The common currencydeclined against the U.S. dollar after stronger-than-expected U.S. economicdata. Earlier today, the Labor Department showed that the CPI rose 0.2% inMarch (above expectations for a 0.1% increase), while the core consumer priceindex (without volatile food and energy items) rose 0.2% last month (also aboveforecast of a 0.1% gain). Thanks to these better-than-expected numbers, theexchange rate tested the strength of the major support line. Will it stopsellers?

In our opinion, thefollowing forex trading positions are justified - summary:

EUR/USD: none

GBP/USD: short(stop-loss order: 1.6855)

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

EUR/USD

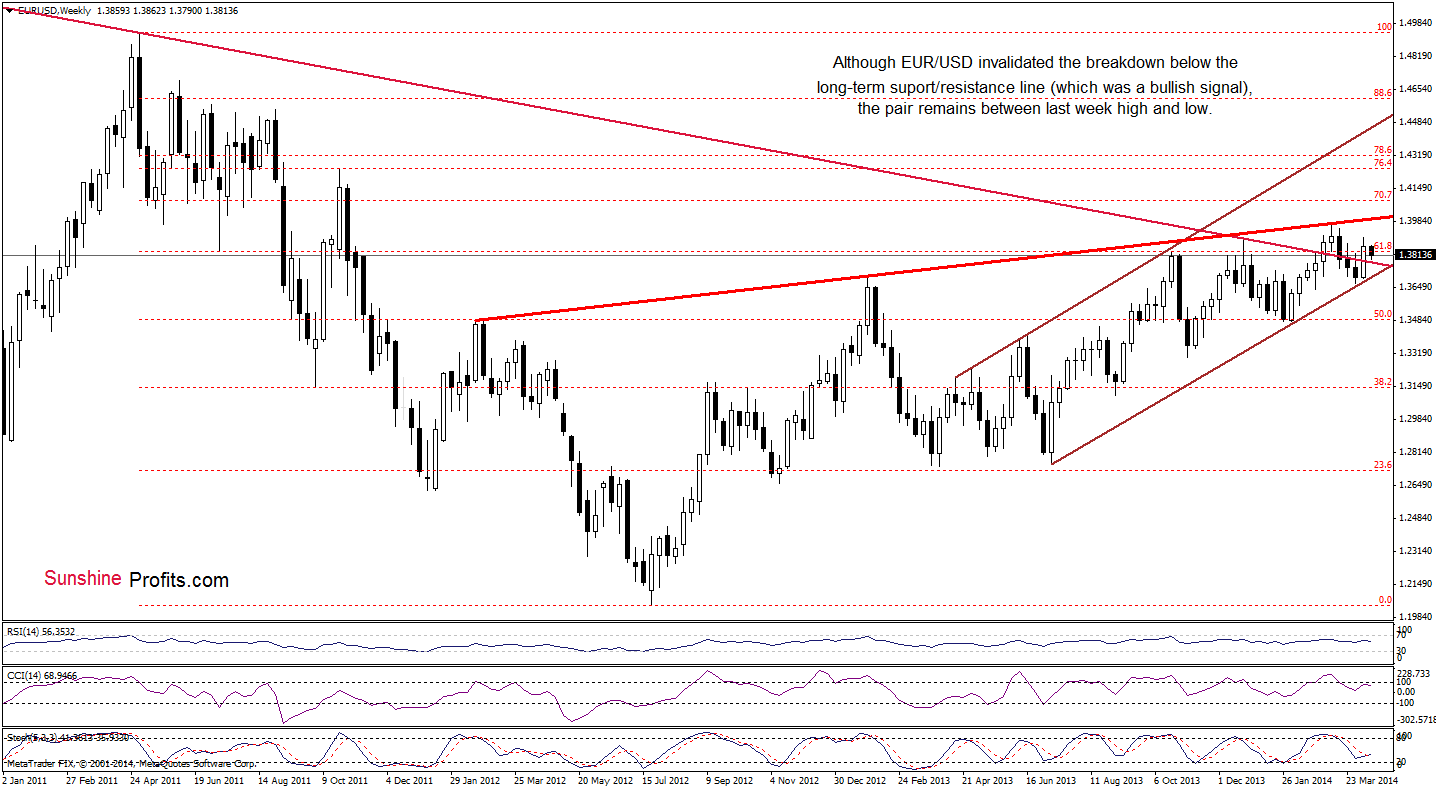

From the weekly perspective, we see that EUR/USD stillremains above the previously-broken long-term declining resistance line and thelower border of the rising trend channel (marked with brown). So, what we wrotein our previous Forex Trading Alert is still up-to-date.

(…)These two important lines still serve as major support. As you see on the abovechart, the exchnge rate remains below the 2014 high and the rising resistanceline (marked with red), which succesfully stopped growth in the previous month.From this perspective, it seems that as long as these key lines are in play, abigger upward or downward move is not likely to be seen.

Let’s take a look at the daily chart.

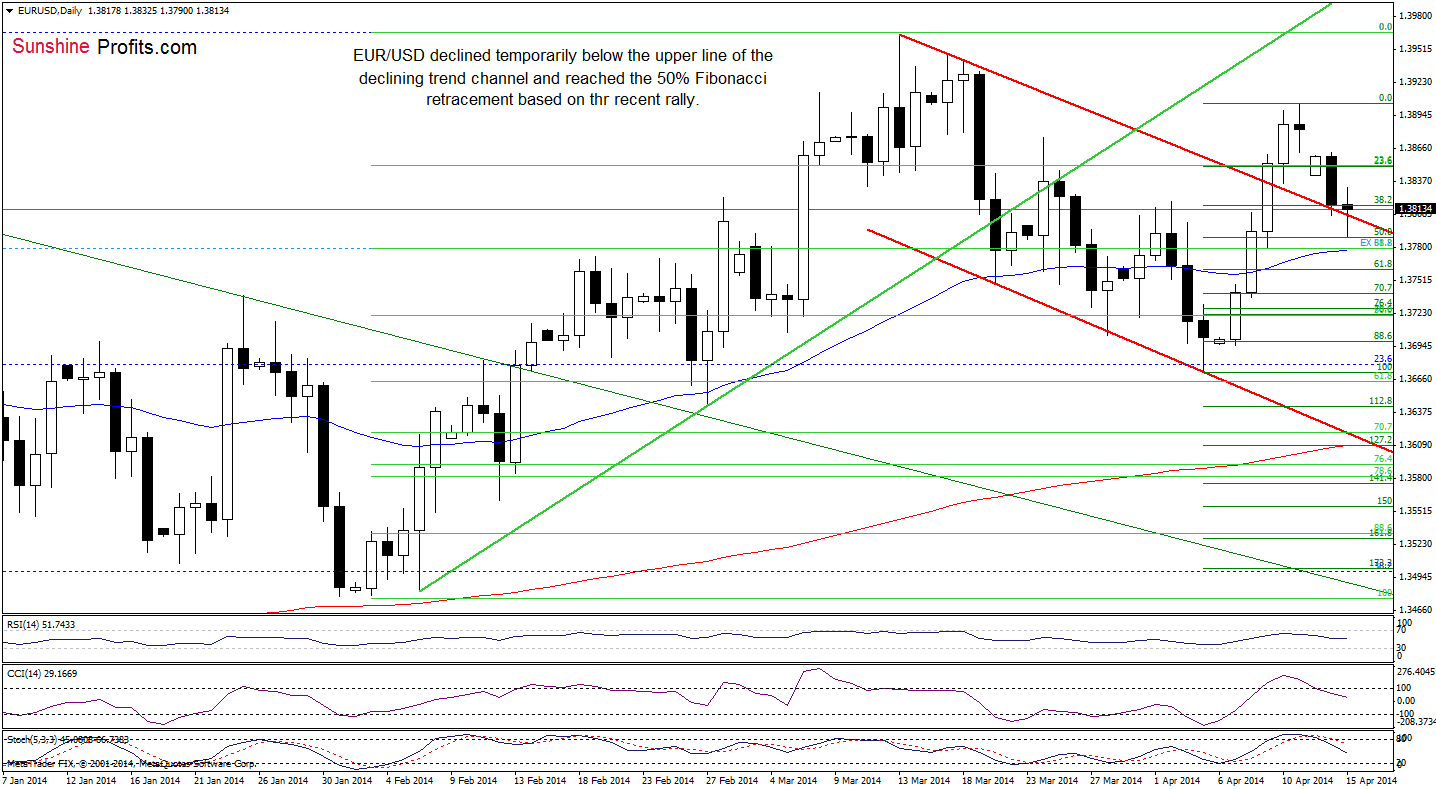

As you see on the dailychart, EUR/USD slipped below the upper line of the declining trend channel andreached the 50% Fibonacci retracement level (based on the recent rally) earliertoday. Although this support level encouraged buyers to act (which resulted ina corrective upswing), the pair still remains quite close to this importantline. If it holds, we may see another corrective upswing in the near future.However, if it is broken, we will likely see further deterioration in thecoming days and the initial downside target will be around 1.3777, where thelong-term declining line is (please note that in this area is also the 50-daymoving average). Additionally, the position of the indicators (sell signalsremain in place) favors sellers at the moment.

Very short-termoutlook: bearish

Short-term outlook:bearish

MT outlook: bearish

LT outlook: bearish

Trading position: In our opinion no positions are justified fromthe risk/reward perspective. We are not opening short positions just yet,because of the divergence on the long-term charts (we wrote more about thissituation in our Forex Trading Alert posted on Thursday), however we will quitelikely open it once we see some kind of confirmation.

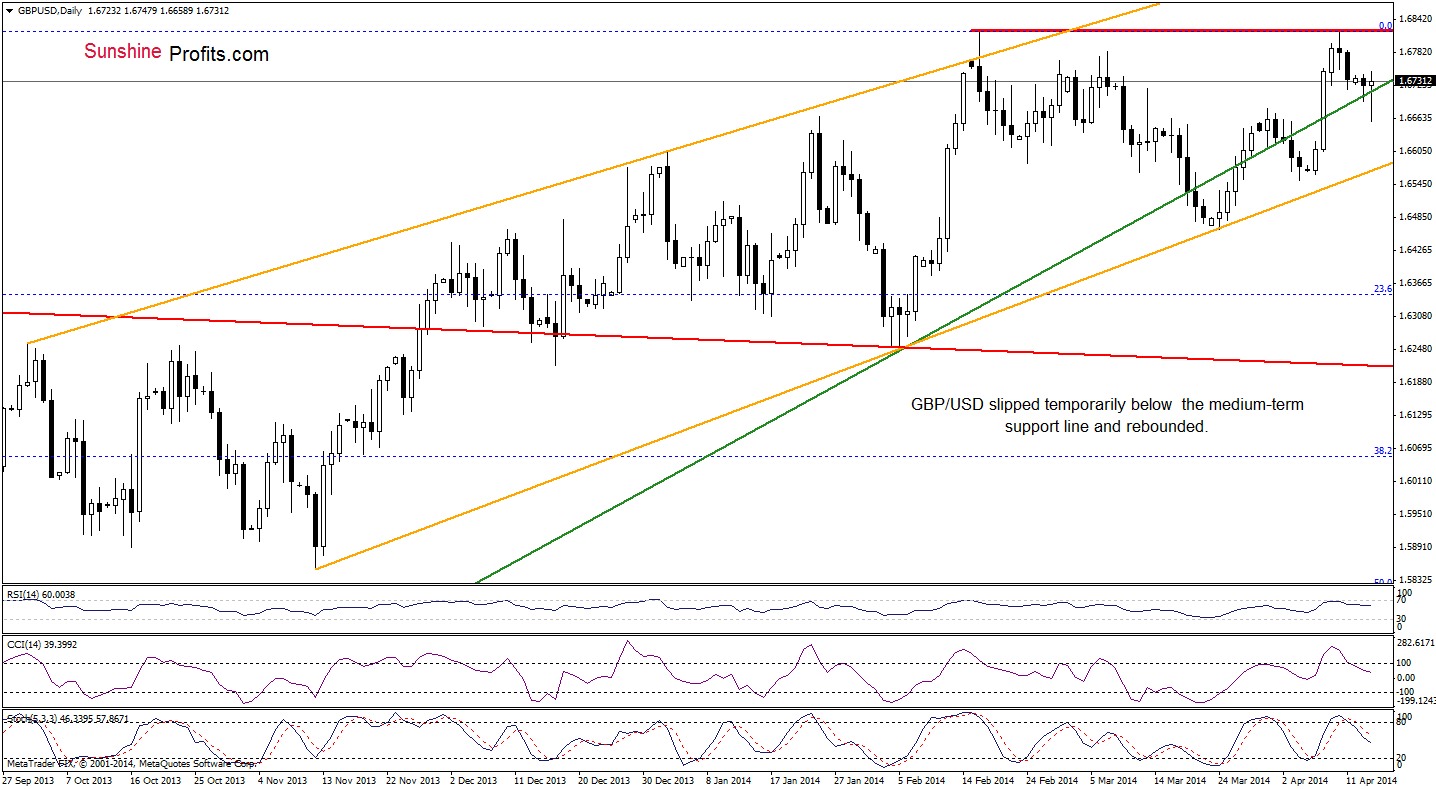

GBP/USD

From the weeklyperspective, we see that the situation hasn’t changed much. So, what we wrotein our last Forex Trading Alert is still up-to-date.

(…) GBP/USD still remains below the strongresistance zone created by the 2009, 2011 and 2014 highs, which suggests thatfurther deterioration should not surprise us. In fact, it’s likely enough tojustify having a speculative short position open (the one that was openedyesterday is already profitable).

To have more complete picture of the current situation in GBP/USD,let’s take a look at the daily chart.

In our Forex Trading Alert posted on Thursday, we wrote thefollowing:

(…) GBP/USD (…) reached the 2014 high earliertoday. If this strong resistance level holds, we will likely see a bearishdouble top pattern. In this case, the initial downside target will be themedium-term rising green line (currently around 1.6676). If it is broken, wemay see a drop to the lower border of the orange rising trend channel (around1.6550), which corresponds to the April low. (…) Please note that the currentposition of the indicators suggests that correction is just around the corner(…)

As you see on theabove chart, GBP/USD extended declines and broke below the medium-term risinggreen line earlier today. Although this deterioration was only temporarily andthe exchange rate came back above this line, sell signals remain in place,which suggests that another attempt to move lower should not surprise us. Ifthis is the case, the above-mentioned downside target will be in play.

Very short-termoutlook: mixed with bearish bias

Short-term outlook:bearish

MT outlook: bearish

LT outlook: mixed

Trading position(short-term; our opinion): Short. Stop-loss order: 1.6855. Please note that even if GBP/USD breaks above the 2014 high (andstop-loss order works), we’ll consider re-openingshort positions around the 2009 high. At this time, however, it seems that these levelswill not be reached before we see another sizable downswing – and thus thecurrent short positions are still justified.

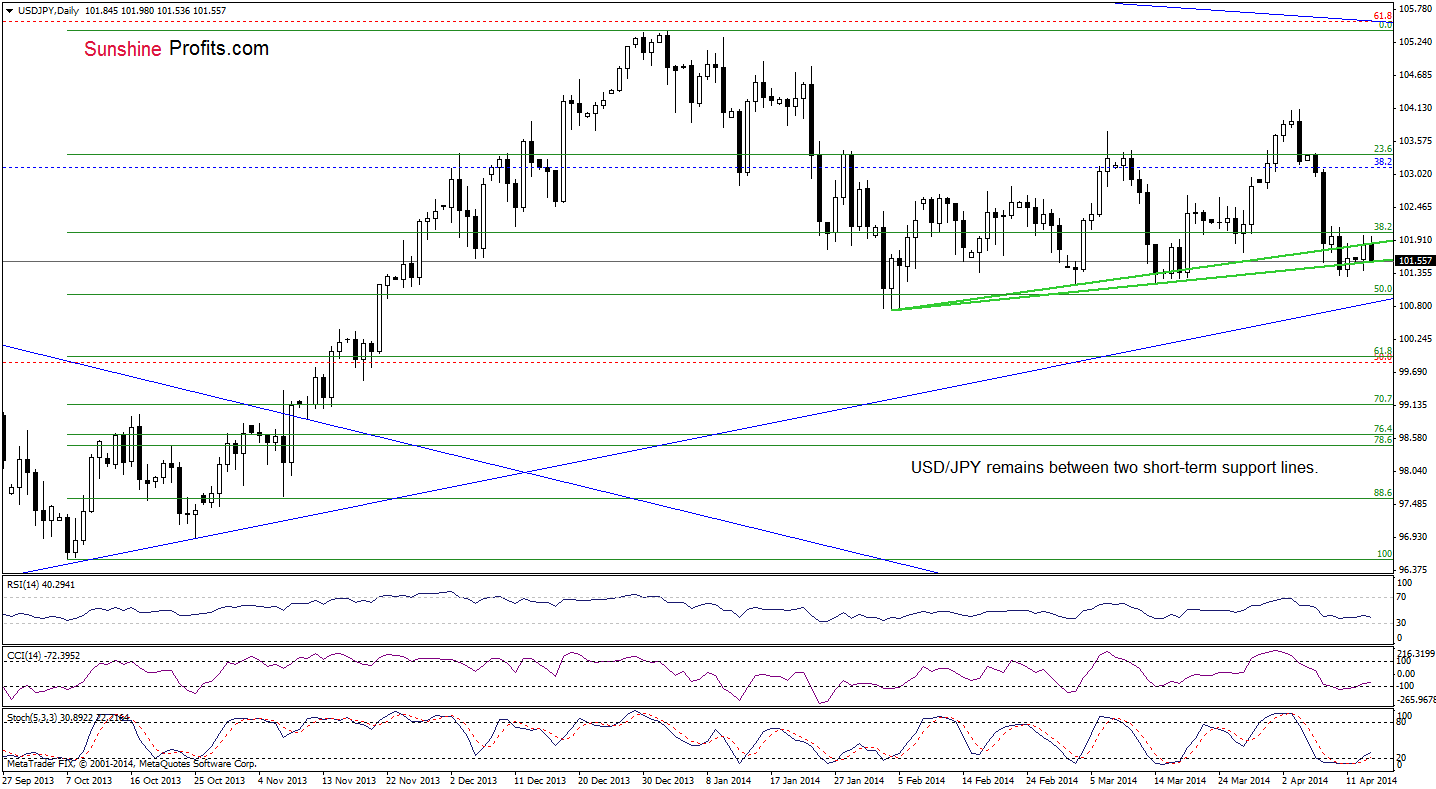

USD/JPY

Looking at theUSD/JPY from the monthly perspective, we see that the exchange rate remainsbelow the long-term declining resistance line. Therefore, even if the pairerases losses and climbs above the April high, it seems that further gains willbe limited around 105.80, where the major long-term resistance is. We mightopen a speculative long or short position after the currency pair breaks abovethe long-term resistance line, or invalidates such breakout.

Having discussed theabove, let’s move on to the daily chart.

From thisperspective, we see that there was another attempt to break above the upper greenline, but the buyers failed, which resulted in a drop to the lower support line.If it holds, we may see another try to close the day above the uppersupport/resistance line. However, if it is broken, we will likely see a drop tothe March 14 low or even to the February low. Nevertheless, we should keep inmind that the CCI and Stochastic Oscillator generated buy signals, whichsuggests that the pro growth scenario is more likely at the moment.

Very short-term outlook:mixed with bullish bias

Short-term outlook:mixed

MT outlook: bullish

LT outlook: bearish

Trading position(short-term): In our opinion no positions are justified from the risk/rewardperspective at the moment.

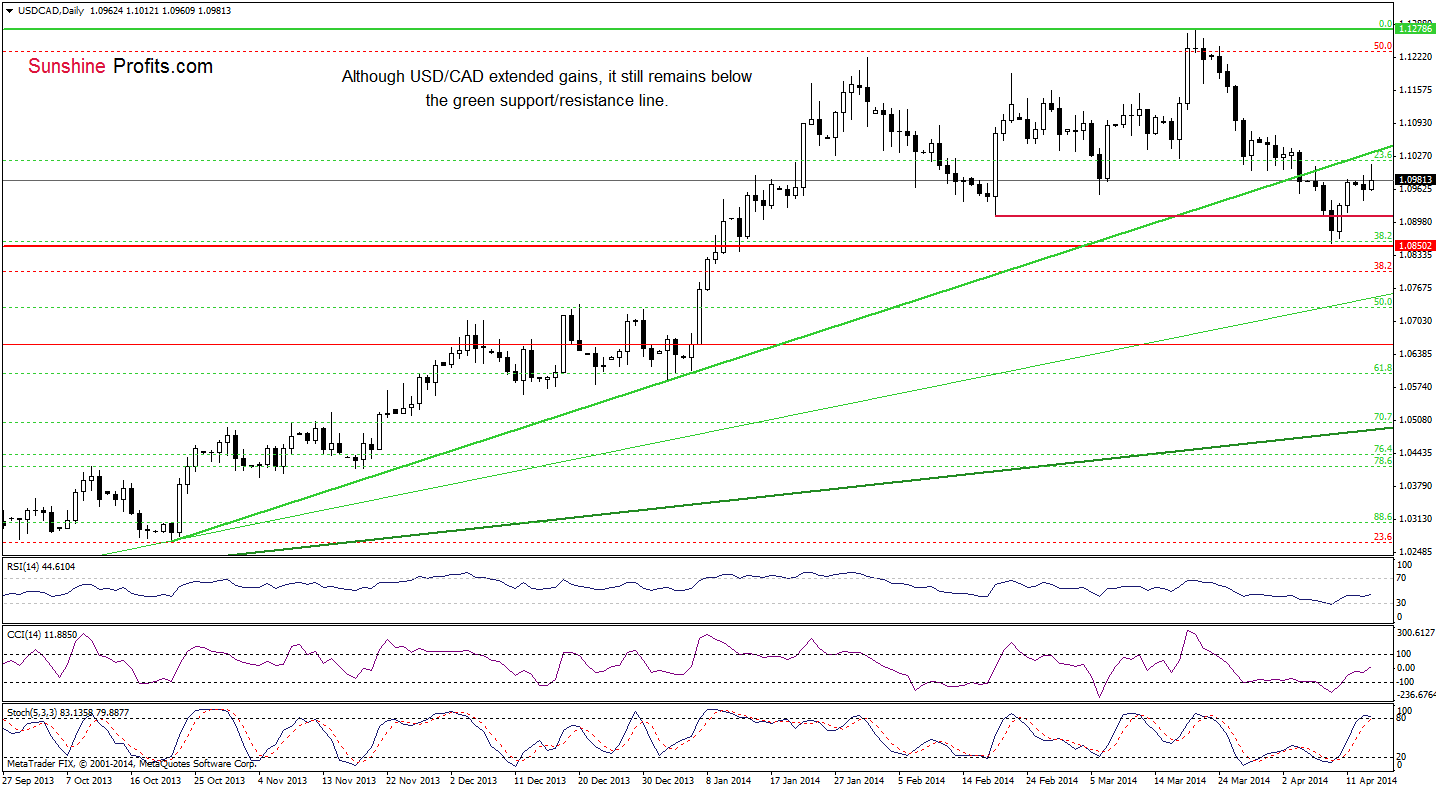

USD/CAD

As you see on the abovechart, USD/CAD extended gains and approached the previously-broken greensupport line earlier today. Despite this improvement, we noticed similar priceaction to the one that we saw yesterday – the exchange rate gave up some gainsand declined. If the pair extends losses, we may see a pullback to around1.0909 (where the Feb.19 low is) or even to the April low of 1.0857. On theother hand, if the buyers manage to push the exchange rate higher, we may seean increase to the major resistance line (currently around 1.1026). Please notethat the pro growth scenario is reinforced by the current position of theindicators (the RSI bounced off the level of 30, while buy signals generated bythe CCI and Stochastic Oscillator remain in place).

Very short-term outlook:mixed with bullish bias

Short-term outlook:mixed

MT outlook: bullish

LT outlook: bearish

Trading position(short-term): In our opinion no positions are justified from the risk/rewardperspective at the moment.

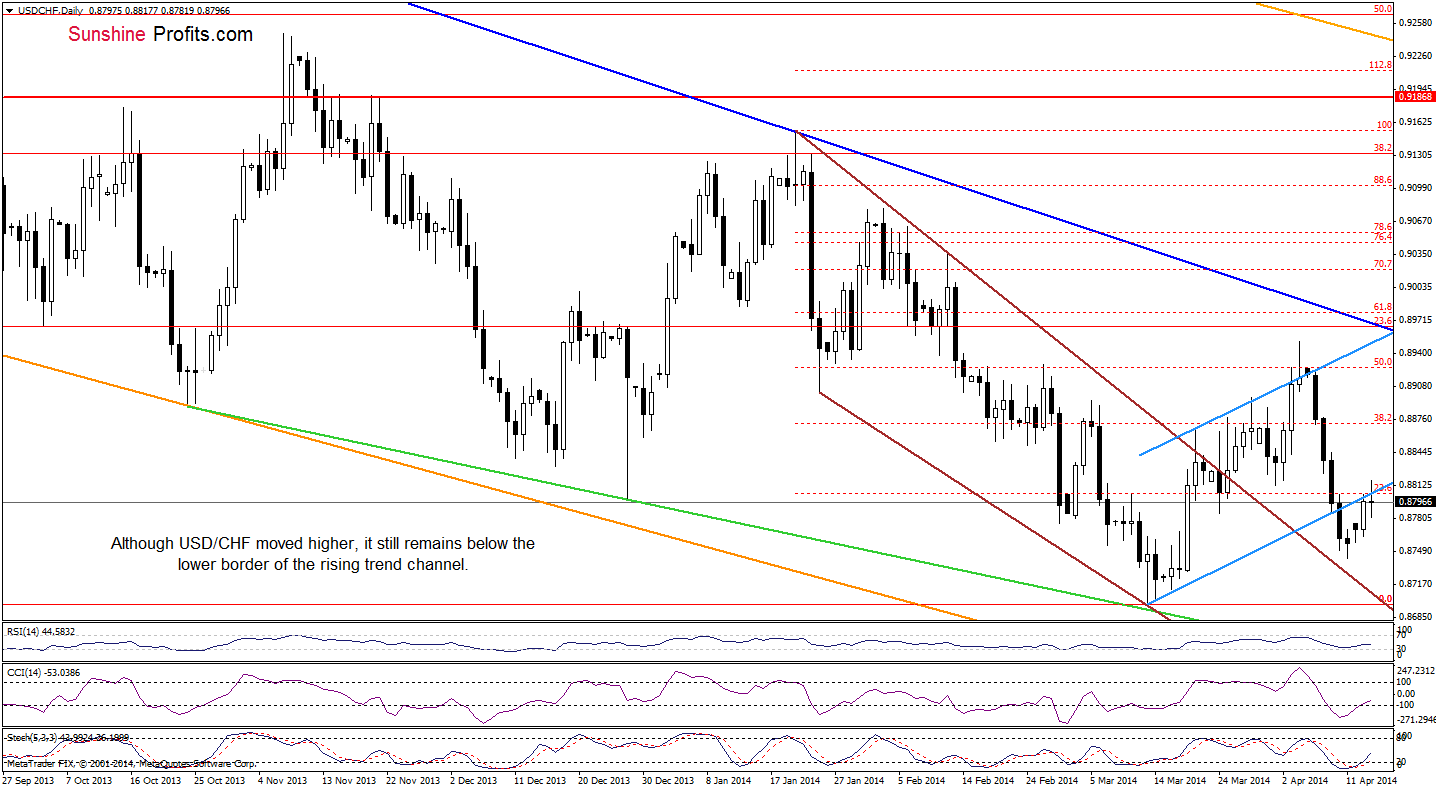

USD/CHF

As you see on the abovechart, the situation hasn’t changed much as USD/CHF remains around the lowerborder of the blue rising trend channel. Therefore, what we wrote yesterday, isstill valid.

(…) If the buyers do not give up and breakabove this resistance line, we may see an increase to (at least) 0.8813, wherethe Apr.1 low is. However, if the fail, we will likely see a pullback to theApril low or even to the declining brown line (currently around 0.8718). Pleasenote that the RSI bounced of the level of 30, while the CCI and StochasticOscillator generated buy signals, which suggests that another attempt to movehigher should not surprise us.

Very short-termoutlook: mixed with bullish bias

Short-term outlook:mixed

MT outlook: bearish

LT outlook: bearish

Trading position(short-term): In our opinion no positions are justified from the risk/rewardperspective at the moment.

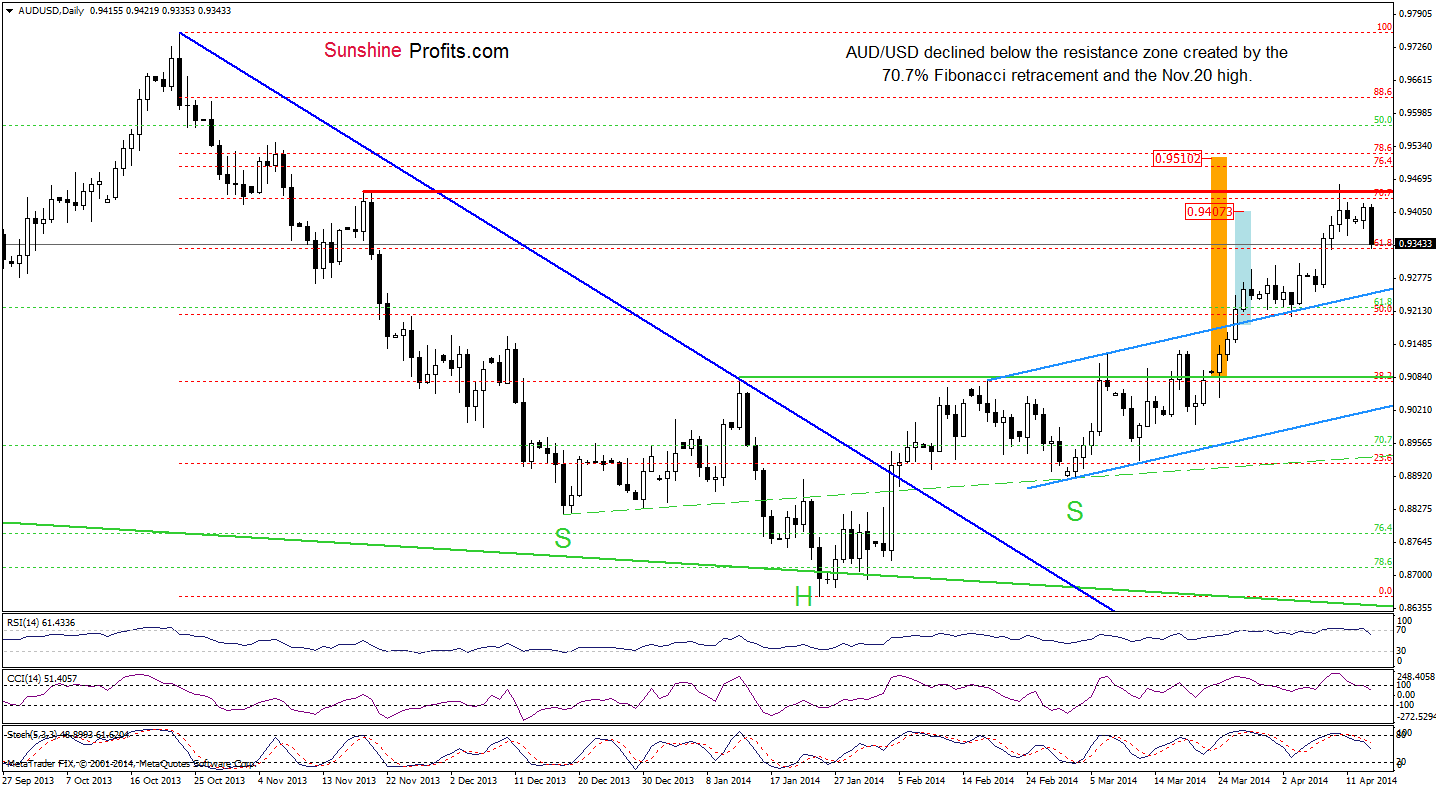

AUD/USD

Quoting our last Forex Trading Alert:

(…) the pair still remains below the resistancezone created by the 70.7% Fibonacci retracement (based on the entire Oct.-Jan.decline). If it holds, we may see a pullback in the coming days. In this case,the downside target for the sellers will be the previously-broken upper line ofthe trend channel. Taking into account the current position of the indicators(the RSI is overbought, while the CCI and Stochastic Oscillator generated sellsignals), it seems that we will see another attempt to realize the bearishscenario in the following days.

Looking at the abovechart, we see that AUD/USD gave up the gains and reversed earlier today. Withthis downswing, the sellers erased not only all yesterday’s gain, but alsopushed the exchange rate below Friday low. Additionally, the current positionof the indicators (sell signals remain in place) still favors sellers, whichsuggests that the bearish scenario from our last Forex Trading Alert is likelyto be seen in the coming days.

Very short-termoutlook: bearish

Short-term outlook:mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Tradingposition (short-term): In our opinion no positions are justified from therisk/reward perspective at the moment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.