This weeks blog post will be a little shorter as we are writing the subscriber report this weekend.

From last weeks blog post which was very close.

"Most important market dates this week are April 25 and April 28th. Looking for the start of a move down Monday with a possible low April 28, 29."

Gold

I'm now looking at March 28th as the start of a new nominal 18 week cycle 1 trough.

This puts us entering either the 6th week of a new Primary cycle. Since I'm looking at this as entering the 6th week we should be prepared for a pullback Bear in mind we are still in a time period with confusing Astros.

This nominal 18 week cycle even had the pullback I've mentioned in a new Primary cycle you often get a pullback 2- 3 weeks from the beginning. They are marked with TT and TB.

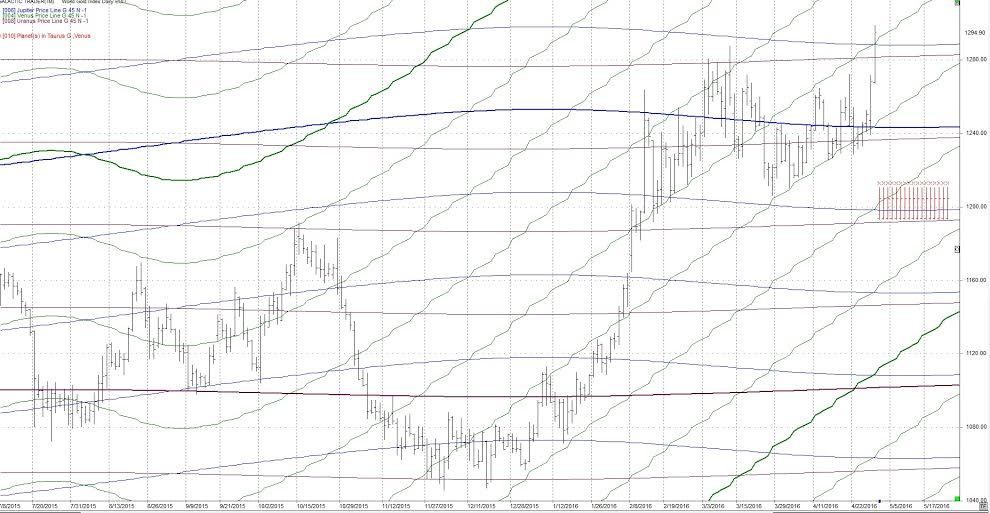

Following is a daily chart for Gold. The orange vertical lines are a 14 cd (calendar day) cycle which has been at highs and lows and hit again on April 21.

Price has moved below the 15 and 45 day sma and the 15 sma is above the 45 sma. This all looks very bullish. Just remember we are entering the 6 week timeframe where we often get pullbacks. The other option is we get a 1/2 Primary cycle which means we'd have a few more weeks of an up move for Gold.

On the following daily Gold charts there are the Venus (green), Jupiter (blue) and Uranus (purple) price lines. These are the longitude of the planet converted to price. Note the Gold price has been following the Venus price line up and as happens so many times, when the Venus and Jupiter lines cross you get a big move (up or down).

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.