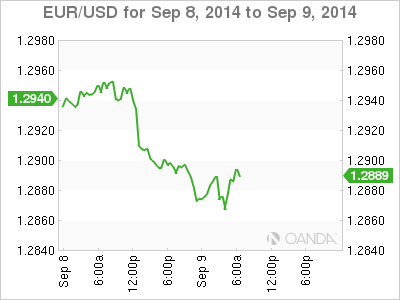

The euro is stable but under pressure on Tuesday, as EUR/USD has dropped below the 1.29 level for the first time since July 2013. It's another quiet day on the release front, with no major events in the Eurozone. In the US, today's highlight is JOLTS Jobs Openings. The employment indicator has improved over three consecutive releases, and the upward swing is expected to continue, with an estimate of 4.72M.

US numbers continue to point to a deepening recovery, but the labor market is showing some signs of trouble. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. The disappointing release follows a weak ADP Nonfarm Payrolls report as well as a rise in unemployment claims. The markets are hoping for some relief from JOLTS Jobs Openings, which is expected to improve in the August release.

Elsewhere in the US, there was positive news from last month's services and manufacturing PMIs. ISM Non-Manufacturing PMI continued its impressive climb, hitting 59.6 points, well above the estimate of 57.3. ISM Manufacturing PMI climbed to 59.0 points, beating the forecast of 57.0 points. The impressive readings from the manufacturing and services sectors point to a balanced economic recovery. If US numbers continue to point upwards, we could see an interest rate hike in the early part of 2015.

German Trade Balance started off the week in fine fashion, as the trade surplus climbed to EUR 22.2 billion, up from 16.2 billion a month earlier. This easily beat the estimate of 17.3 billion. The strong figure follows impressive German manufacturing data last week. Industrial Production gained 1.9%, its strongest showing in 2014. This handily beat the estimate of 0.5%. Factory Orders sparkled with a 4.6% last month, its highest gain since November 2011. This easily beat the estimate of 1.6%, and follows two straight declines.

Dramatic and unexpected monetary action by the ECB on Thursday sent the euro reeling below the 1.30 level. The markets had not expected any change to interest rates, but the ECB took the axe for the second time in three months, cutting the benchmark rate to a record low of 0.05%, down from 0.15%. As well, the deposit facility rate was lowered to -0.20% from -0.10% and the marginal lending rate dropped to 0.30% from 0.40%. ECB head Mario Draghi had more in store, saying that the central bank plans to implement an asset purchase program (QE). No details of a QE scheme were provided, but the ECB said it would release details in October. The interest rate cuts and QE scheme are intended to bolster anemic growth in the Eurozone and combat the growing threat of deflation. Draghi is using everything he can lay his hands on in the ECB toolbox, and time will tell if the latest measures have a positive effect on the stumbling Eurozone economy.

EUR/USD 1.2890 H: 1.2890 L: 1.2859

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.