Are we experiencing a calm before a great raging storm?

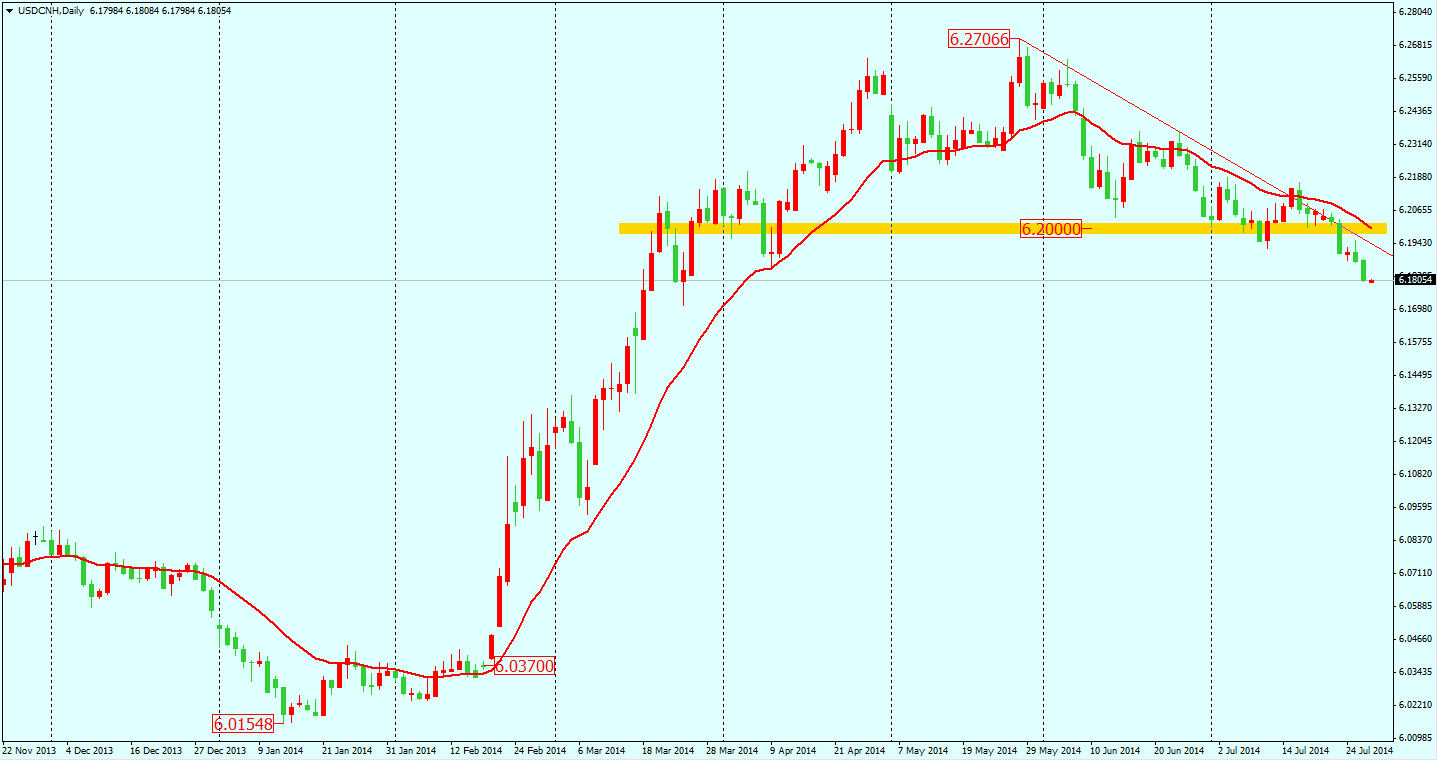

The Chinese Yuan rebounded from its weakness in the first quarter and reached a four-month high yesterday. USDCNH fell to 6.1820 as the RMB was inspired by the Chinese upbeat economic data released in the weekend. The recent data is showing signs of the Chinese economy gradually recovering and the business confidence has improved. In the mid-term, Chinese Yuan should continue its strength against Dollar.

On the other side of the planet, Argentina is confronting its second default in 14 years as its government has limited reserves to repay the debt that will expire at the end of this month.

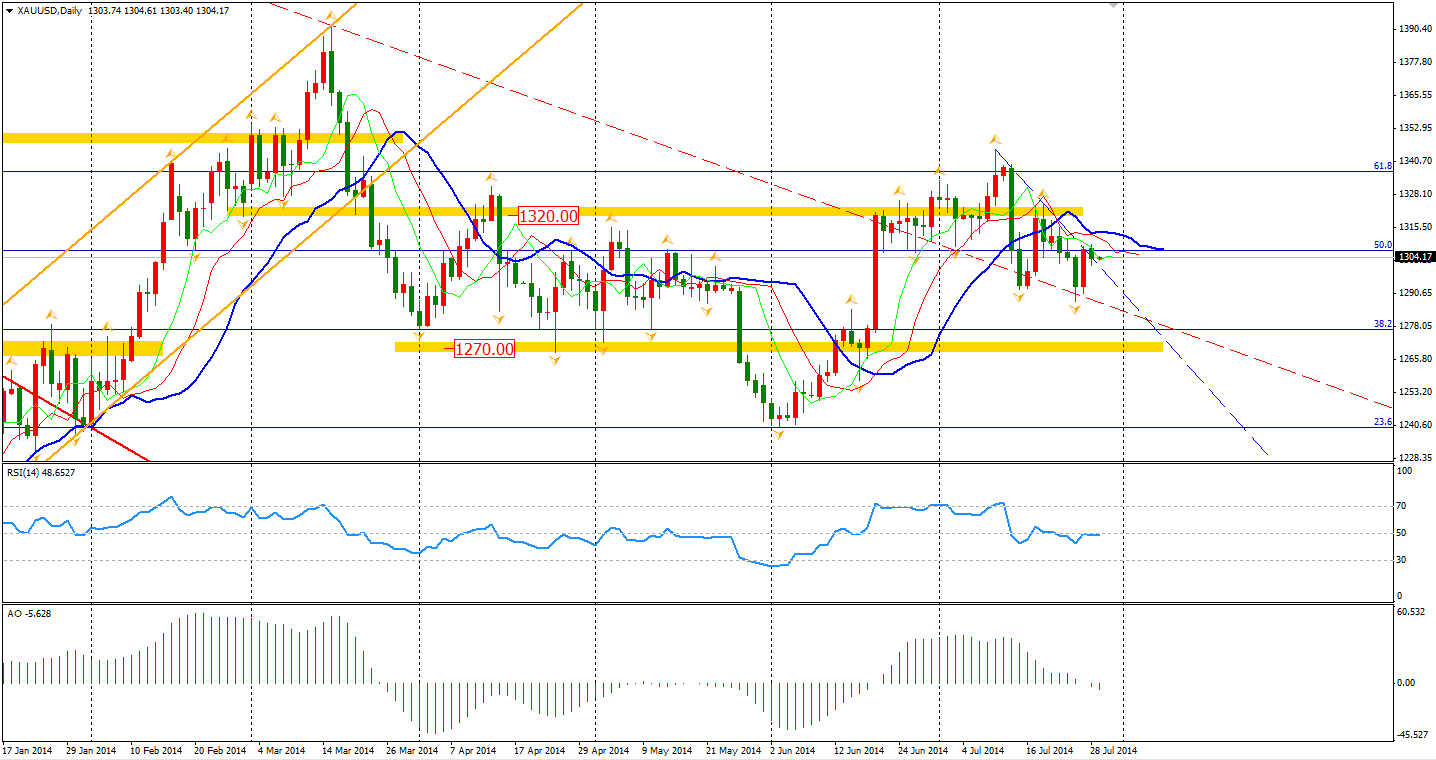

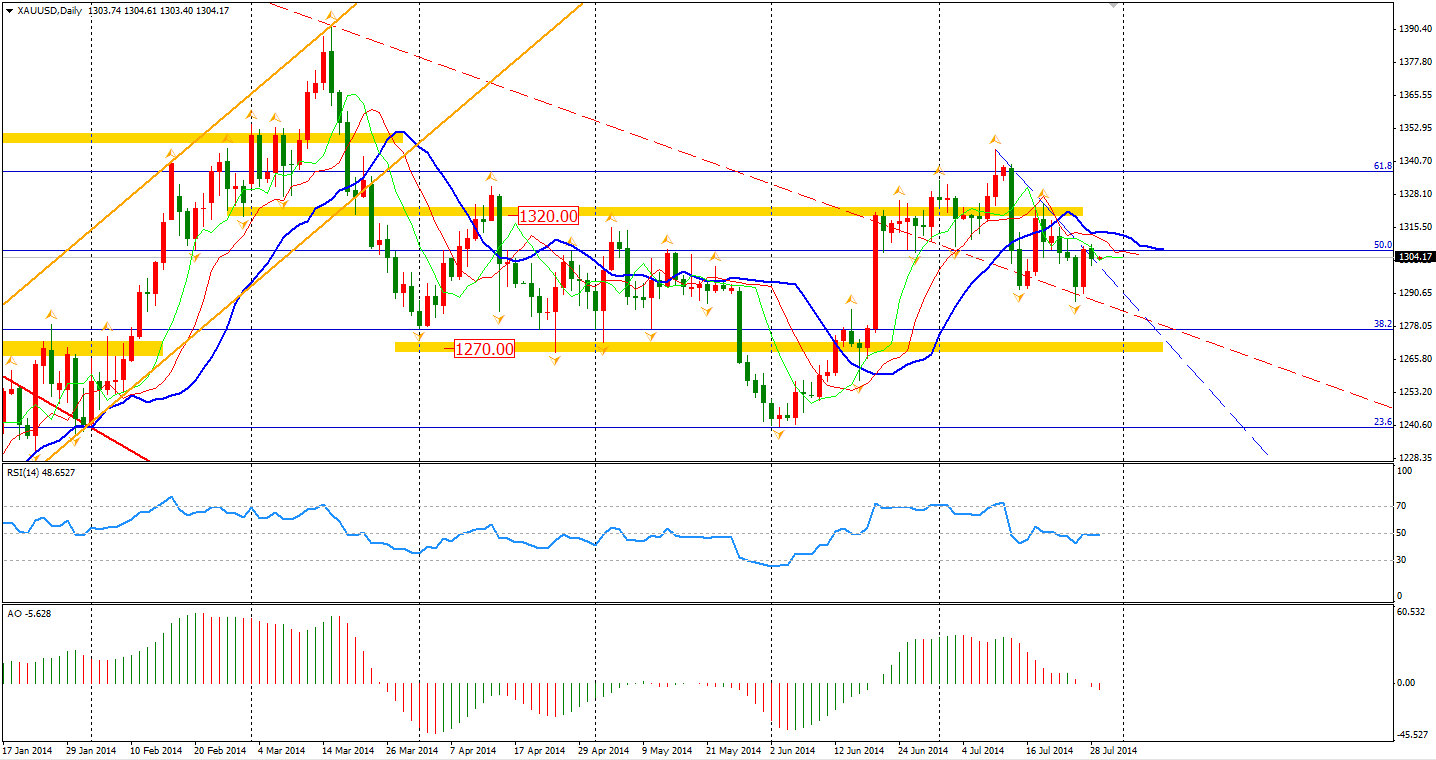

Its last sovereign default in 2001 dragged the country into deep recession causing society and political system turmoils. Now, 13 years later, this potential default may again isolate the Argentina from international financial markets and will raise the financial burden of its neighbours, like Brazil. The whole Latin America will be hit by this setting off a chain reaction in the global financial markets. It may be the first domino in a new round of financial crisis. Usually, US dollar and safe-haven assets like Gold will gain from such risk events.

The Aussie Dollar fell from the top of its sideway range implying a continual weakness. The pattern seems to be bearish for the mid-term as the Aussie should not move beyond the 0.9460 and the downward trend line of October 2013. Local traders may be on the lookout for Building Approval data this Thursday and PPI on Friday.

In the Asian market, Chinese stocks were inspired by bright industrial firms’ profits and potential privatization reforms of state-controlled banks. Shanghai Composite surged 2.41% to 2178, a seven month high. The Nikkei Stock Average gained 0.46%. The Australian ASX 200 closed flat at 5577. In the European stock markets, the FTSE closed 0.05% lower, the DAX fell 0.48%, and the French CAC advanced 0.33%. The U.S. closed with little changes as investors are waiting for FOMC meeting and data release in this week. The Dows rose 0.13% to 16983. The S&P 500 closed flat at 1979, while the Nasdaq Composite Index lost 0.1% to 4445.

Today may still be a quiet trading day. Only the U.S. CB Consumer Confidence released at midnight may catch traders’ eyes.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.