Similar situation happened in the last two days when European currencies rose on little-disappointing US data and Aussie Dollar tumbled.

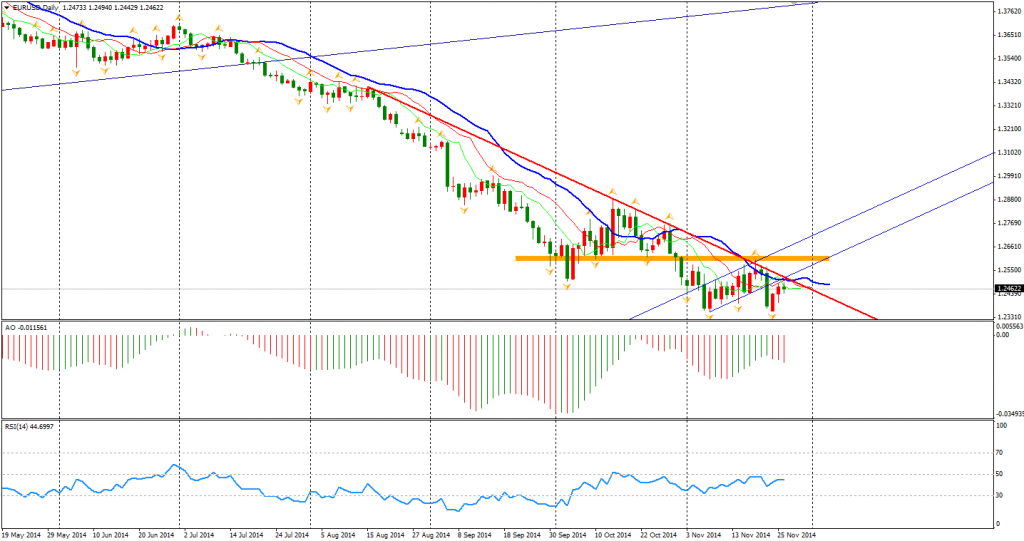

Euro emerged on its third consecutive day above 1.25. However, Friday’s loss has yet to be recovered, given this week’s movement on EURUSD was just a correction. As the As Thanksgiving Day approaches, the range of movement may contract for the rest of the week and the bearishness of Euro may probably restart after the weekend.

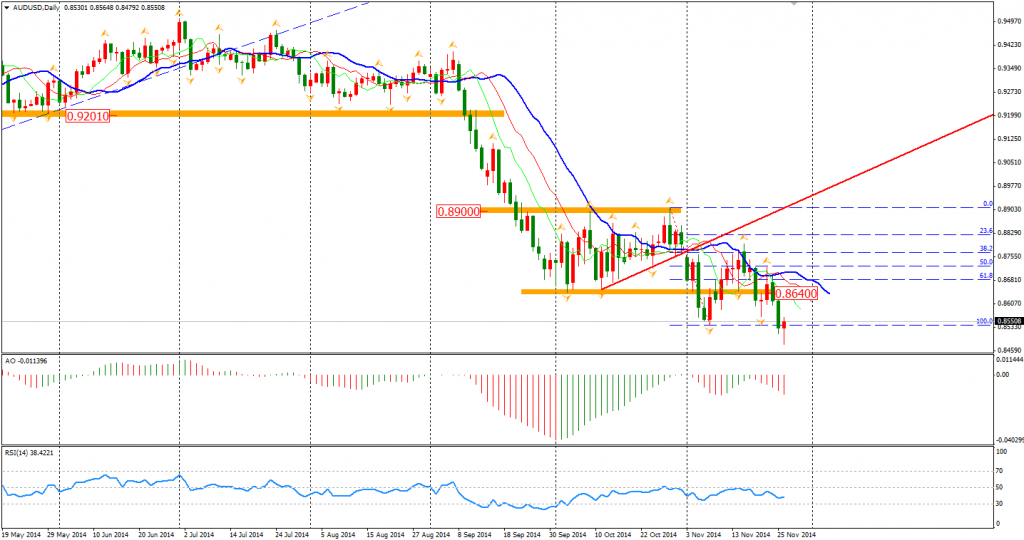

Australian Dollar was still the weakest player yesterday, refreshed low at 0.8480. RBA officials continued sending bearish speeches on their currency and the biggest export good – iron ore, remained at multi-year low. The RBA deputy governor Philip Lowe even mentioned rate cut in his speech. Even though the possibility of this action is still low in 2015, the market now has no choice but follow RBA to push the Aussie Dollar to a lower level.

Sure, we have witnessed several fake breakouts lately on AUDUSD, but this time might be real.

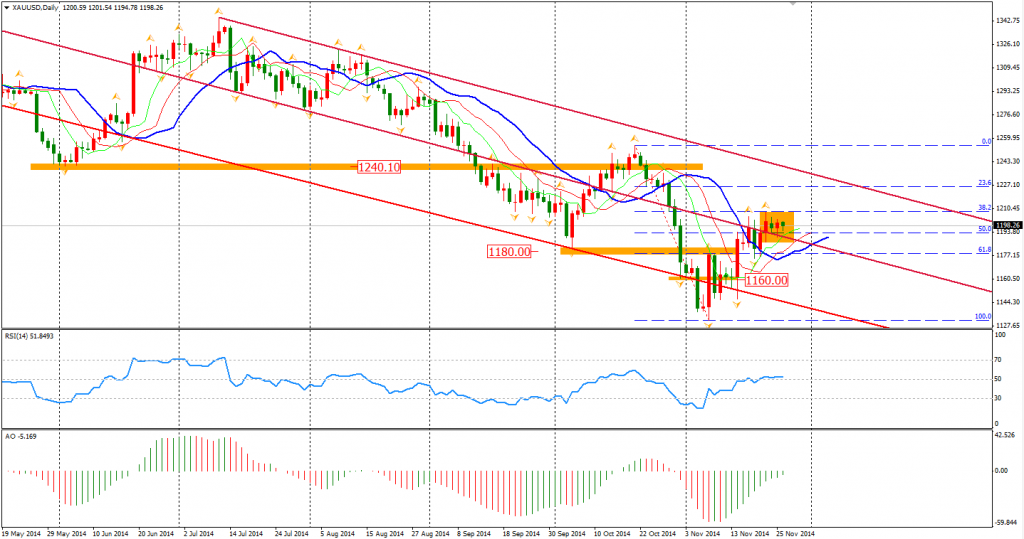

The consolidation of the yellow metal continues, the trading range of this week is still within the spin of last Friday, showing that participants are conservative before the long weekend. We can see the upper boundary of the downward channel suppressing the gold price, but we may have to wait till next week to see whether there will be a breakout or falling on the price.

Most Asian stock markets remained rising. The Shanghai Composite surged 1.43% for the third day in a row to 2604, a 39-month high. ASX 200 also advanced 1.15% to 5396. In the European stock markets, the UK FTSE was down 0.03%, the German DAX rose 0.55% and the French CAC Index lost 0.2%. The US market inched lower. The S&P 500 gained 0.28% to 2073. The Dow closed 0.07% higher at 17828, and the Nasdaq Composite Index rose 0.61% to 4787.

On the data front, Australian Private Capital Expenditure will be released at 11:30 AEDST. German Unemployment Change and Prelim CPI are the main data in European session. Also, the result of OPEC Meetings will be the focus later today.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.