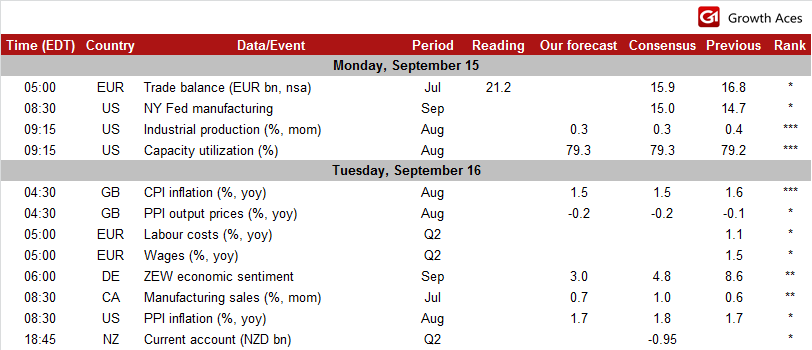

ECONOMIC CALENDAR

EUR/USD: More and more bullish signals.

(bullish outlook in the medium term)

The main event for the EUR/USD this week is the FOMC meeting on Wednesday. We expect further USD 10bn reduction in the pace of monthly asset purchases. Interest rates will be left unchanged. In conjunction with the meeting, the Fed will release an update of its economic forecasts, which will include projections for 2017. We expect the Fed to be less dovish in its forward guidance. In the opinion of GrowthAces.com the Fed is likely to drop the word “significant” in the sentence: “(…) a range of labor market indicators suggests that there remains significant underutilization of labor resources.” We also think that the Fed could replace the word “considerable” in the guidance that the first rate hike will only come “a considerable time after the asset purchase program ends.”

Some relief for the EUR/USD come from the Prime Minister Manuel Valls winning the confidence vote in France on Tuesday (September 16). A defeat could potentially lead to new elections. In our opinion it is unlikely that there will be a significant number of Socialists who are ready to bring down the government., especially knowing that in this case they would be reducing their chances of obtaining a seat in the new elections.

The seasonally adjusted trade surplus of the Euro zone narrowed again to USD 12.2 bn in July from USD 13.8 bn in June, due to a 0.2 monthly fall in export values and a 0.9% rise in import values. July’s euro-zone figures suggest that net trade continued to contribute poorly to GDP growth at the start of the third quarter, after making a negligible contribution to GDP in the previous quarter. Exporters continue to face problems due to crisis in Ukraine and the sanctions on Russia.

The EUR/USD opened today’s Asian session at 1.2965 and increased to a day’s high at 1.2980. The EUR/USD will likely consolidate ahead of the FOMC decision on Wednesday. Bullish hammer on the weekly candles last week is a buy signal for the EUR/USD. We see double top on the charts at 1.2980 which is the nearest strong resistance level. The 21-dma at 1.3106 is pivotal to the currency bulls. GrowthAces.com went long on the EUR/USD at 1.2920.

Significant technical analysis' levels:

Resistance: 1.2980 (high Sep 15), 1.2990 (high Sep 5), 1.3030 (recovery high Sep 4)

Support: 1.2859 (low Sep 9), 1.2788 (61.8% of 1.2042-1.3995), 1.2755 (low Jul 9, 2013)

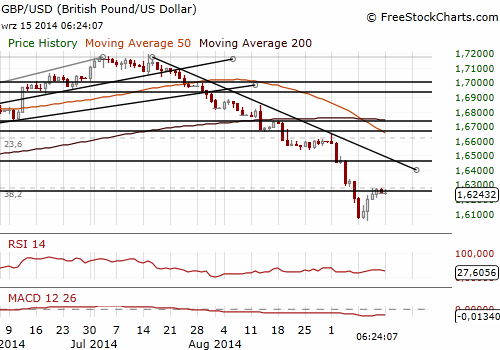

GBP/USD: Scotland's independence vote is still too close to call.

(still long, expecting "No" vote on Thursday)

The Sunday Times released a poll conducted by the Panelbase company giving a small advantage to those favoring Scotland's remaining in the United Kingdom, 50.6%, compared to 49.4% for supporters of independence.

The broadest "No" advantage was in the Opinium poll for The Observer, the Sunday edition of the daily The Guardian, which gave 47% to the "Yes" vote and 53% to those wanting Scotland to remain in the U.K.

The survey shows a similar result to that released Saturday by Survation, which gives an 8-point advantage to the "No" option – 54% to 46%.

The survey carried out for the Sunday Telegraph by ICM, on the other hand, shows the same advantage for the "Yes" vote – 54% to 46% - according to a sample of 705 people.

The GBP/USD rallied to test the 38.2% of 1.6645-1.6052 at 1.6279 overnight but retreated. We keep our long position expecting “No” on Thursday.

Significant technical analysis' levels:

Resistance: 1.6279 (38.2% of 1.6645-1.6052), 1.6340 (high Sep 5), 1.6358 (recovery high Sep 4)

Support: 1.6205 (low Sep 12), 1.6187 (low Sep 11), 1.6052 (low Sep 10)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.