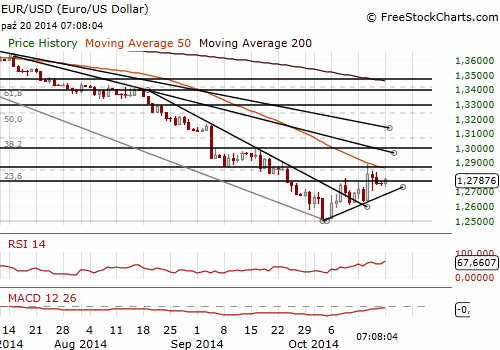

EUR/USD: Outlook still uncertain

(we keep our short position, but have lowered the stop-loss level)

Fed’ chair Janet Yellen did not comment on the economic outlook after investors reappraised the Fed's likely policy path. Yellen did not comment on the volatility of financial markets or on monetary policy. Instead, she was speaking on widening economic inequality in the United States.

Boston Fed President Eric Rosengren (dovish, does not have a rotating vote on Fed policy until 2016) said the recent volatility in financial markets reinforces the need for the Federal Reserve to be patient with its policy stimulus and to clearly tie an eventual interest-rate rise to improving economic conditions. Rosengren backs ending quantitative easing this month unless something dramatic happens. His comments reflect the dovish point of view and show there is no support from the doves for extending QE.

The current account balance in the Euro zone amounted in August to EUR 18.9 bn (seasonally adjusted) vs. EUR 21.6 bn in July, mainly due to lower foreign trade surplus.

The run of better U.S. data at the end of last week (industrial production, higher consumer sentiment reading and better-than-expected housing numbers) left the fundamental picture in favour of the USD. However, further dovish comments from the Fed officials may strengthen the EUR/USD.

We keep the target of our short EUR/USD position at 1.2710, but have lowered the stop-loss level to 1.2810, just to save our small profit. We do not see potential for a strong decline of the EUR/USD in the short term, but in our opinion the target is achievable.

Significant technical analysis' levels:

Resistance: 1.2779 (hourly high Oct 20), 1.2845 (high Oct 16), 1.2887 (high Oct 15)

Support: 1.2730 (10-dma), 1.2714 (21-dma), 1.2705 (session low Oct 16)

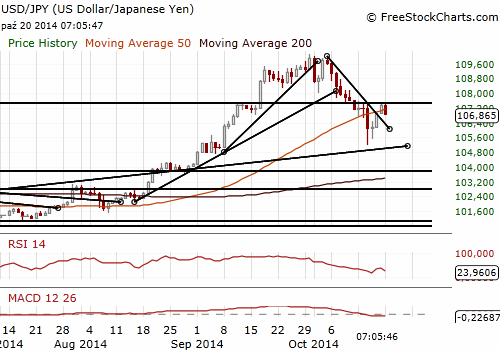

USD/JPY: Strong stocks despite political turmoil

(we keep our long position, key resistance at 107.63)

The junior partner in Japanese Prime Minister Shinzo Abe's coalition government called for steps to stimulate an economy hit by April's sales tax rise and to soften the pain of rising costs caused by a weak yen. Keiichi Ishii, policy chief of the Komeito party, said the government needs to craft an extra budget given the economy's current weakness regardless of Abe's decision on whether to go ahead with a second tax hike in 2015.

Japan's trade and justice ministers resigned after accusations they misused campaign funds.

Bank of Japan Governor Haruhiko Kuroda said on Monday the country's economy continues to recover moderately as a trend, although there are some weaknesses mainly in output. His speech was the same as what the recent policy meeting statement said.

The head of the central bank's Osaka branch Atsushi Miyanoya said the JPY's decline has boosted profits at big manufacturers in the Kinki region of western Japan as well as companies in the leisure industry as it lured more foreign tourists. Toru Umemori, the BOJ's Nagoya branch manager, said many companies in the Tokai central Japan region feel that rapid exchange-rate moves are undesirable.

Japan’s stocks traded higher on Monday despite resignations of prominent ministers from the Abe cabinet. The USD/JPY saw an early rally near 107.30 on news that Government Pension Investment Fund (GPIF) was looking to up its domestic equity allocation from 12% now to 25%. The USD/JPY fell back a bit to slightly below 107.00 later.

The currency bears are under pressure after recent strong recovery moves. We have raised the target of our long USD/JPY position to 108.30 from 107.50 previously. An important resistance level is situated at 107.63 (kijun line and daily high October 13). Breaking above that level will open the way for the currency bulls. We have moved also our stop-loss level to 106.50, to save our profit.

Significant technical analysis' levels:

Resistance: 107.49 (high Oct 15), 107.64 (high Oct 13), 108.15 (high Oct 10)

Support: 106.95 (session low Oct 20), 106.14 (low Oct 17), 105.51 (low Oct 16)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.