Market Overview

With the US closed for Thanksgiving public holiday, global markets have been struggling for direction. Daily trading ranges have been very tight on key markets such as EUR/USD (just 34 pips) and Gold (just $5) whilst Treasuries and Wall Street were closed. However the dampened trading activity due to Thanksgiving is likely to continue today as many traders looks to extend their holiday weekend on Black Friday. The drift higher in European markets failed to hold up the Asian indices overnight which were broadly lower with sentiment dogged by weaker than expected China Industrial Profits which fell by 4.6% for the year. European markets are subsequently trading lower today.

In forex markets the dollar bulls will be looking to once more reassert themselves after a quiet session yesterday. However the dollar is trading mixed today with the euro and yen both stronger. The Japanese yen had initially weakened on the back of the news that core CPI in Japan remains under pressure and fell by 0.1% last month, which will add to speculation that the Bank of Japan will need to act on further monetary easing. However in the hours since the Japanese inflation data, the yen has pared those losses and is once more gaining against the dollar. Commodities are once more on the back foot with gold and oil both under pressure in early trading.

Traders have got a little more economic data to get stuck into today, with the second reading of UK GDP at 0930GMT. The expectation is for the quarter on quarter figure to come in at +0.5% with the yearly data in line with the first reading at +2.3%.

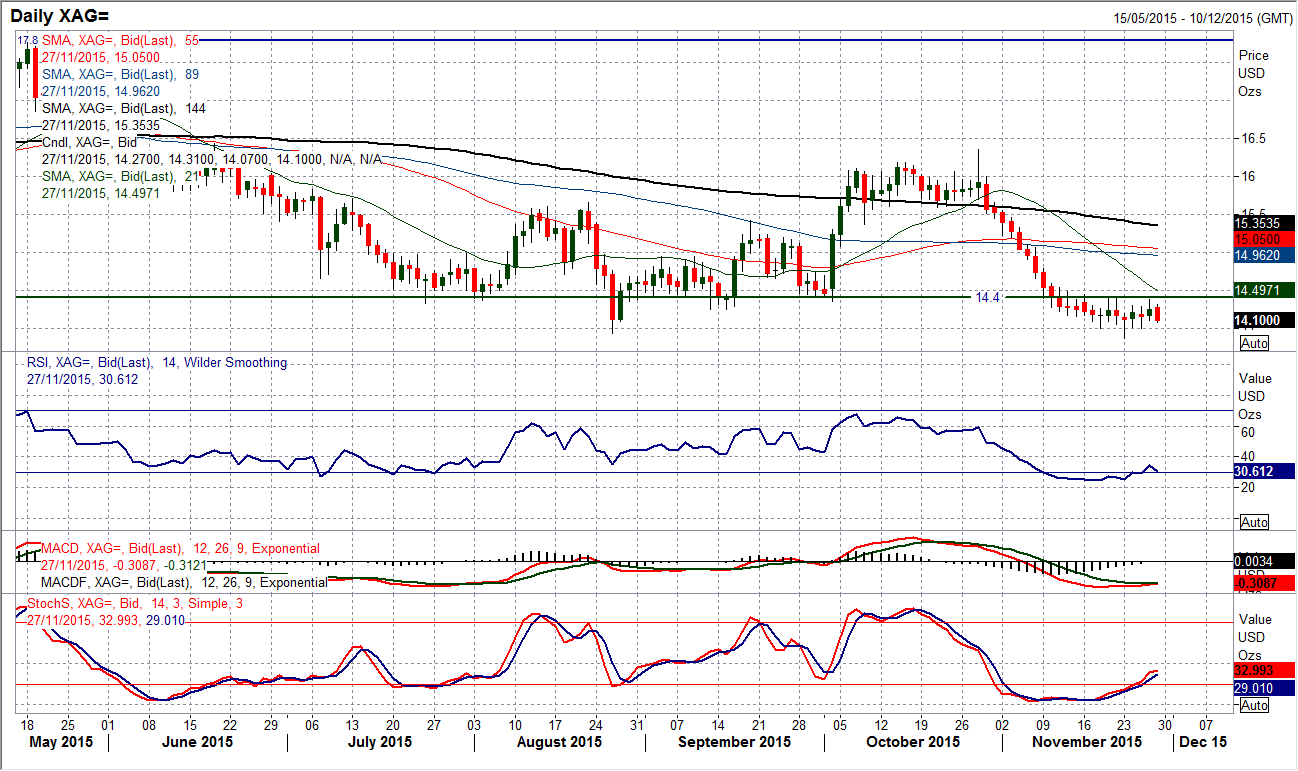

Chart of the Day – Silver

Can it be that the chart of silver is telling us something about a potential rebound for the precious metals that have been so badly impacted due to the recent strength of the dollar? Both silver and also its more widely traded cousin, gold, have been consolidating in the past couple of weeks but there is an improvement in the technical momentum studies on silver which reflect an improvement which could now lead to a near term recovery. They come in the form of near term technical buy signals on the RSI (classic cross above 30) and Stochastics (confirmed in the past couple of days), whilst the MACD lines are also threatening to turn higher. The resistance at $14.40 is now very important for the near term outlook. This has been the barrier for the bulls throughout the past two weeks, but this also coincides with an old historic band of support throughout the mid to late summer. Once more yesterday saw a rally rebuffed at this overhead supply and the bulls are yet to make the breakthrough. A closing break above $14.40 would be a significant move as it would complete a base pattern that would imply a move to $14.95. More importantly though it would confirm the beginning of a retracement of the late October/early November sell-off. However for now we wait whilst the key resistance remains intact. Key near term support is at $13.85.

EUR/USD

In the absence of full strength US trading (due to Thanksgiving public holiday) the euro has remained under pressure on the slide lower. The resistance of Wednesday’s high is subsequently growing at $1.0690. There is little for the bulls to hang on to currently as the momentum indicators remains firmly bearishly configured. I continue to expect downside pressure on the recent low at $1.0565 with the likelihood of a test of the crucial March low of $1.0456 still on track. The lack of volatility through yesterday’s trading (the daily range was a mere 34 pips) may once more be a feature of today with reduced trading activity continuing, however any intraday rallies should still be seen as a chance to sell. Near term resistance comes in at $1.0640 and more importantly $1.0690.

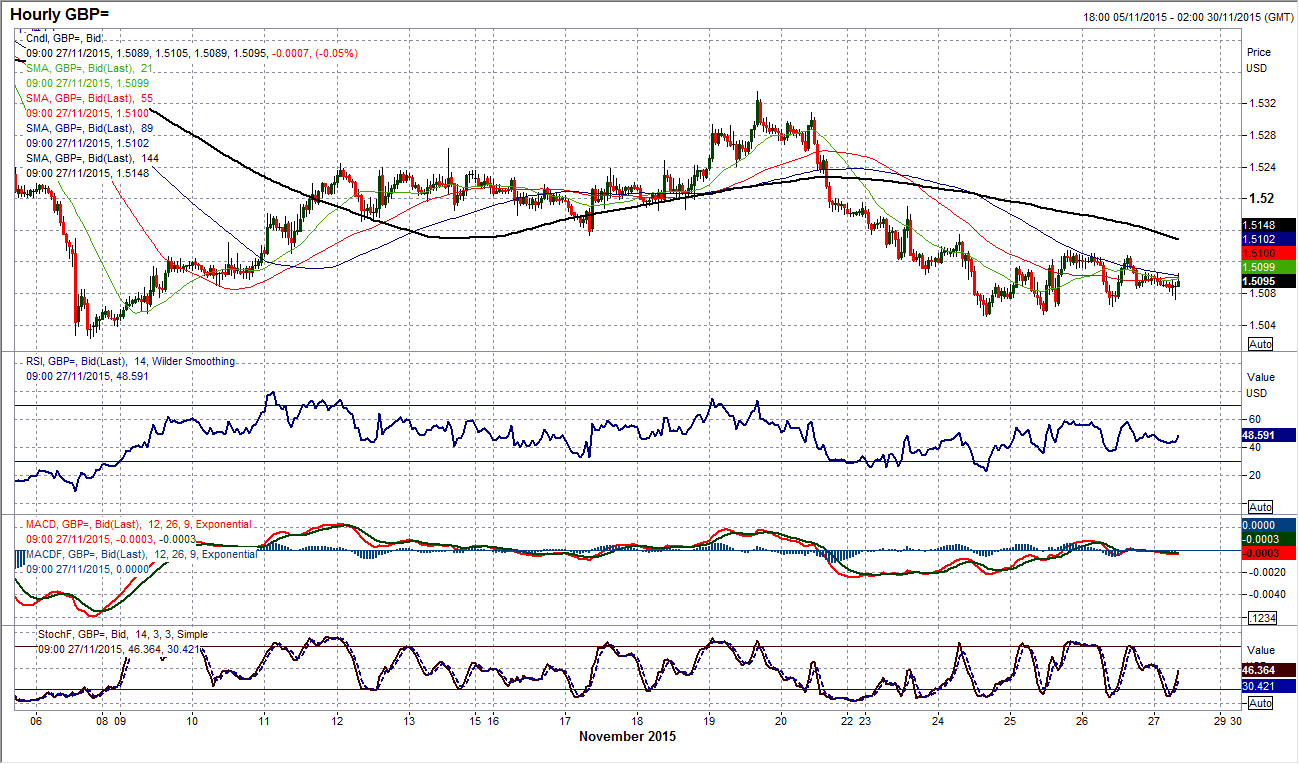

GBP/USD

I continue to see the likelihood that rallies will be seen as a chance to sell. Yesterday’s trading has not given us much more of a steer near term with an inside day on the range, however the sellers seem to still be in control as the overnight Asian session has seen a further slide and the initial support at $1.5050 looks to be under pressure today. All momentum indicators continue to point towards rallies being sold into, whilst the RSI shows that there is further downside potential still in this latest leg lower. I continue to expect pressure on the key November low at $1.5023 in due course. The intraday hourly chart continues to show momentum as bearishly configured with the hourly RSI consistently failing around 50/60 before the selling pressure returns again. Initial resistance is at $1.5135 and strengthens in the band $1.5150/$1.5190.

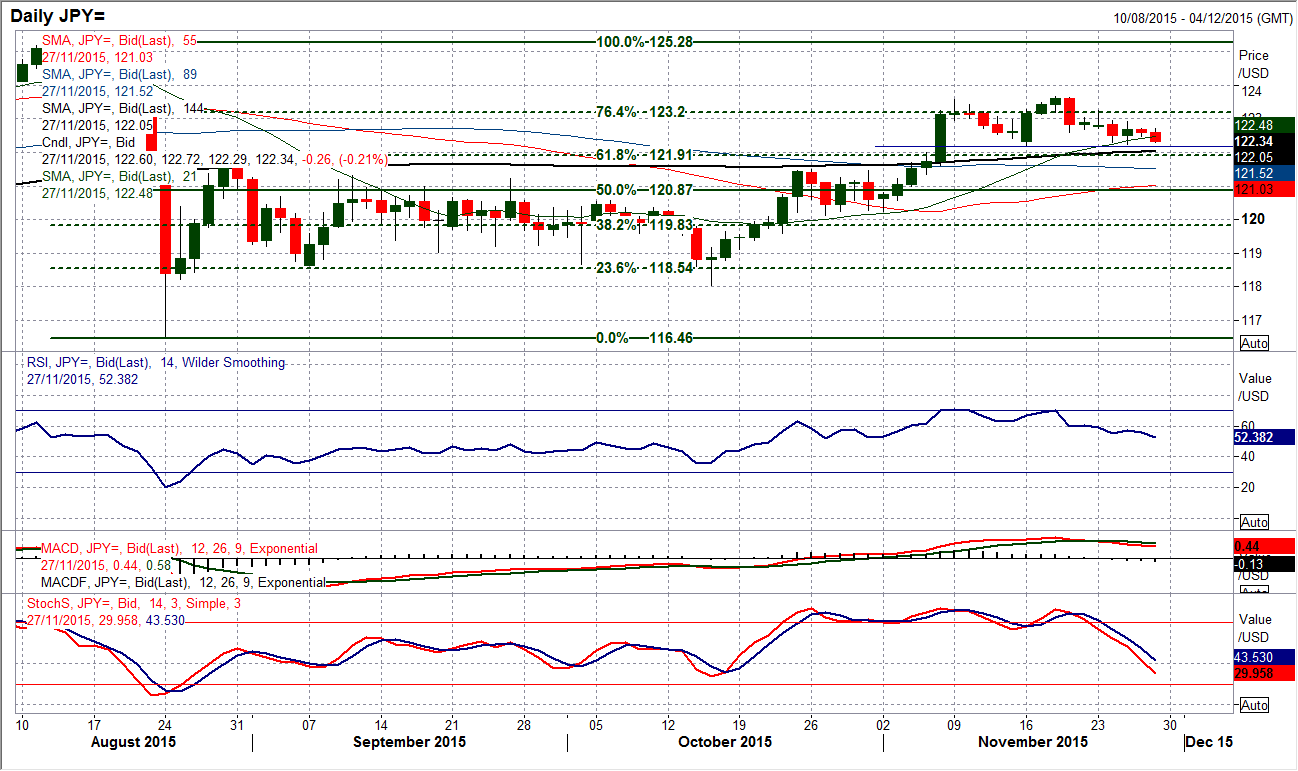

USD/JPY

I spoke yesterday about the prospect of a near term top pattern formation below the support at 122.20 and the price action of the past week suggests that this pattern is close to completion. There needs to be a closing breach of the 122.20 support but if you look at the momentum indicators the pressure is certainly building. The RSI continues to fall away and is at a 3 week low, the Stochastics are falling sharply now and the MACD lines have crossed lower. The intraday hourly chart shows that as the Asian session has gone on overnight the momentum is building to the downside and the price is trading below all the hourly moving averages. The reduced trading volumes are expected to continue today which may mean that the sellers are not quite ready for the move, but the near term drift lower continues with a 7 day downtrend intact on the hourly chart. The resistance comes in at the overnight high of 122.72 and then at 122.92.

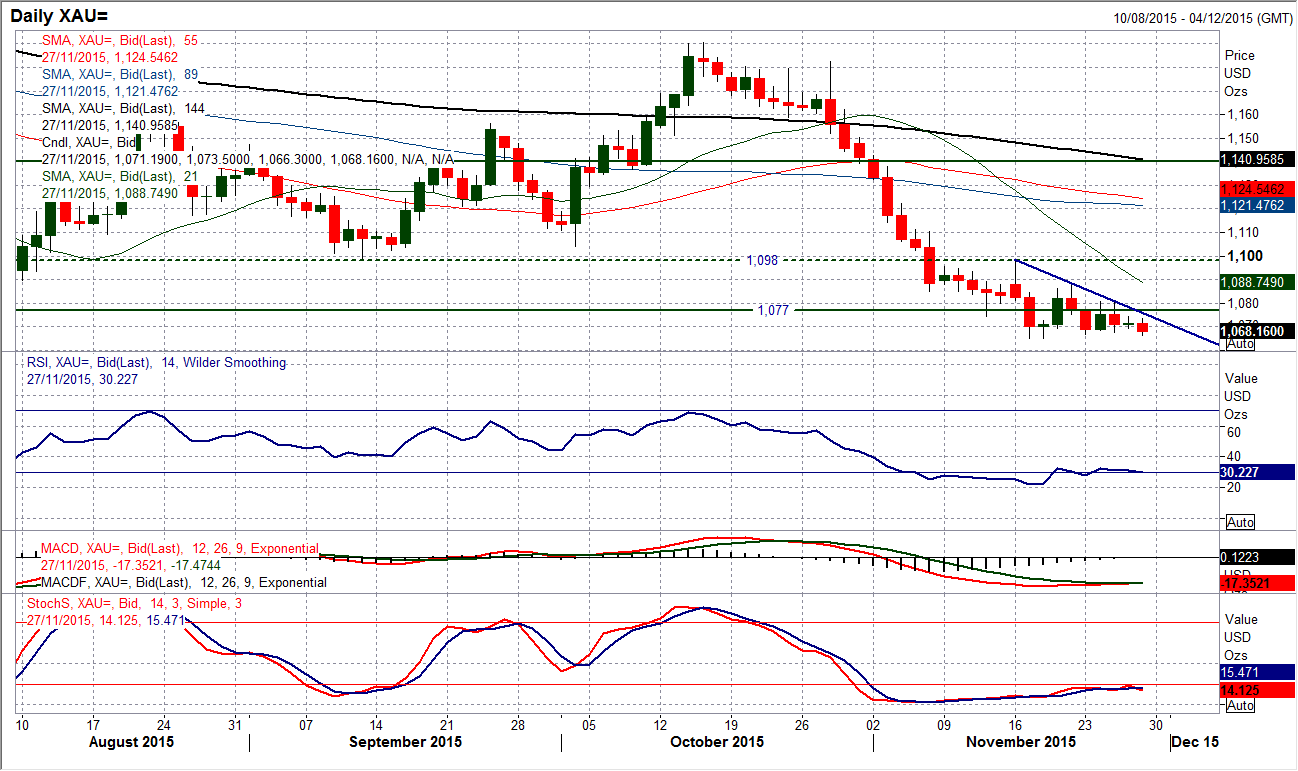

Gold

The respite of a mere $5 daily trading range yesterday has failed to stem the tide as the sellers look to have been regaining the upper hand during the Asian session. Despite the apparent consolidation throughout this week (Monday’s low at $1066.60 is intact, for now) there is still no denying the fact that there is still a sequence of lower highs over the past two weeks at $1098, $1087.40 and this week at $1080.50. The momentum indicators are bearishly configured and for now there is little other strategy to play other than using rallies as a chance to sell. There is no real sign that the bulls are ready to put in some meaningful support yet. The concern after such a big decline is that there is the potential for a short squeeze, so being vigilant with stops would be prudent. Expect further pressure on the $1065 support with the next level at $1043.75 which is the February 2010 low.

WTI Oil

There seems to be a sense once more that the recent rally on oil will simply be used as a chance to sell again. The technical rally in the first few days of this week has unwound the oversold momentum on WTI however the old key support band between $42.60/$43.70 which had been holding throughout September and October is now a key basis of resistance and the overhead supply is providing the sellers which is preventing further recovery. This level also coincides with the resistance at $43.36 which is also the 23.6% Fibonacci retracement of the big July/August sell-off to $37.75. The key near term support is Wednesday’s low and band of support that has built in the range $41.50/$41.70, with a breakdown re-opening the key low at £39.00 again. The intraday hourly chart shows the near term significance of Tuesday’s high at $43.50 which the bulls need to overcome.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.