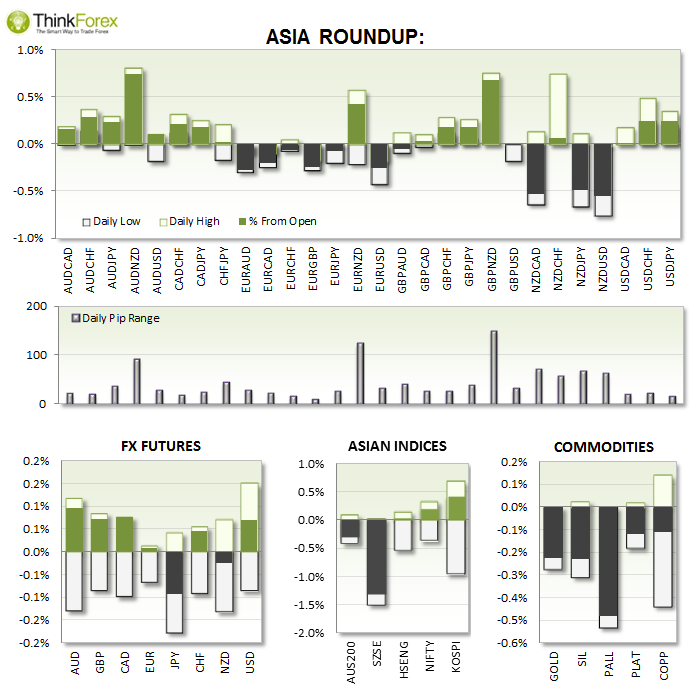

Early Asia saw continued strength from the USD as it gapped up against all majors. However the latter half was relatively quiet due to a lack of scheduled news and markets continue to absorb what was said over the weekend from Key figures at the Jackson Hole summit.

UP NEXT:

UK: Bank Holiday - as the major hub of FX transactions we can expect lower liquidity during London open.

US: With the Greenback still benefiting from Yellen's slightly more Hawkish stance then positive data should have even more of an impact to help support for USD. Check out today's video to see key levels for USD crosses but the pairs I suspect to provide the more clear trends are EURUSD, GBPUSD and USDJPY.

NZD: Early Asia session we have Kiwi Trade Balance where only a particularly strong number should help support the flailing Kiwi. It is forecast to be the lowest since September 2013 and in deficit for the first time this year, so only a surprise result in surplus is likely to be of benefit for NZD.

TECHNICAL ANALYSIS:

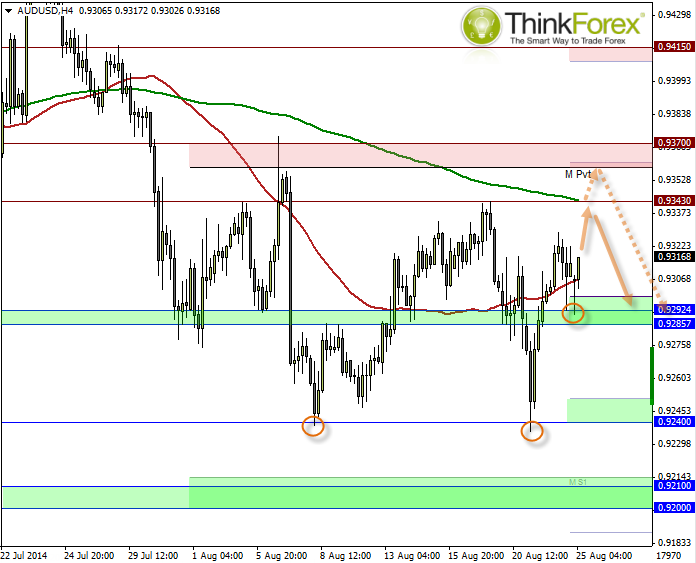

AUDUSD: Intraday bulls may take advantage of the range trading

Whilst we remain below 0.937 my bias remains for a run down to 0.920. However I thought we would have tested the 92c level last week. Instead we saw aggressive buyer around 0.924 to show solid support around these levels and it does make me question the likelihood of 92c. Early Asia trading has seen the Australian Dollar remain resilient against the Greenback and form intraday support above 0.9280. If we see any weakness from data tonight for the US the 0.9343 is a likely target, with a break above here likely to be capped by the 0.937 resistance zone.

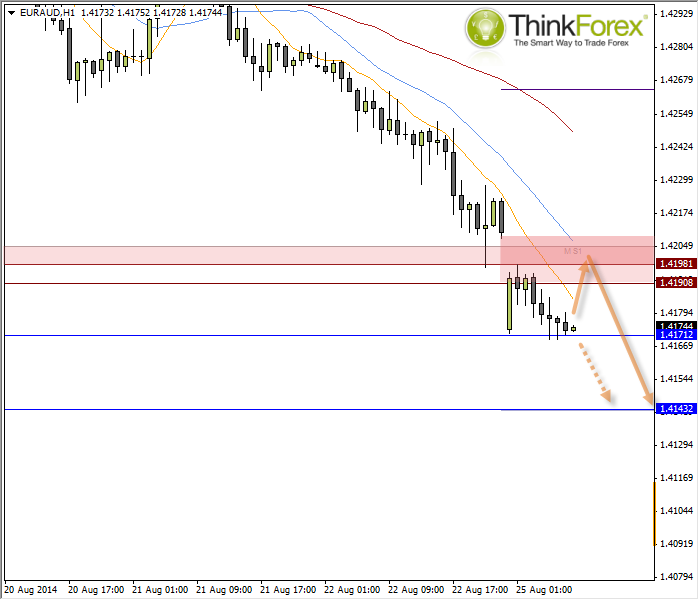

EURAUD: Looking to fade any rallies

Asia trading has seen 1.470 hold as support and with the weekend gap yet to be fully closed i suspect we may see a bullish run up to the support zone before the dominant bearish trend resumes.

That said we may not even see the gap close - in which case we can take a break below 1.417 as a bearish continuation and for price to target 1.41.

Due to the overwhelming bearish momentum I would prefer to not counter-trend trade, instead seeking opportunities to sell into any rallies.

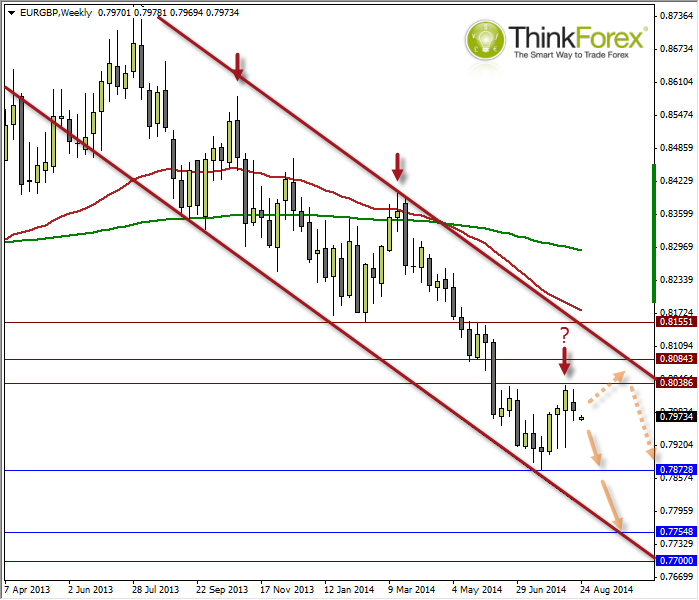

EURGBP: Suspect weekly charts have returned to dominant bearish trend

I suspect EURGBP has returned to its longer-term downtrend. It is still widely assumed that BoE will be one of the first major banks to increase interest rates, despite a spate of poor fundamental data. Interestingly despite the poor data Large Traders remain Net Long (according to data from CFTC) which suggests the declines seen against the US may be nearing an end. When you compare this to the increasingly fragile looking Euro then it would make sense for EURGBP to continue its bearish trend. Technically we saw a Hanging Man Reversal Candle 2 weeks again which was followed by a small, bearish Inside week to then gap down during Asia trading on Monday. Combined this suggests we have seen a top at 0.8035 and for the bears to target 0.79 and 01.787 (2014 low). A break below here should then target 0.78 and 0.775 over the coming months.

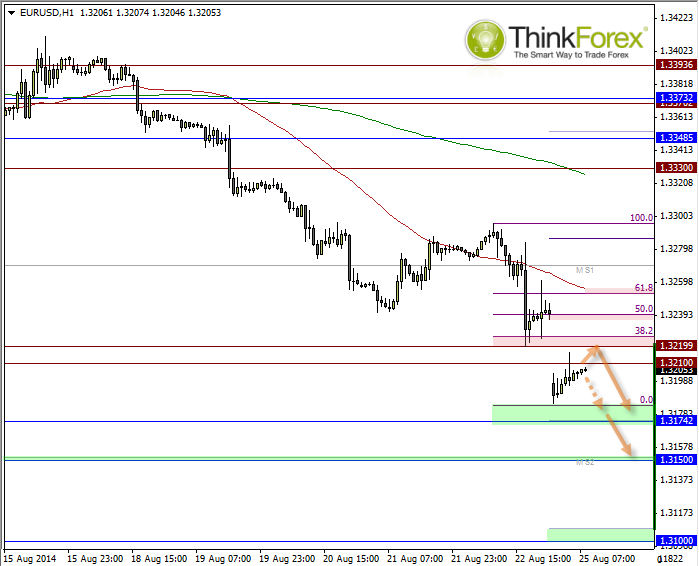

EURUSD: Further downside still looms

Due to the bearish momentum and shallow pullbacks then short positions will continue to be favoured. We have already seen a high-test wick to suggests a reluctance to trade higher, however as we have European and US news out later we can also allow for further spikes higher before the bearish trend resumes.

Only a break above 1.33 warns of a much larger retracement. However if we break above 1.325 then EURUSD becomes a 'stand aside' candidate until further directional clues are provided. Until then the downside continues to loom.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.