Key Highlights

Aussie Dollar rocketed higher during the Asian session, as the employment report released in Australian was better-than-expected.

Australian Employment Change released by the Australian Bureau of Statistics came in at 42.0K in May 2015, compared to the expectation of 11.0K.

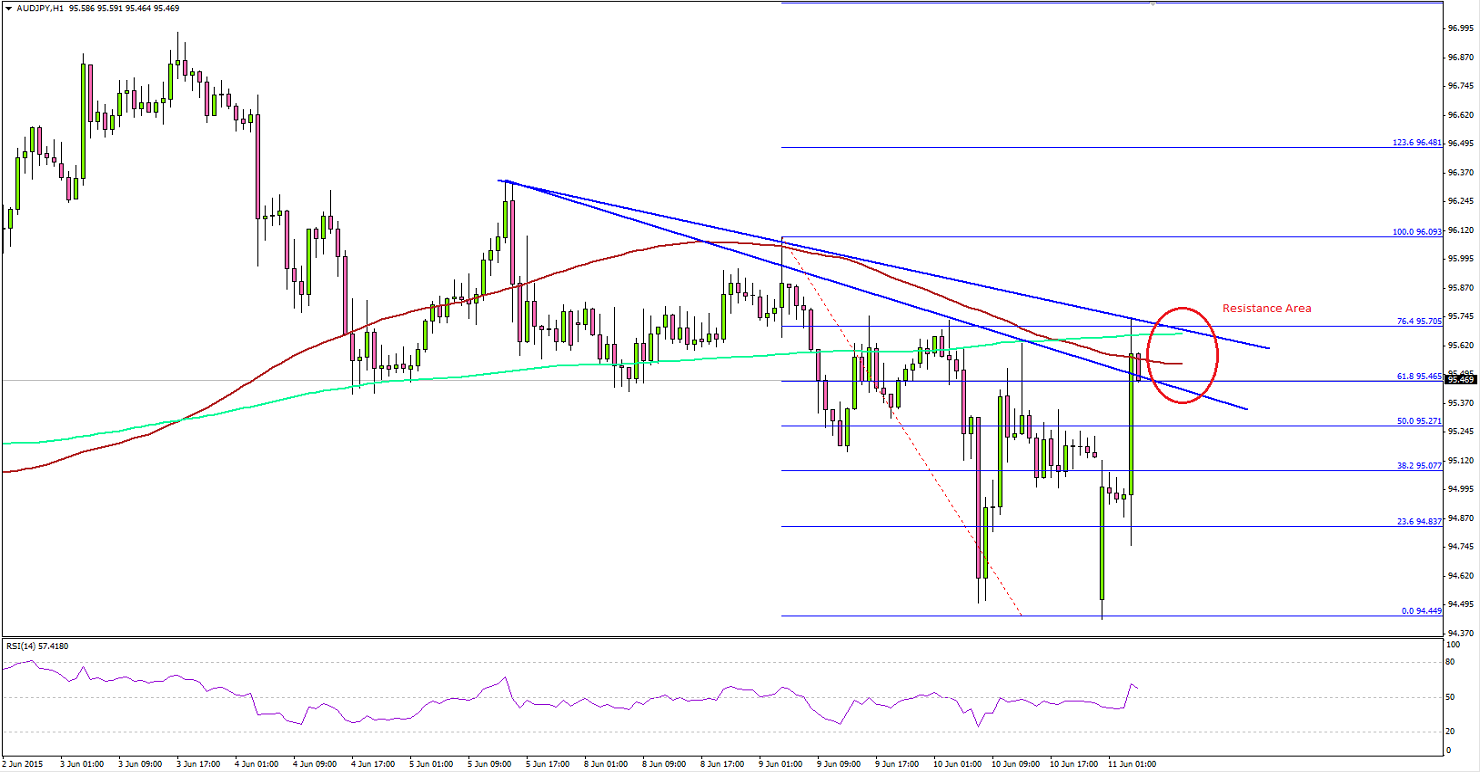

AUDJPY pair surged higher after the report was published, but facing an important resistance area.

AUDJPY – Technical Analysis

As mentioned the AUDJPY pair traded higher, and moved by more than 50 pips to trade near a monster resistance area. There is a critical confluence area formed around 95.50-70, as there are many hurdles around the mentioned area. The 100 hourly simple moving average (SMA), 200 SMA, a couple of bearish trend lines and the 76.4% Fib retracement level of the last drop from the 96.09 high to 94.44 low are positioned around a same area. In short, buyers might face a tough time to take the pair higher moving ahead.

If the AUDJPY pair settles successfully above the 95.70 level, then there is a chance of it moving towards 96.00. On the downside, the 95.40 level can be seen as an immediate support area, followed by 95.10. The hourly RSI is above the 50 level, which is a bullish sign in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by 50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.