Market Overview

Despite the slight gains on Wall Street last night, driven by positive results for Netflix, Asian trading was extremely cautious overnight with a mixture of flat to slight losses. The geopolitics of Ukraine remains a key issue for investors as forex trading is facing a slight flight to the safe haven of the Yen this morning at the expense of both the dollar and the euro, while gold is also slightly in positive territory. The only exceptions to this safe haven shift come in the form of the Australian and New Zealand dollars.

With European indices mostly closed yesterday for the Eastern bank holiday, many of these markets are playing catch up today, hence the positive open. Whether this can last though with an air of caution to trading today.

Traders face little major European economic data this morning, with Eurozone Consumer Confidence the only real release at 10:00BST; whilst Existing Home Sales data for the US will be the main driver this afternoon.

Chart of the Day – EUR/JPY

The recovery in Euro/Yen has been rather gradual and lacked any real conviction and is increasingly at risk of falling over. A breach of the reaction high at 141.55 has never really been backed by the bulls and with the daily momentum indicators rolling over once more, the prospect of another downside shift is increasing. The uptrend on the daily chart comes in at around 141.00 and this could be tested soon. The intraday hourly chart shows this picture more clearly. With early selling pressure in Asian trading hours the key support near term at 141.24 has been broken to mark a two day low and open the next important support at 140.94. With hourly momentum indicators increasingly in negative configuration, using rallies as a chance to sell looks to be a good way to play this now.

EUR/USD

After a series of negative candlestick patterns on the daily chart the pressure for a correction is growing. The support at $1.3778 would mark a one week low and this now represents the key near term low as a breach would re-open the key April low of $1.3671, with a retreat towards the 144 day moving average at $1.3675 increasingly likely now. Momentum indicators are in a slight negative drift and also back this assertion. The intraday also reflects the increasing near term negative pressure, trading below all the hourly moving averages and momentum indicators suggesting rallies are being sold into. There is now a solid band of resistance $1.3800/$1.3830 that should be seen as a chance to sell. There is small support at $1.3738 but little meaningful support until the key low at $1.3671.

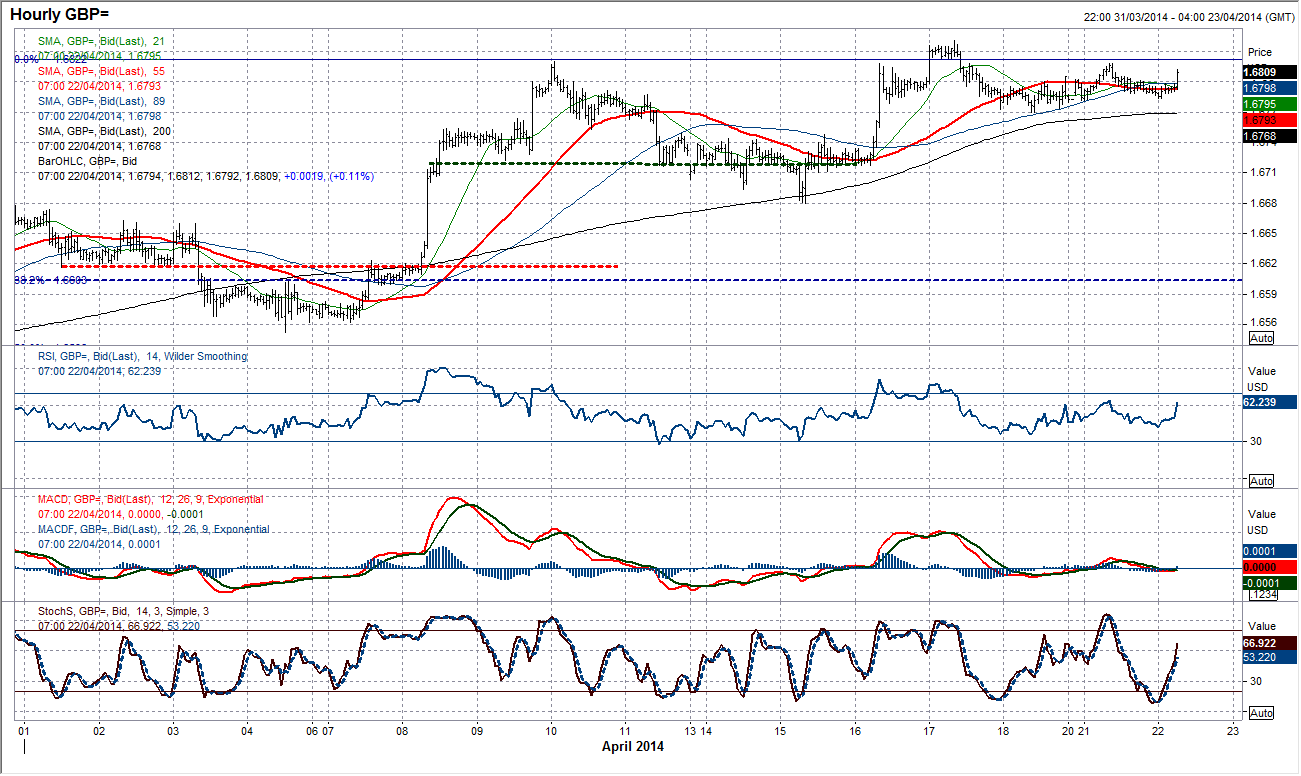

GBP/USD

Despite last week’s move above the key high at $1.6822 this has come with a slight air of disappointment as the move has been taken with very little real conviction (this could be simply due to the Easter break though), with a high having been left at $1.6841. The tight trading ranges could therefore be a warning sign that the run higher could be susceptible to a correction now. If a retest of the high today does not come with a decisive upside break then the bulls could tire and profit taking become an issue with daily momentum indicators showing signs of fatigue. The hourly intraday chart shows that $1.6770 is a key near term support as hourly moving averages and momentum indicators become increasingly neutral. The sense is that going with a decisive move will be the best way to play Cable near term.

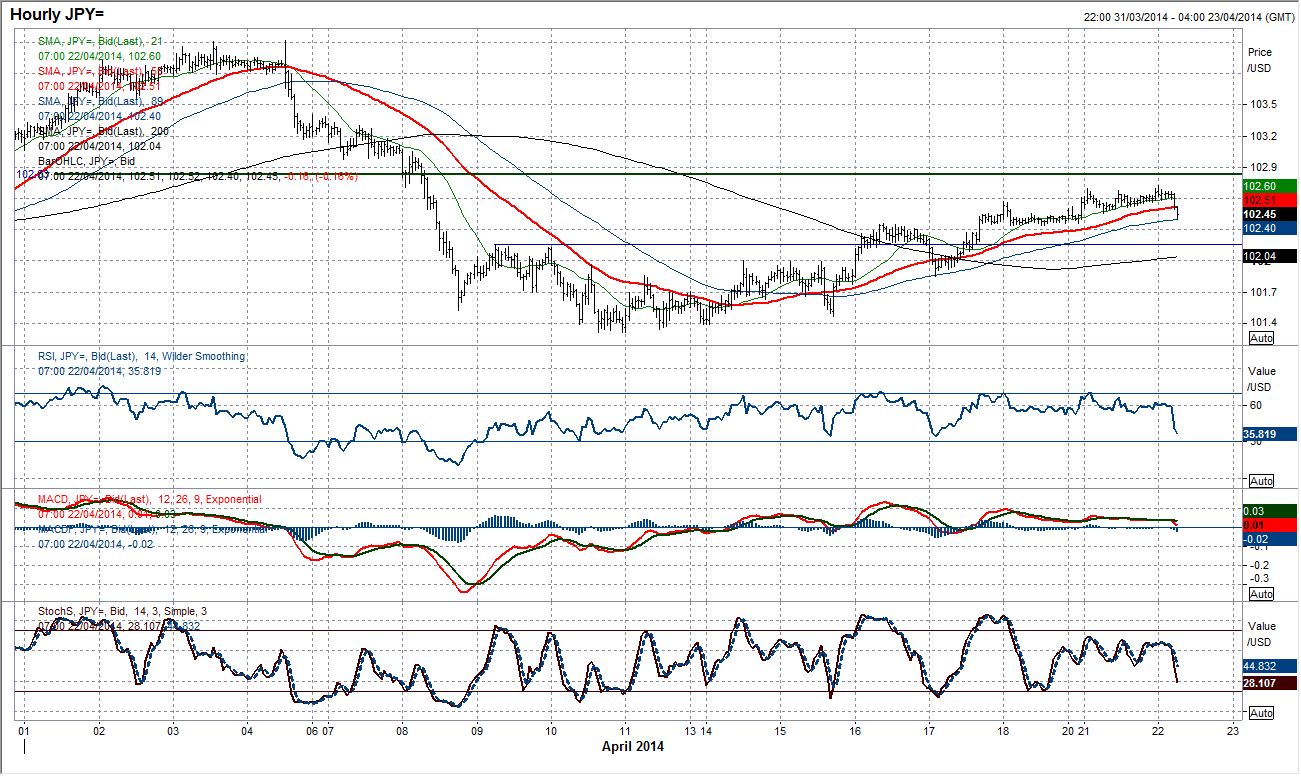

USD/JPY

After six days of successive higher lows the recovery in Dollar/Yen is progressing well and despite being a little sluggish in Asian trading this morning, there should be little reason to suggest that this will not continue. However, watch for yesterday’s low at 102.36 to act as an early warning sign should there be a breach. The intraday hourly chart shows a solid and considered recovery flanked by rising moving averages and positive configuration in the momentum indicators. However, there has been a slight move to the downside in the past hour which needs to be watched, with the hourly RSI now at a three day low. As with the daily chart, the hourly chart suggests that a breach of yesterday’s low at 102.36 could open a correction.

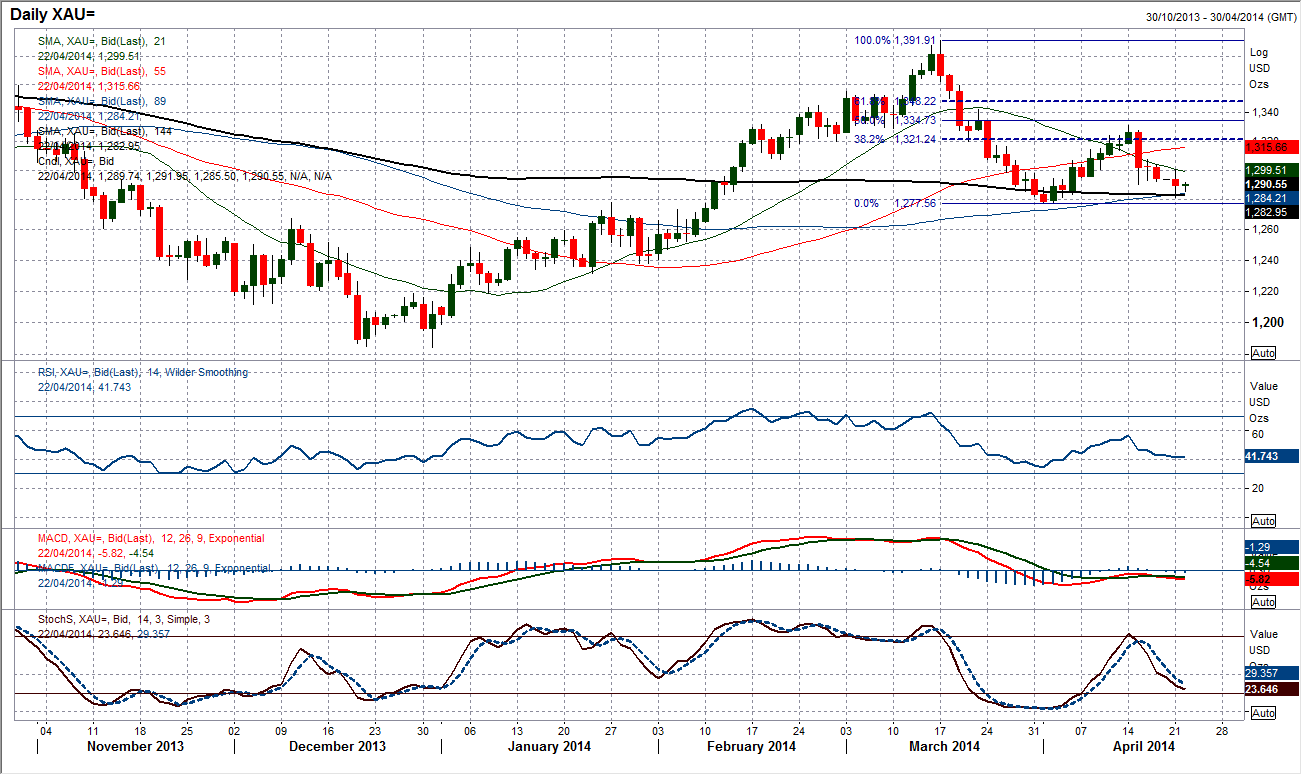

Gold

With the continued downside pressure of the past few days, the gold price is once more back into range of a test of the key 144 day moving average (currently $1282.95). Daily momentum indicators are not especially positive though and suggest that downside pressure is a problem still and a retest of the early April low at $1277.29 should not be ruled out. The hourly intraday chart shows that much needs to be done for the bulls to regain control, with rallies increasingly now being sold into. There is now resistance in the band $1300.90/$1304.30. Expect further pressure on yesterday’s low at $1281.40.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.