Market Overview

What an amazing day for the financial markets yesterday. Huge volatility across asset classes with bonds, forex and equities alike all feeling the pressure. There was a confluence of factors yesterday with another case of Ebola in the US, but also the fear that the economic malaise that has been spreading through the world may be reaching US shores. The US has been the one real bright light amid a slowdown in the global economy in recent months. However the consumer is around 70% of the US economy and with retail sales falling for the first time since January (and worse than expected) there is a degree of fear moving through these markets that the US is now being dragged lower too.

This all created huge spikes in Treasury yields lower due to a surge of safe haven bond buying. This caused a big move out of the US dollar which has had a significant impact across the major pairs but also in commodities such as gold and also oil. The Wall Street indices had huge intraday falls but were able to rebound into the close. The S&P 500 “only” closed down 0.8% having been down over 3% at one stage. Asian markets played catch-up overnight with the Nikkei sharply lower by over 2%, although certainly not helped by the sharply stronger value for the yen too. However European markets are showing some signs of stability in early trading, with slight gains.

After yesterday’s carnage for the dollar in forex trading, the greenback is staging something of a recovery today, with a solid rebound against all major currencies. The gold price is also trading slightly lower. There is quite a heavy calendar of announcements today, starting with the final reading of September Eurozone HICP inflation at 10:00BST which is forecast to hold the flash number of 0.3%. The weekly jobless claims for the US is at 13:30BST with the number expected to remain broadly steady at 290,000 (last week was 287,000). The Industrial Production numbers are released at 14:15BST which is expected to bounce back by 0.4%, with special focus on the capacity utilization (something that the Fed looks at closely) which is expected to improve to 79.0 (from 78.8). The Housing Market Index is at 15:00BST and is expected to remains flat at 59. There are also a few FOMC members speaking today with Plosser, Lockhart and Kocherlakota all giving speeches. Lots to keep traders interested today then.

Chart of the Day – NZD/USD

Since testing the critical support of 0.7700 a couple of weeks ago the Kiwi has been in a state of volatile consolidation. This move has seen the formation of support above the critical levels and a rebound begin to take shape. Momentum indicators are improving and yesterday’s dollar weakness has certainly helped to pull the Kiwi higher. However, this rebound is now up to its first key test. The downtrend that has been solidly in place since mid-July today comes in around 0.8000 which will also be a psychological barrier. The intraday hourly chart shows a volatile picture anyway before yesterday’s price action is taken into account. If the Kiwi starts to lose near term momentum as the stretched hourly indicators start to unwind, then there is a band of support 0.7915/0.7925.

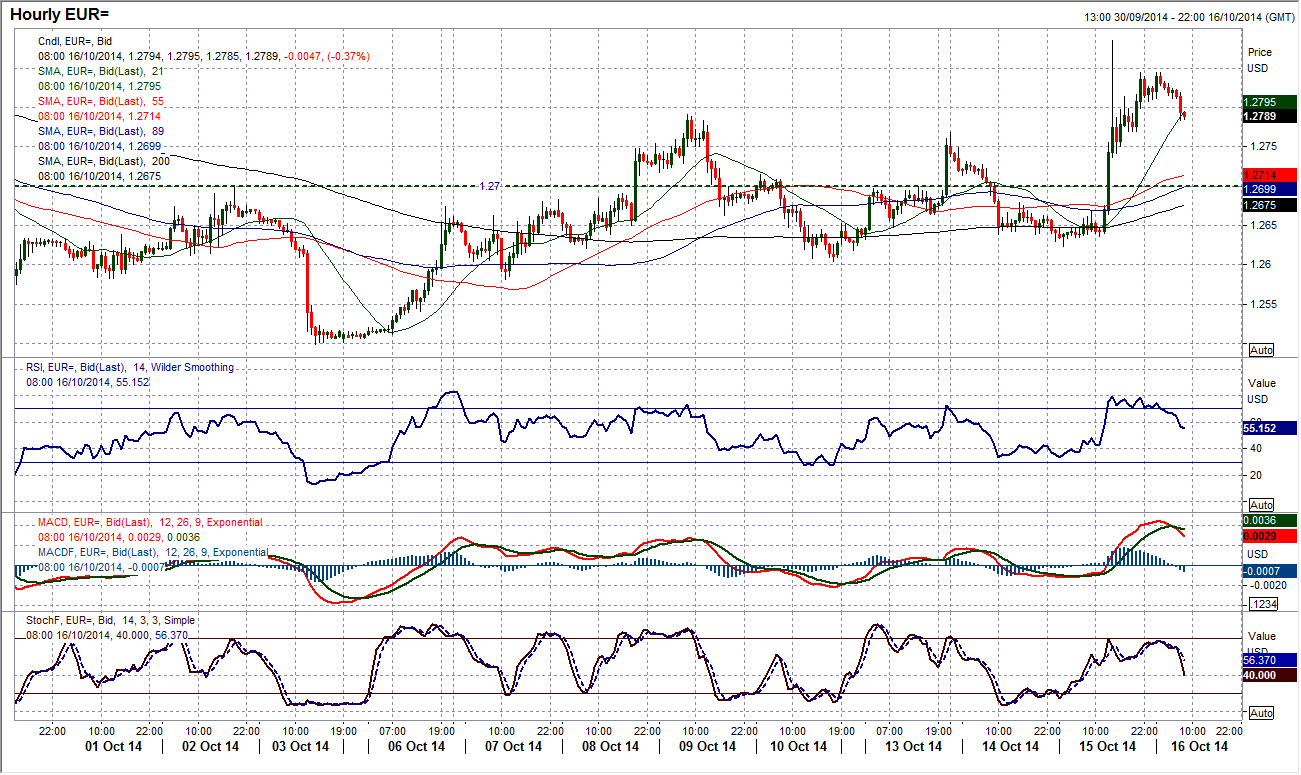

EUR/USD

The volatility for the dollar has been enormous in the past 24 hours and this has been shown in the wild swings on EUR/USD which resulted in a 280 pip range yesterday. However the volatility exhibited over the past few days suggests it is incredibly difficult to call the direction with any conviction over a period of days. The sharp moves witnessed suggest that on a net basis the euro is on an improving trend, with momentum indicators continuing to improve, but running long positions for any length of time could prove risky. The near term chart suggests that the euro is still overbought from yesterday’s moves, with hourly momentum indicators rolling over there is scope for a technical correction. Resistance has formed overnight at $1.2844 and with yesterday’s high at $1.2885.

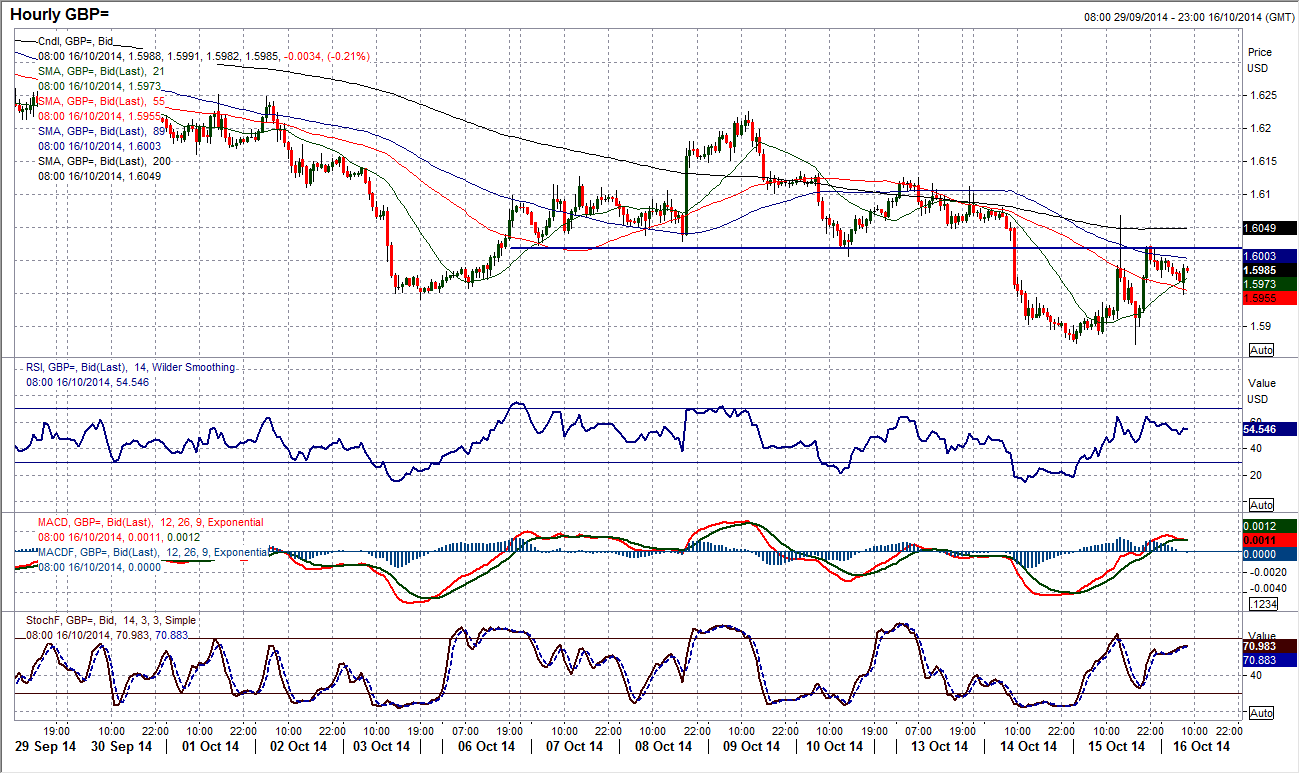

GBP/USD

On of the remarkable features of yesterday’s sharp dollar sell-off against forex majors was the lack of impact that the move had on the medium term outlook for Cable. The 195 pip range day could not even push back above the previous session’s high. This suggests a strategy of selling into this rebound is a viable one. The momentum indicators show little improvement and despite the significant volatility the bearish trends remain intact. Intraday hourly momentum is already running out of steam and having left overnight resistance at $1.6020 below the spike high at $1.6068 this looks like an opportunity to sell.

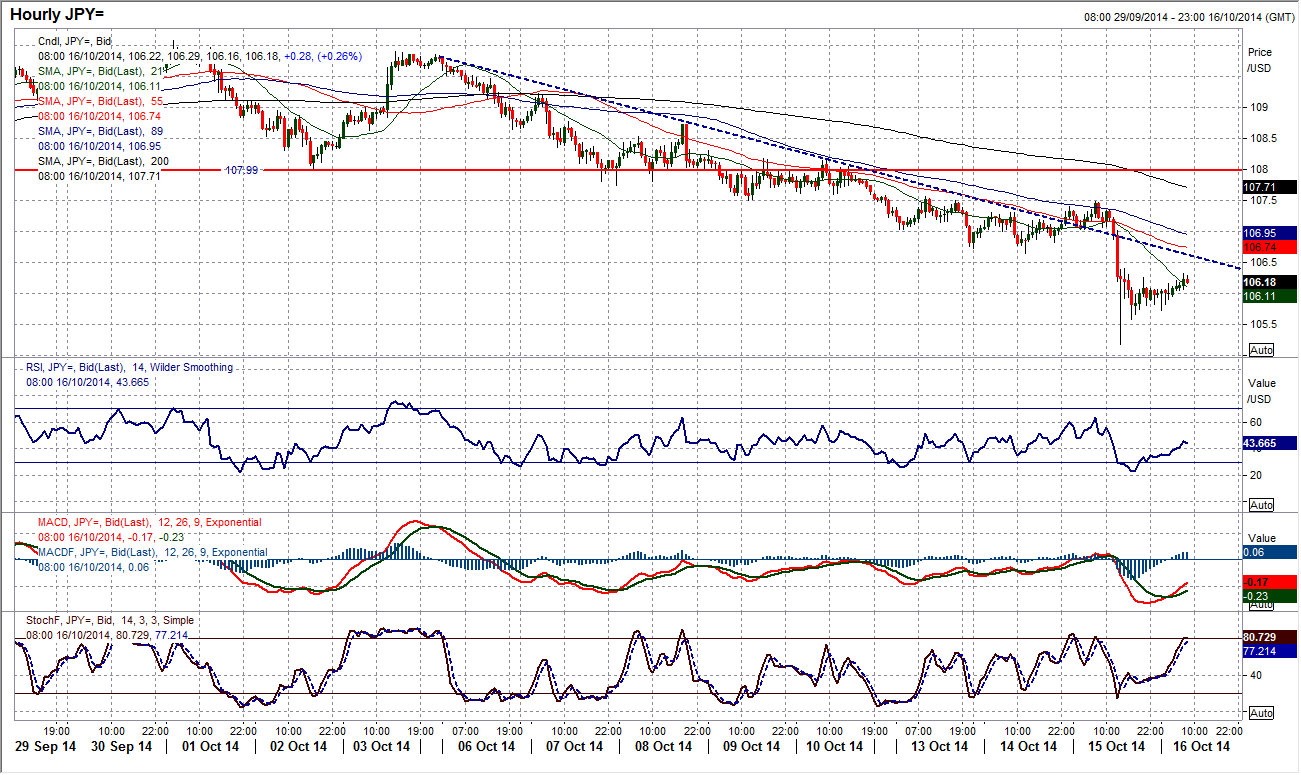

USD/JPY

The incredible volatility saw Dollar/Yen spike down to 105.18, which means that in the space of just over 2 weeks, the pair has corrected almost 5% from its 110.08 multi-year high. The implied target from the top pattern completed below 108.00 has been achieved at 106.00 so I am now looking for the basis of support for a medium term buy signal. This signal is beginning to develop too, with a bull cross on the Stochastics, although we must wait for confirmation (a cross back above 20). Also RSI and MACD continue to fall so with such a big call there would need to be multiple confirmation. For now though the near term outlook needs to settle down after yesterday’s sharp decline. Overnight there has been some support forming at 105.58 above the 105.18 low. With initial resistance now until 106.65 there is room for an unwinding move.

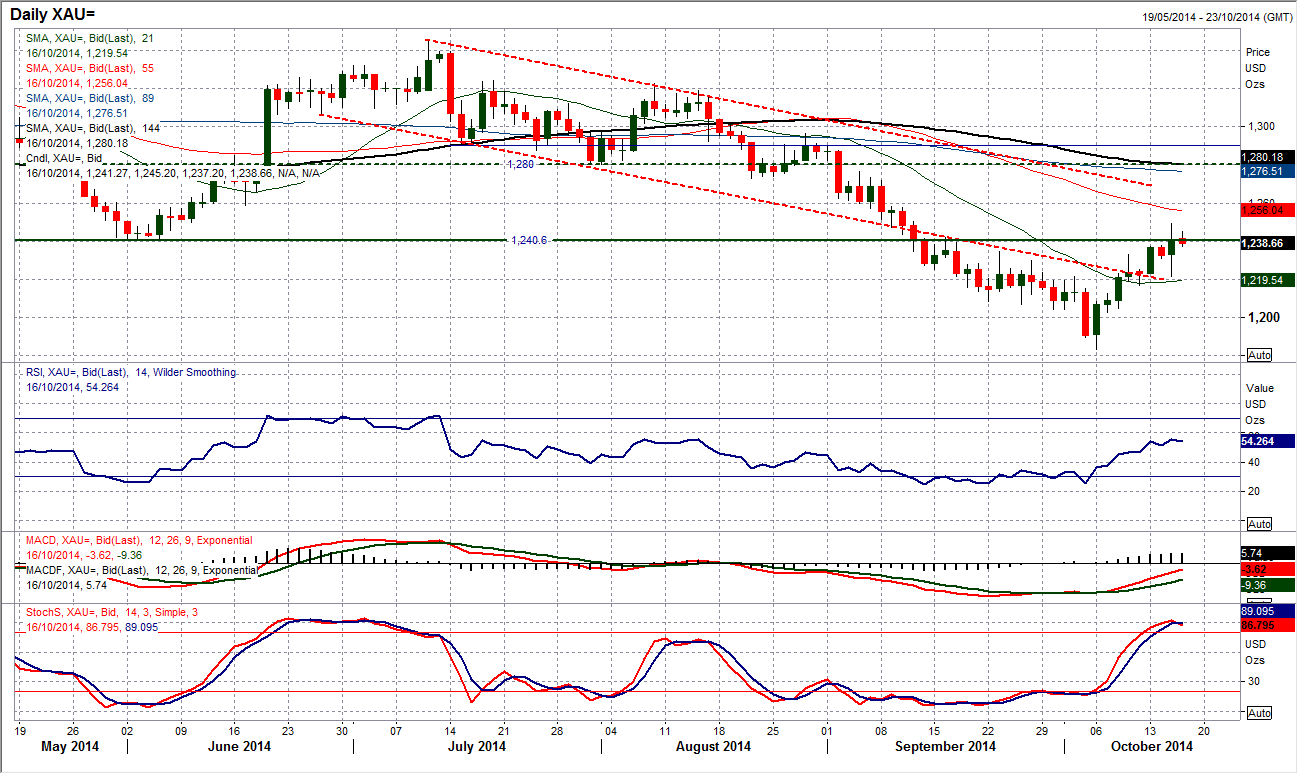

Gold

An incredibly big swing on the day yesterday saw gold propelled higher through the key medium term resistance at $1240.60. I have been saying that there would need to be a closing break above $1240.60 to confirm a breach of the resistance, however last night gold closed (on my Reuters chart) at $1240.57, incredibly basically bang on the resistance! I still want to see a close above the resistance to confirm that the rebound can breach key levels and suggest further upside towards $1260 and the next key overhead level at $1280. There has been a slight consolidation overnight and this has left minor resistance now at $1245.70 just below the spike high at $1249.30 yesterday. A breach of the near term support at $1237 could start a drift lower to unwind some of the exuberant rally. The support is now at the reaction low from yesterday at $1221.70.

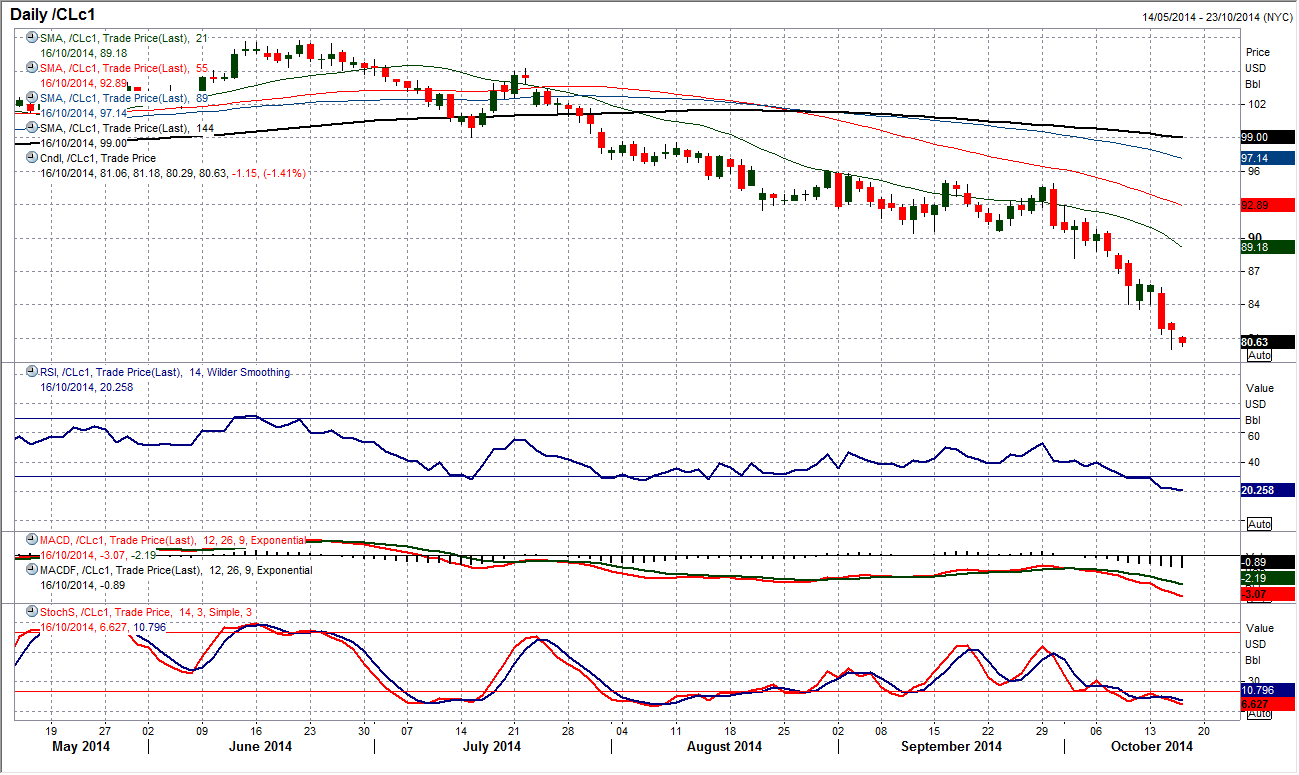

WTI Oil

Yesterday was another huge day of volatility for WTI. The volatility is also coming on big volume, with the two largest trading volume days of 2014 in the past two days. It would be incredibly risky to trade against the selling pressure, with a test of the $77.28 June 2012 low still likely, however there are some near term exhaustion signals beginning to come through. The whole of yesterday’s session traded outside the 2.0 standard deviation Bollinger Bands on the daily chart, which suggests that the move is beginning to become extreme. The low of the session all but hit the psychological support at $80 before rebounding, with the rebound closing not far from the session high to leave arguably a bull hammer (although not a perfect example). It is far too early to start talking about a recovery, and even today the downside pressure has continued. However after a high to low range of $15 in just over 2 weeks there is likely to be a snap rally at some stage. The resistance is at $83.59 and is the first barrier to a recovery.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.