Analysis for May 19th, 2014

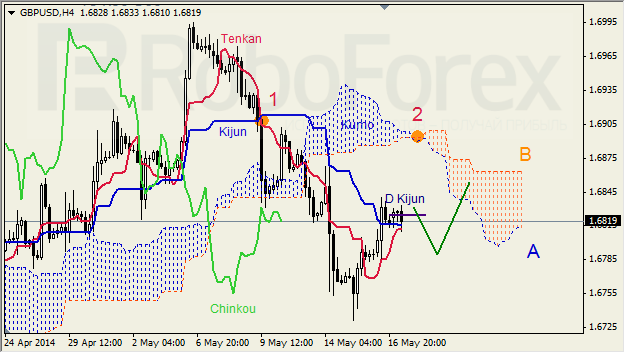

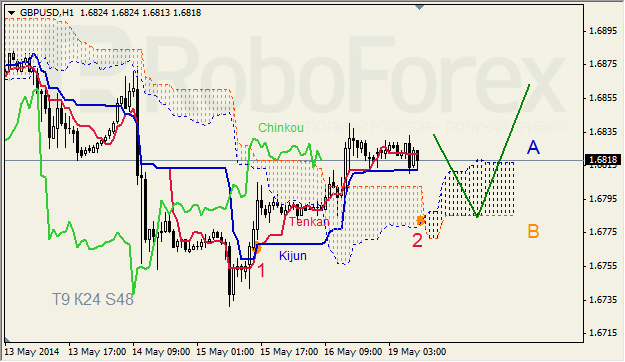

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are close to each other, but still influenced by “Dead Cross” (1). Ichimoku Cloud is going down (2), and Chinkou Lagging Span is below the chart. Short‑term forecast: we can expect resistance from D Kijun-Sen, and attempts of the price to stay inside Kumo.

GBPUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen are close to each other influenced by “Golden Cross” (1). Ichimoku Cloud is going up (2), and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect support from Senkou Span A.

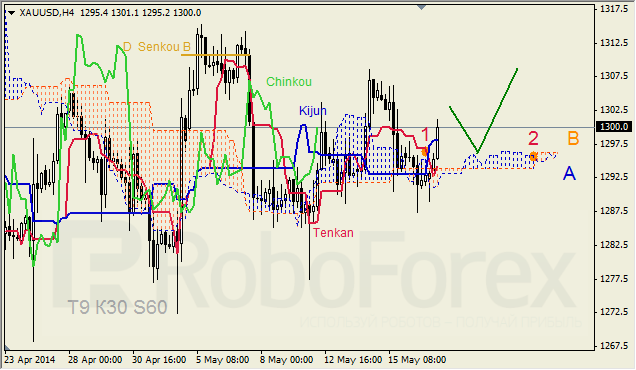

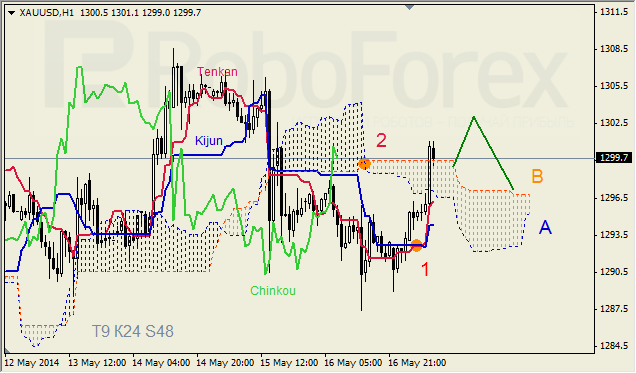

XAUUSD, “Gold vs US Dollar”

XAUUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Dead Cross” above Kumo Cloud (1). Ichimoku Cloud is going down (2) and almost closed, and Chinkou Lagging Span is above to the chart. Short-term forecast: we can expect support from Tenkan-Sen – Senkou Span A, and growth of the price.

XAUUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Golden Cross” (1) below Kumo Cloud. Ichimoku Cloud is going down (2), and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect support from Senkou Span B, and growth of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD drops to 0.6650 on risk-off mood

AUD/USD has come under fresh selling pressure, dropping near 0.6650 amid broad risk-aversion-led US Dollar demand in Asian trades on Tuesday. The pair fails to find any inspiration from the RBA's hawkish Minutes. More Fedspeak awaited.

USD/JPY extends gains to near 156.50, tracking positive US yields

USD/JPY is extending previous gains to test 156.50, despite the comments from Japan's Finance Minister Shunichi Suzuki. The pair stays supported amid an uptick in the US Treasury bond yields and the US Dollar after Fed officials adopted a cautious stance on the inflation and policy outlook.

Gold price turns red amid renewed US Dollar demand

Gold price loses its recovery momentum on Tuesday after reaching a record high earlier. The lack of fresh catalysts in a quiet session in terms of top-tier economic data might limit the precious metal’s upside.

New York Attorney General reaches $2 billion settlement with Genesis after claims of fraud

After a lawsuit filed by the New York Attorney General against crypto lender Genesis in late 2023, the company reached a settlement of $2 billion with the AG on Monday.

The market-moving data this week comes from everywhere other than the US

The market-moving data this week comes from everywhere other than the US. We get inflation from the UK, Canada, and Japan, possibly shifting central bank outlooks. The Fed releases FOMC minutes on Wednesday. And we get a slew of PMI’s on Thursday.