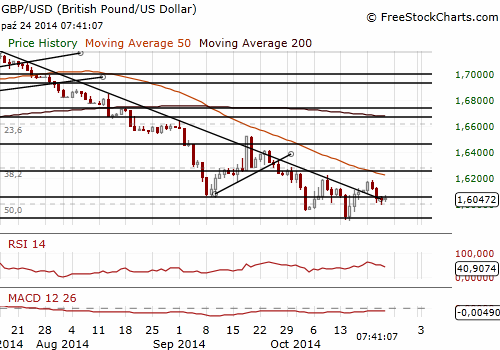

GBP/USD: Limited reaction to Q3 GDP data

(the outlook is mixed, we stay sideways)

Britain’s GDP rose 0.7% qoq and 3.0% yoy in the third quarter, compared with 0.9% and 3.2% in the second quarter, in line with forecasts, but lower than the estimate of the Bank of England. The central bank estimated Britain's economy grew by 0.9% in the third quarter.

The sharpest slowing sector was Britain's services industry, where growth dropped to 0.7% from 1.1%. Factory output growth dropped to 0.4% on the quarter from 0.5%, its slowest rate of growth since the first three months of 2013.

The GBP/USD rose to 1.6071 after GDP data, but came back in the area of Thursday’s close rapidly. We stay flat on the GBP/USD, but keep our long position on the GBP/JPY with the target of 175.00.

Significant technical analysis' levels:

Resistance: 1.6100 (21-dma), 1.6130 (high Oct 22), 1.6167 (30-dma)

Support: 1.5995 (low Oct 23), 1.5994 (61.8% of 1.5875-1.6186), 1.5940 (low Oct 16)

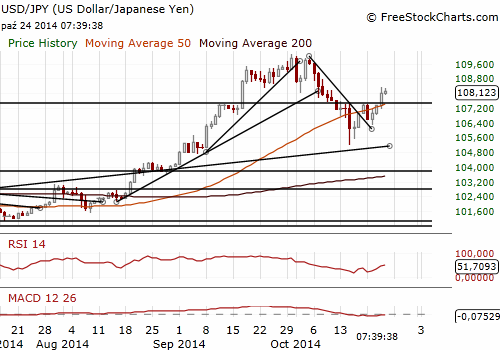

USD/JPY: Buy at 107.60

(the outlook is still bullish)

Japanese Finance Minister Taro Aso said on Friday the government should stick with its plan to raise the sales tax to 10% next year to maintain trust in the government debt market. In April the government raised the sales tax to 8% from 5%.

The USD/JPY rose strongly yesterday as investors returned to riskier assets. An important reason for yesterday’s USD/JPY rally was strong US. Conference Board's Leading Economic Index reading. It increased 0.8% mom in September after being flat in August, pointing to solid economic growth for the remainder of the year.

Bank of Japan’s meeting is scheduled for Friday next week. We do not expect any monetary policy changes by the BoJ next week. We have also some Japanese macroeconomic data releases next week (retail sales, industrial production, CPI and housing starts). The data will probably put some pressure on the BoJ to add further dovish hints into its statement.

The outlook for the USD/JPY is bullish and we are looking to get long again. Our strategy for the USD/JPY is to buy at 107.60 with the target near 109.25 (high Oct 7). We keep our long positions on the EUR/JPY and GBP/JPY.

Significant technical analysis' levels:

Resistance: 108.36 (high Oct 23), 108.74 (high Oct 8), 109.08 (61.8% of 109.91-107.75)

Support: 107.86 (session low Oct 24), 107.11 (low Oct 23), 106.78 (low Oct 22)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.