Good morning from a sunny Hamburg and welcome to our last Daily FX Report for this week. Thailand’s army chief seized control of the government in a coup yesterday, two days after declaring martial law. He said the military had to restore order and push through reforms after six months of turmoil. Beyond that a Turkish bystander who was shot in the head during clashes between Turkish police and protesters has died yesterday.

We wish you a relaxing weekend!

Market Review – Fundamental Perspective

Yesterday, the Dow Jones Index of shares rose 0.1 percent and the Standard & Poor’s index climbed 0.2 percent. On Thursday data showed that U.S. manufacturing growth pickep up to a three-month high in May while private business activity in the euro zone increased at just under its fastest pace in three years. The U.S. Manufacturing Purchasing Managers Index climbed to 56.2 in May from 55.4 in April. On the other hand there was a bigger than estimated increase in U.S. weekly jobless claims. Yesterday data also showed that euro zone composite PMI for May as forecasted declined to 53.9, coming from 54. But some economists said that this data still pointed to quarterly growth of around 0.3 - 0.4 percent. Nevertheless the data also revealed that there is a big split in the euro zone’s two largest economies because France contracted in market manufacturing and services while Germany bounded ahead in market services. As a result the EUR dropped to almost a three month low versus the USD while anti-establishment political groups seek to win power at polls this weekend in Europe. The EUR/USD decreased 0.2 percent to 1.3655. The JPY weakened the most in two weeks as a report signaling an improving outlook for Chinese manufacturing and damped haven assets. The USD/JPY strengthened 0.4 percent to 101.75 and the EUR/JPY gained 0.1 percent to 138.95.

Yesterday, reports showed that U.K. first-quarter gross domestic product advanced as estimated 0.8 percent. The GBP decreased versus 12 of its 16 major counterparts as the market expects the first interest-rate rose since 2007. The GBP/USD tumbled 0.3 percent to 1.6860 and the EUR/GBP was at 0.8093. The GBP is the best performer among 10 developed-nation currencies, as it advanced 10 percent in the past 12 months. Released minutes of the Bank of England showed that officials decided to keep benchmark interest rate at a record-low 0.5 percent.

Daily Technical Analysis

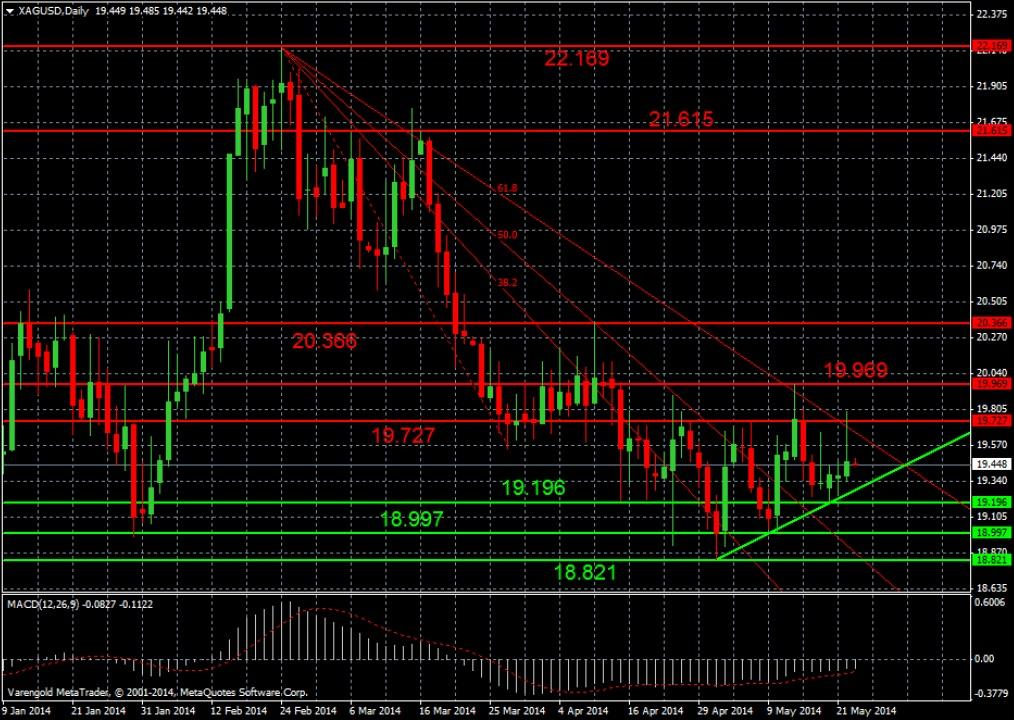

XAG/USD (Daily)

At the beginning of this week we estimated a further decrease for silver versus the USD but as you can see the XAG/USD was able to move slightly out to the fan but rebounded at the resistance level around 19.72. We assume that the sideways trend will come to an end if the metal continues to climb along the current trend line, supported by the MACD.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.