Market playing rate divergence catch up with Yen

Yen outright could be the next dollar strength barometer

Fixed income need to reprice the front end for Fed

Euro periphery contagion fears muted for now

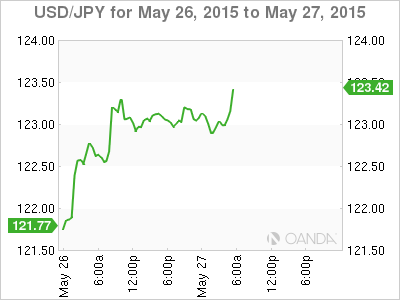

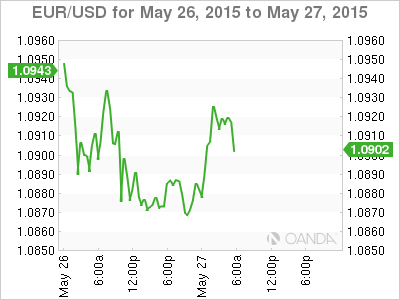

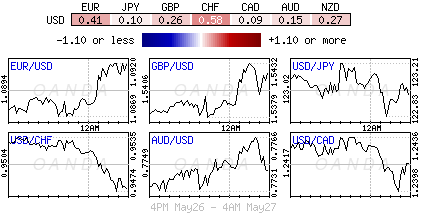

With one session down into an already shortened trading week, has the mighty dollar consolidating some of the strong gains it has acquired since last Friday. Yen outright trades close to its eight-year low (¥123.30), while the EUR is struggling to stay afloat of its multi-week support levels (€1.0920).

The Europe’s single unit remains under pressure by the same fear of a Greek IMF default payment next week. With a large percentage of the market believing that the Fed will begin their rate normalizing process sooner rather than later, is favoring the dollar across the board. The constant ‘hawkish’ Fed rhetoric continues to fan the interest rate divergence argument, like Richmond Fed Lacker’s comments that it looks “pretty clear that U.S inflation is heading back to 2%,” has the markets becoming even more sensitive to economic touch point releases.

Yet, today stateside, there are no tier 1 releases apart from the BoC interest rate announcement where Governor Poloz is expected to stand pat. The loonie has been suffering from withdrawal symptoms of late, similar to other commodity sensitive currencies. The dollars gain has created the commodity price downfall and with it their associated currencies (AUD and NZD). Mind you, their respected Central Banks have also been rather vocal on the value of their own currencies.

Yen Trading in “No Man’s Land”

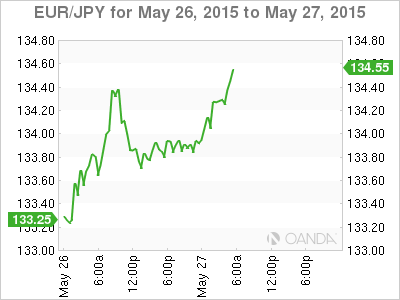

For months, JPY has been trading in a contained and rather boring range against the dollar. However, on the crosses, albeit for risk or order demand, the Yen cross has always been a moving target. A commodity sensitive currency pairing like CAD/JPY is a good example. Nevertheless, if we follow the rate divergence argument, today’s most popular of trades seems to be the EUR/USD (€1.0920). The single unit has lost almost -10% year-to-date, and -20% in a calendar year to the dollar. USD/JPY should be the other most popular rate divergence trade, however, JPY has lost only -2.5% outright, with most of that loss occurring in the past two-weeks. This week’s USD/JPY acceleration higher is significant – now that the market has broken through its eight-year highs (¥123.30), the currency pair is now encroaching on some significant multi-year resistance levels.

It seems that the recent stability in the USD/JPY over the past few months had greatly reduced speculative yen shorts — the market now needs to play catch-up to the potential upside momentum due to U.S. and Japanese interest rate differentials. Technically, the currency pair is now straddling atop of a major make-or-break juncture, with the risk that a momentum break higher creates the risk of greater upside towards ¥135.00 or ¥140.00. This is most significant, especially as the Fed continues to tout the possibility of normalizing their rate policy later this year.

The yen’s weakness could end up being the markets go to dollar strength barometer. Watch Japanese importers demand for U.S dollars, its picking up, especially on the back of bigger energy buying needs and with higher oil prices. With the lack of USD/JPY upside positioning, the game seems to be afoot for dollar bulls to take a serious look.

Grexit Contagion Fears Muted

Bond market trading is again dominated about Greek default worries. So far, fears of contagion remain muted despite Spanish (+1.88%), Portuguese (+2.51%) and Italian (+1.95%) yields spreads to the German bund having widened somewhat. Investors and hedge funds are happy to pare some of these positions in anticipation of a further rise in volatility. The market seems to be pricing in a +50% possibility of a Greek default by the end of June. Thus far, trading remains relatively orderly, however, if this scenario actually were to occur, expect investors to be in the midst of what could be considered heightened volatility driven by market worries over the stability of the monetary union. If recent plummeting Euro bond prices were a problem, imagine what the summer liquidity would be like if contagion were eventually to become a serious issue.

For now, the fixed income market seems content on repricing the U.S bull flattener curve accurately after yesterday moves – market purchased long product pushing yields lower and through their recent lows. If the market is serious in their Fed normalization thinking, expect dealers to be repricing the front end of the U.S curve more aggressively over the coming weeks (pushing yields higher). However, their aggressiveness remains data dependent, just like Ms. Yellen.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.