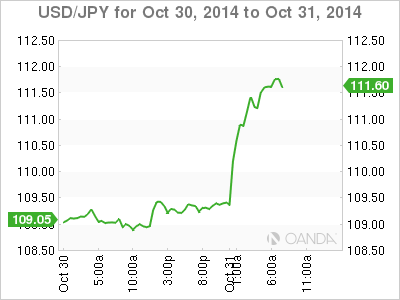

USD/JPY has climbed sharply on Friday, as the pair trades in the mid-111 range in the European session. The pair jumped after a surprise announcement by the BoJ to increase stimulus by raising its monetary base target to JPY 80 trillion annually. In the US, today’s highlight is Revised UoM Consumer Sentiment. The markets are expecting the indicator’s upward trend to continue, with the estimate standing at 86.4 points.

The dollar has gained about 250 points against the yen on Friday, as the Japanese currency finds itself close to 7-year lows. The yen took a tumble after the BoJ surprised the markets with a move to increase monetary stimulus. The monetary base target has been increased from JPY 60-70 trillion per year to JPY 80 trillion. The BoJ said that the move was needed to increase inflation, which remains short of the central bank’s target of 2%.

Japanese data continues to impress this week. Preliminary Industrial Production sparkled in September, with a gain of 2.7%, compared to a reading of -1.5% a month earlier. The estimate stood at 2.3%. Earlier in the week, Japanese Retail Sales was unexpectedly strong in September, climbing 2.3%, its strongest gain since March and well above the estimate of 0.9%. There has been concern about consumer spending in Japan after the sales tax was raised in April from 5% to 8%. The government plans to increase the tax to 10%, but is wary about hurting the economy, which has been marked by modest growth. Meanwhile, Household Spending, an important consumer spending indicator, fell 5.6%, well below expectations.

It was another solid performance from US GDP, which posted a strong gain of 3.5% in Q3, ahead of the estimate of 3.1%. Although this was short of the Q2 reading of 4.0%, the two readings mark the strongest six-month gain we’ve seen in ten years. Unemployment Claims increased slightly to 287 thousand, slightly higher than the previous reading of 284 thousand. However, the four-week average remains at multi-year lows, pointing to an improving labor market.

The US dollar posted strong gains on Wednesday, boosted by a hawkish Federal Reserve policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected, the Fed completed the taper of its QE3 program. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

USD/JPY 111.61 H: 111.89 L: 109.20

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.