Market Overview

Whilst the headline figure for the Non-farm Payrolls report remained strong the devil was in the detail of the 0.2% decline in average hourly earnings. This shows that the Fed still has to get a grasp on disinflationary pressures and it reduces the likelihood of any potential early rate hikes. The dollar has since come under a bit of corrective pressure and it remains to be seen whether this is a near term situation or whether there is any longevity to it. In forex trading there are slight gains for the euro, the yen and the Aussie dollar, whilst interestingly as well, the gold price is also hanging on to the gains posted on Friday.

Equity markets closed sharply lower on Friday as the volatility continues to pull investors back and forth. The S&P 500 closed down 0.8% which has given way to a mixed trading session in Asia overnight this morning and mixed to slightly weaker European indices.

There is very little by way of economic announcements today for traders to get their teeth into so the market will continue to trade on the legacy of Friday’s payrolls report. There will though be some interest in a speech by FOMC member Dennis Lockhart who is a dove and has got voting rights on the FOMC this year.

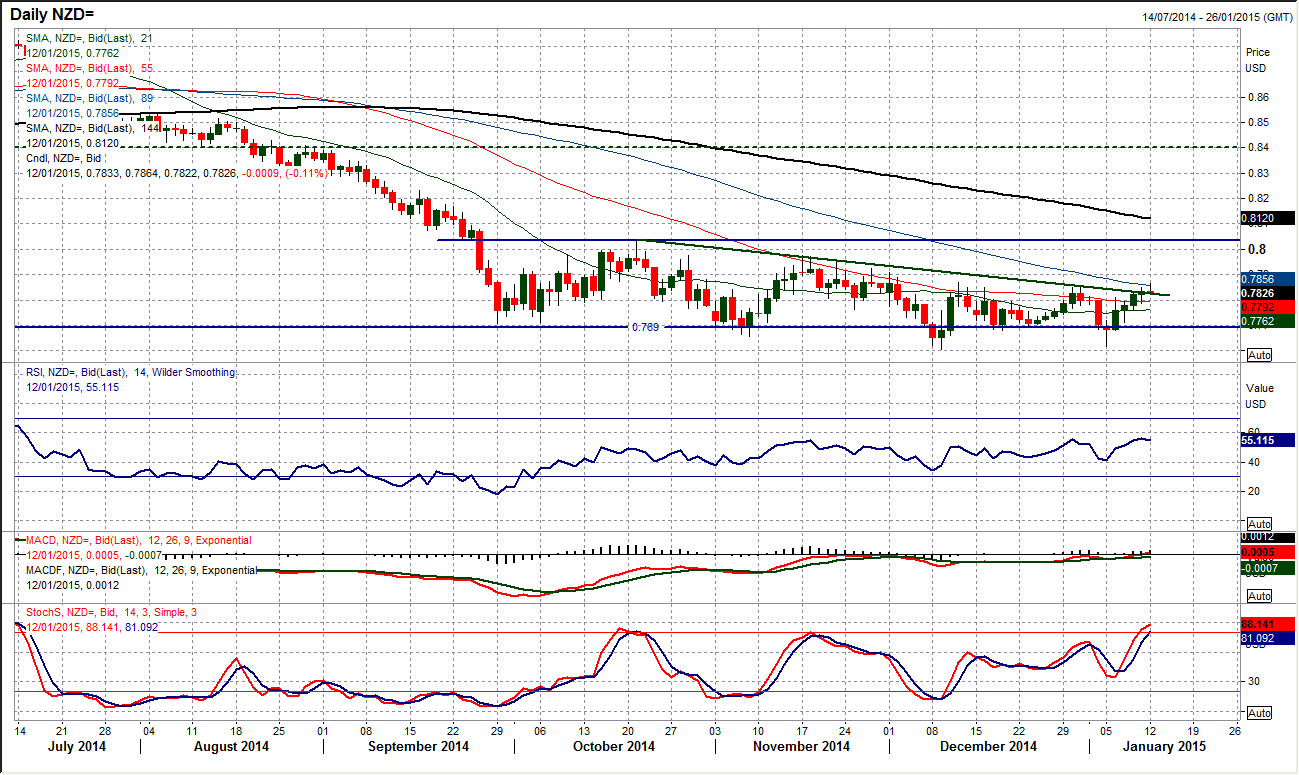

Chart of the Day – NZD/USD

The kiwi was certainly one of the better performing majors moving into the turn of the year and this strength has continued. Having hit a low of 0.7616 the Kiwi has put together 4 straight days of gains which are now seriously testing the resistance of a downtrend in place since 21st October. The momentum indicators are also improving with the RSI at its highest level since July. If the RSI can now push higher into the 60s it would suggest momentum is strengthening on a medium term basis. The Stochastics are also at a 3 month high. A breach of near term resistance at 0.7870 would be a sign of intent. The intraday hourly chart shows Friday’s reaction low of 0.7788 (following Non-farm Payrolls) is the key near term support that needs to hold for the bulls to remain in control.

EUR/USD

The signs of a technical rally which had been developing during the latter part of last week continue to drip feed a slight rebound. The mixed Non-farm Payrolls report on Friday have done little to scupper the potential for a bounce which has continued today. The daily RSI is now very close to its most basic of positive signals, the crossover (a move back above 30), whilst the Stochastics have turned higher too. This paints the picture of slight euro gains in the near term. The intraday hourly chart shows progress but very soon the first real band of resistance will be encountered in the band between $1.1900/$1.1976. Having bottomed on Friday at $1.1760 it is likely that a 150/200 pip rally would be considered enough to start considering selling opportunities once more. Buying into such a significantly bearish trend is high risk as the sellers will tend to resume control quickly.

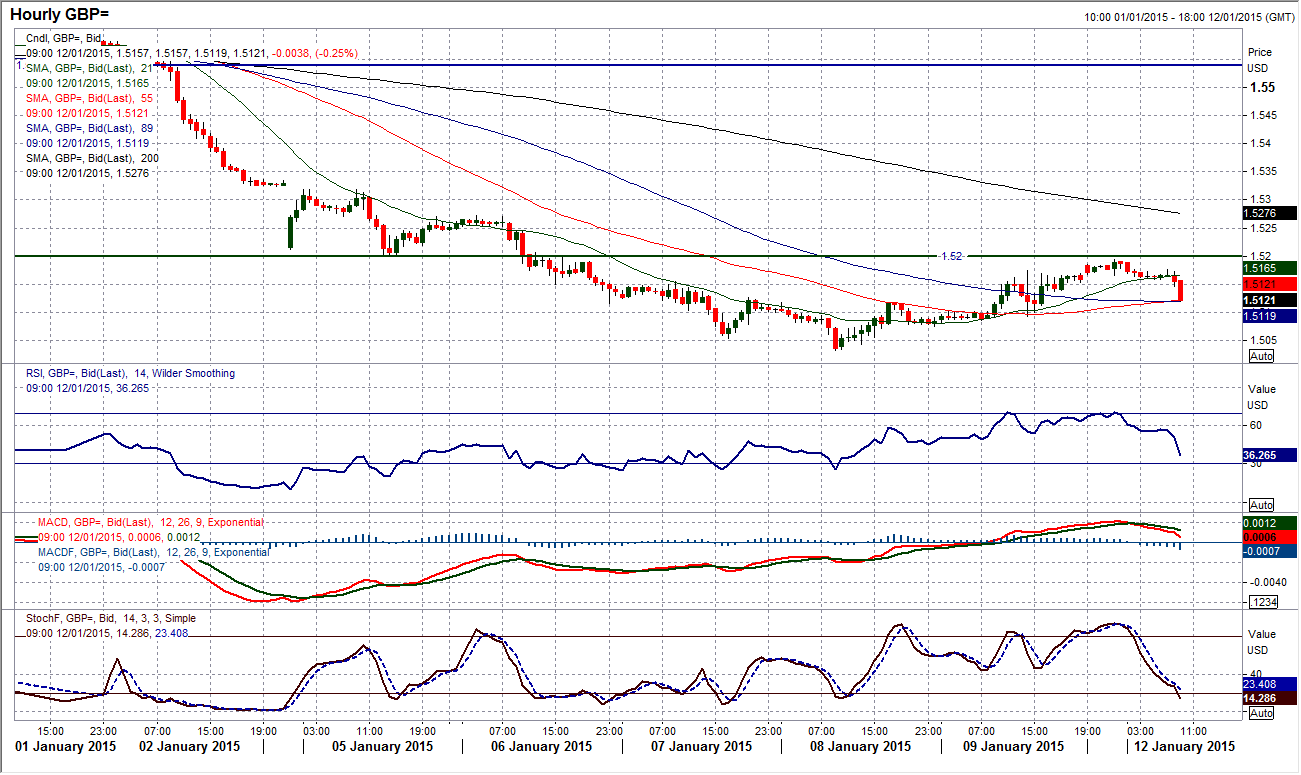

GBP/USD

Cable is another pair that has seen a technical rally taking hold. With a solid green (bullish) candle on Friday the near term recovery could be underway. The RSI which bottomed at 24 is looking to push back above 30 which would arguably be a near term buy signal. However, looking at the intraday hourly chart there is still an interesting level of resistance at $1.5200 which has held back the bulls. As the European trading session has got going, sterling has come under some slight downside pressure again and this means we are seeing a test of the near term support at $1.5093 which is the reaction low following the Non-farm Payrolls report on Friday. If this support can hold then the prospect of a technical rally remains on track.

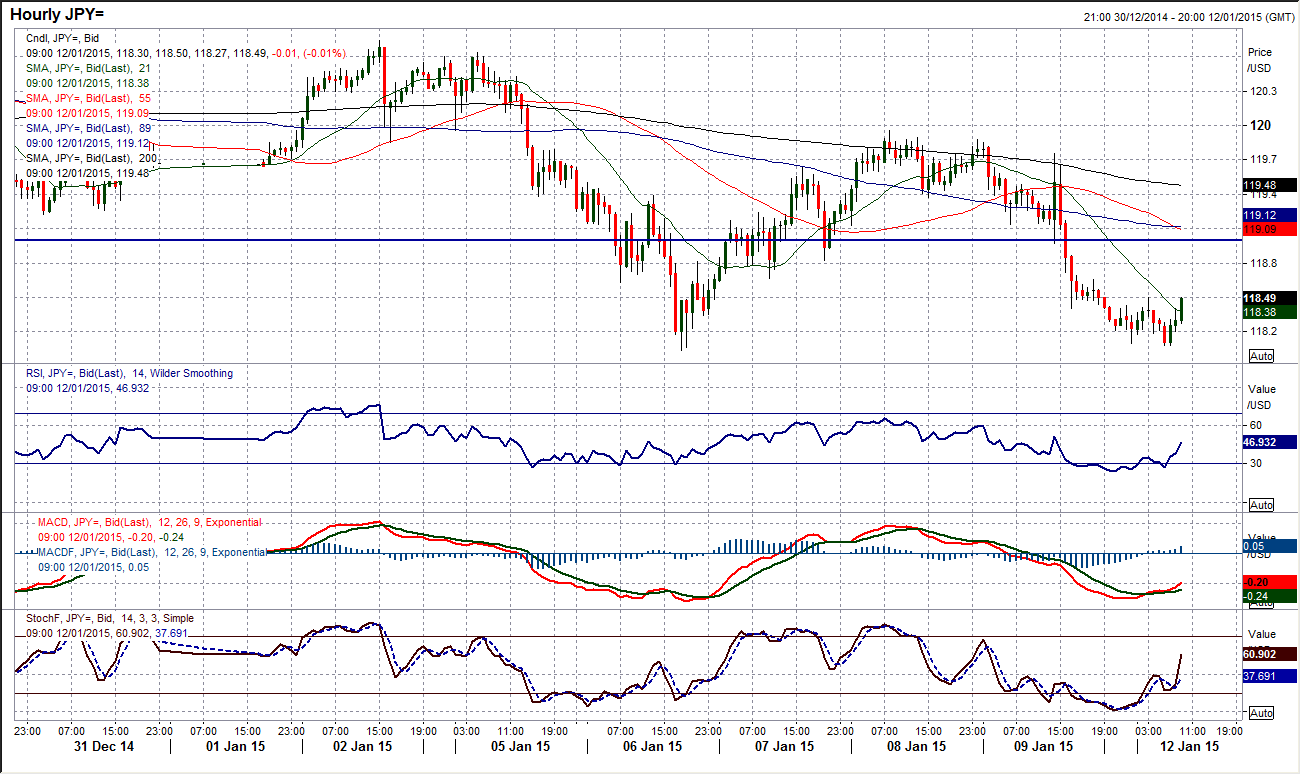

USD/JPY

The consolidation in Dollar/Yen shows little sign of ending. This period of trading over the past few weeks has lacked any trend or decisive moves. The yen has again just strengthened slightly since Friday afternoon and a test of support around 118 is again possible. However if the break were to be seen I would not expect it to be a clean one. I still see this as a correction within the medium to longer term bull market and that the move is helping to renew upside potential. Momentum indicators are all in bullish configuration and are simply unwinding. The intraday hourly chart shows pressure on 118, but hourly momentum is also beginning to show signs of improvement and this could suggest that the support may be set to hold for now. A move back above intraday resistance at 118.66 would pull the pair back into a near term upswing.

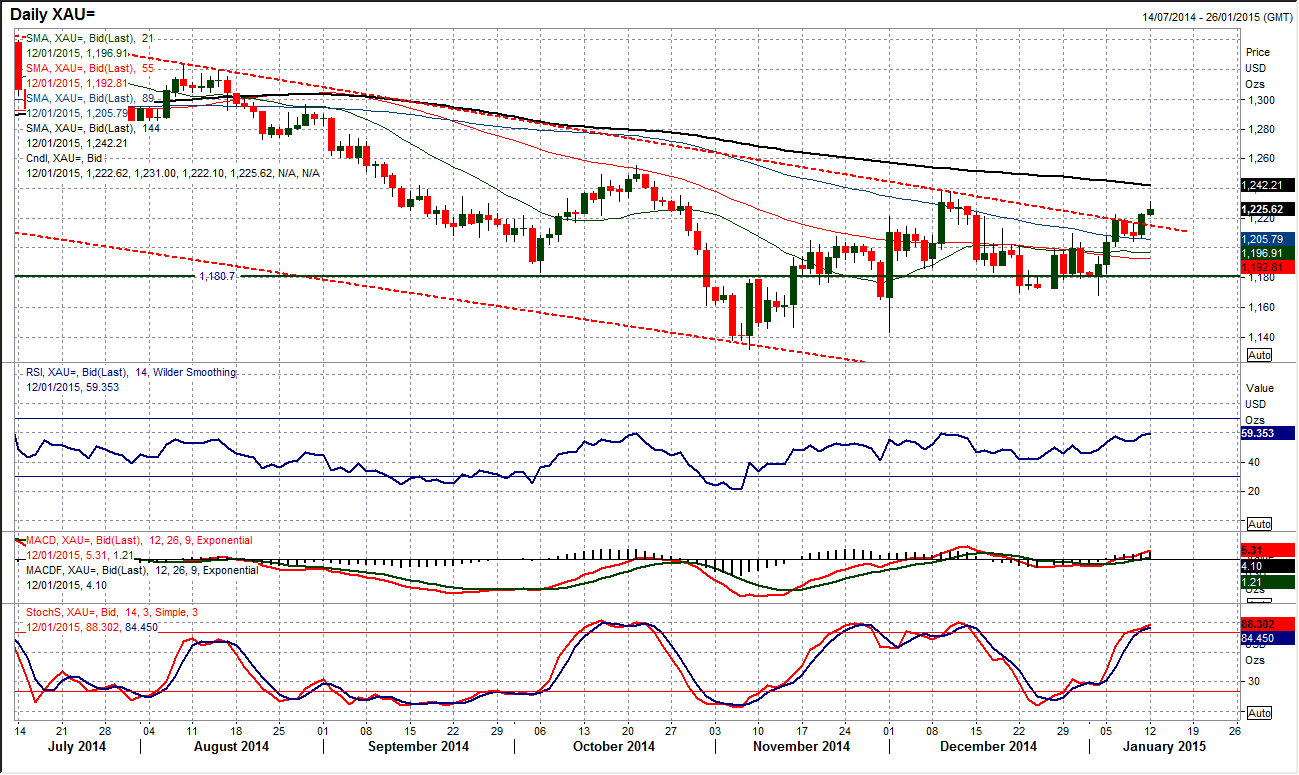

Gold

The gold bulls look to be gaining in confidence and on the brink of confirming a key break. Friday’s post Non-farm Payrolls move (which was dollar negative) has resulted in a break of the long term downtrend which has been in force since October 2012. This means that today’s continuation higher for a test of $1238.20 could signal a very important day. If this resistance can be breached, it would signal a 3 month high and bring the gold bulls into range of the key lower high at $1255.20. Furthermore, look at the RSI, which is now back at 60. If the RSI can start to trade consistently above 60 then this will signify strengthening medium term momentum and suggest a shift in sentiment. On a near term basis the old resistances between $1216.30/$1222.40 become supportive. There is now important support at $1204.50.

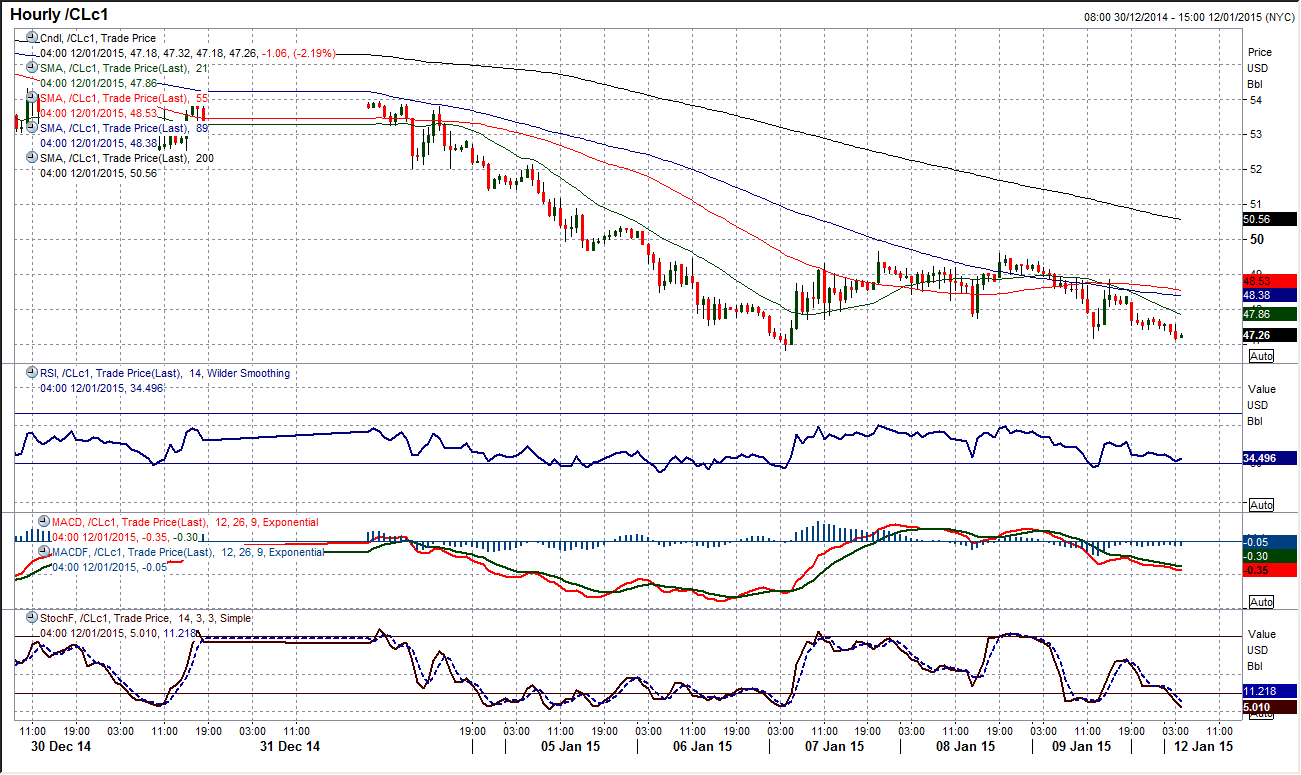

WTI Oil

Well if that was the technical rally, it did not last very long. With the rebound from the low at $46.83 seemingly peaking at just 6%, at $49.65, Friday’s resumption of the sell-off suggests that the bears remain prominent. The resistance has also come under $50, a psychological level which has now been strengthened as a ceiling for any future rebounds. Momentum remains incredibly bearish still and there is a the fear that if $46.83 is breached it will just open the floodgates to the downside once more. The hourly intraday chart shows that downside potential on the momentum indicators has been renewed. The April 2009 low at $43.83 is the next hint of support.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.