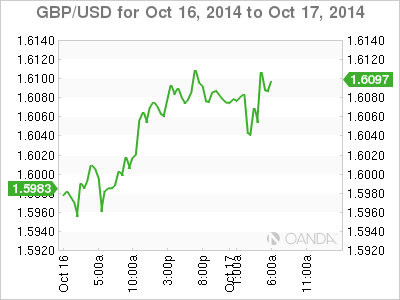

After sharp losses earlier in the week, the pound has rebounded. In Friday’s European session, GBP/USD is trading at the 1.61 line. On the release front, there are no UK releases on Friday. Over in the US, it’s another busy day, with the release of Building Permits and UoM Consumer Sentiment. As well, Federal Reserve Chair Janet Yellen will deliver remarks at an event in Boston.

On Wednesday, the pound got a boost thanks to strong British numbers and disappointing US data. In the UK, Average Earnings Index edged up to 0.7%, matching the estimate. This was a four-month high for the indicator, which is an important indicator of consumer inflation. On the employment front, Claimant Count Change continues to drop, but the reading of -18.6 thousand was well of the forecast of -34.2 thousand. Meanwhile, the unemployment rate dropped from 6.2% to 6.0%, its lowest level since November 2008. In the US, retail sales and inflation numbers sagged, Core Retail Sales dipped 0.2%, its first decline since April 2013. It was a similar story with Core Retail Sales, which posted a decline of 0.3%, its first loss since January. This points to a decrease in consumer spending, a key component of economic growth. Meanwhile, PPI fell by 0.1%, after a reading of 0.0% a month earlier. All three events missed their estimates.

There was better news on Thursday, as US Unemployment Claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand. Manufacturing numbers were a mix, as Industrial Production gained 1.0%, its best showing since November. The Philly Fed Manufacturing Index dipped to 20.7 points, but this beat the estimate of 19.9 points.

British CPI, the primary gauge of consumer inflation, continues to lose ground. The index dropped to 1.2%, a five-year low and short of the estimate of 1.4%. Core CPI and PPI Input also missed their estimates, as inflation indicators continue to point downwards. The weak CPI reading gives Governor Mark Carney more breathing room to maintain current interest rate levels, and investors responded to the news by dumping their pound holdings on Tuesday. There is growing sentiment that the BoE could delay a rate hike until the second half of 2014, with inflationary pressures continuing to recede.

GBP/USD 1.6101 H: 1.6130 L: 1.6030

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.