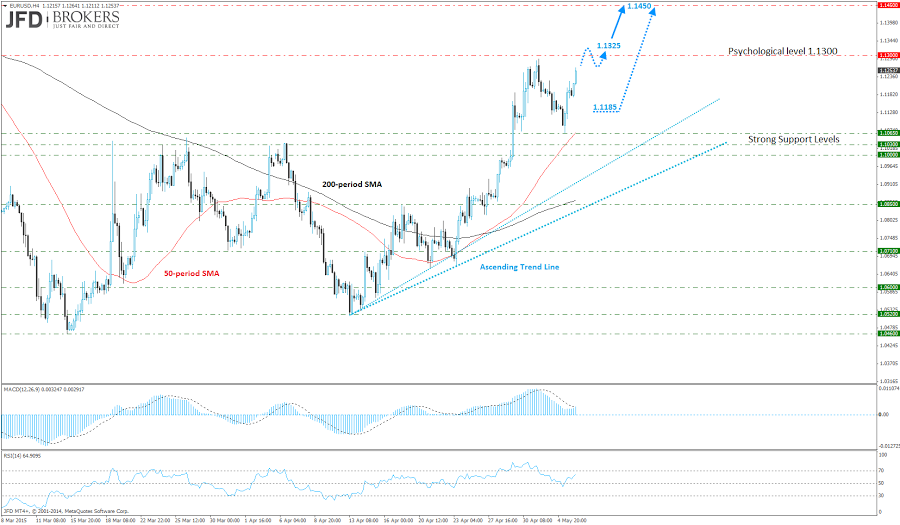

The euro rebounded from the 50-period SMA, slightly above the key support level of 1.1030 as investors looked ahead of the US ADP Employment Change report and the all-important NFP report, as well as some mixed European data, including today’s Retail Sales and tomorrow’s German Factory Orders.

The EUR/USD pair has been in an upward trend for more than weeks now, following the strong rebound around the psychological level of 1.0500. Since then, the euro is rising, taking out some important obstacles including the key level of 1.0850, the psychological level of 1.1000, as well as the 50-period and the 200-period SMA on both timeframes, the 1-hour and 4-hour charts.

The daily chart as well as the weekly chart shows that the bulls are under strong momentum driving the price back towards the psychological level of 1.1300. Technically, we have said that a close above the psychological level of 1.1300 would be a very bullish development for the euro, as we have not seen a daily close above that level since March. With the US ADP coming later in the day, we could expect any kind of reaction as the US employment change, including the NFP report on Friday, will determine the pair’s move and trend direction.

Bearing the above in mind, if we see a close above the key resistance level of 1.1300, then we could see a bigger retracement, following three positive weeks for the euro, prompting a more aggressive move towards the 1.1450 level. The former level is significant as it includes the 23.6% Fibonacci retracement level. However, for confirmation of the trend reversal, we will need to see a break above the key resistance level of 1.1500.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.