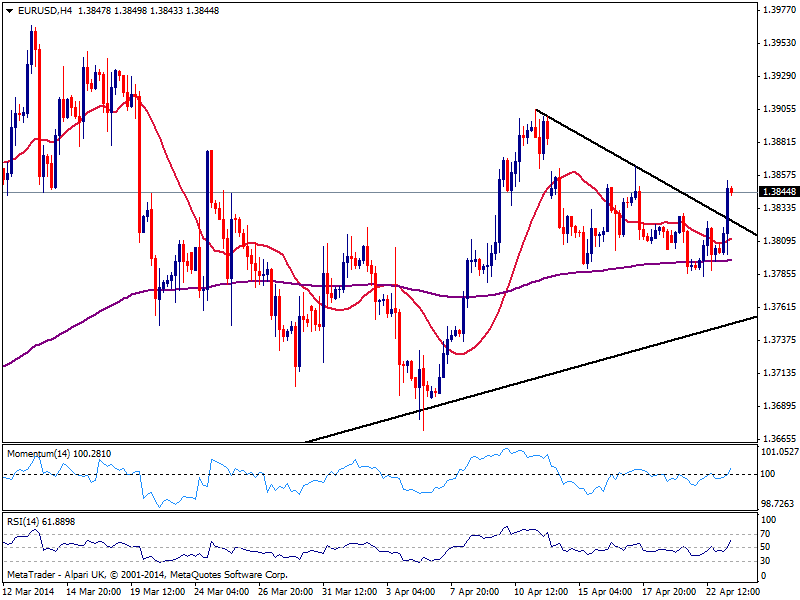

And while local share markets trade slightly negative, the pair consolidates a few pips below mentioned high. Technically, price has broke above a descendant trend line coming from 1.3905, April 11th daily high now offering short term support around 1.3825; the 4 hours chart shows price accelerated above its 20 SMA and indicators heading higher in positive territory, supporting further upward moves for today, with immediate resistance at 1.3860 past week high. A break above this last should lead to an extension up to 1.3890 where the pair will fill the weekly opening gap left 2 weeks ago.

A break below 1.3825 should be highly discouraging for buyers, and some profit taking may force the pair down to 1.3780/90 area, probable floor for today.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.