Analysis for July 6th, 2015

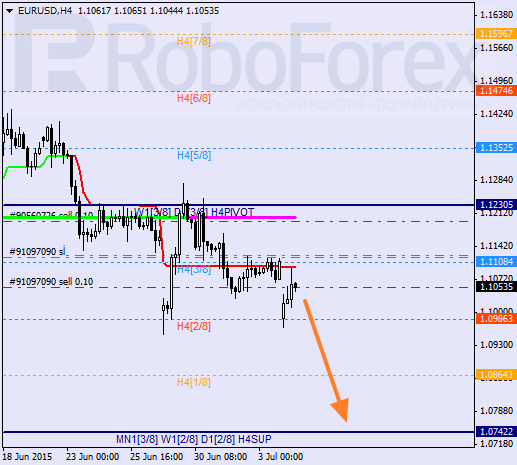

EUR USD, “Euro vs US Dollar”

Just like a week ago, the market was opened with a gap down. The pair is still supported by Super Trends. Considering that Eurodollar is already moving below the 3/8 level, in the future it may continue falling towards the 0/8 one.

As we can see at the H1 chart, the price has been supported by the 3/8 level. I’m planning to open another sell order as soon as the price is able to stay below the H1 Super Trend. The closest target is at the -2/8 level. If the market breaks it, the lines at the chart will be redrawn.

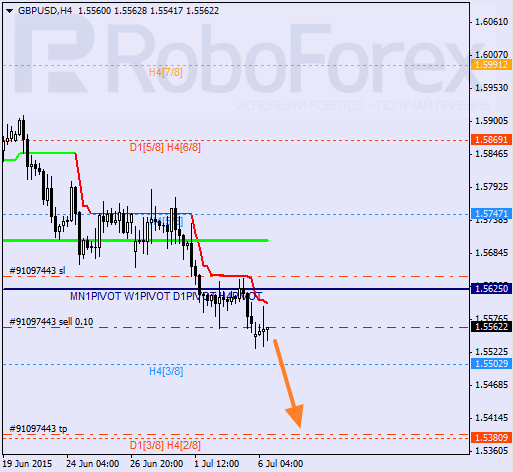

GBP USD, “Great Britain Pound vs US Dollar”

Pound has been supported by the 4/8 level; the price has rebounded from this level several times. Earlier Super Trends formed “bearish cross”. In the nearest future, the market is expected to continue falling towards the 2/8 level.

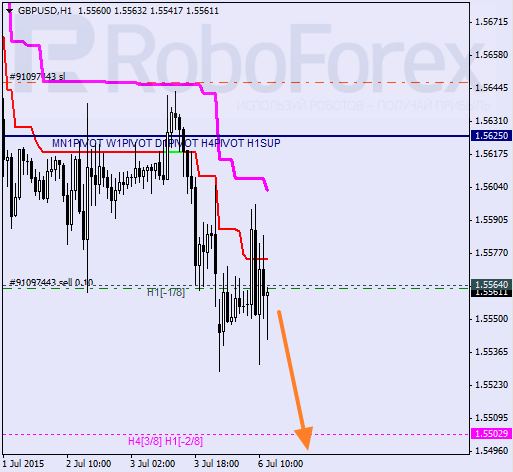

At the H1 chart, the pair is moving inside “oversold zone”; bears are supported by Super Trends, which are influenced by “bearish cross”. Probably, the price may reach a new local low during the day.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

UK CPI set to grow at stable 2.2% in August ahead of BoE meeting

The United Kingdom Office for National Statistics will release August Consumer Price Index figures on Wednesday. Inflation, as measured by the CPI, is one of the main factors on which the Bank of England bases its monetary policy decision, meaning the data is considered a major mover of the Pound Sterling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.