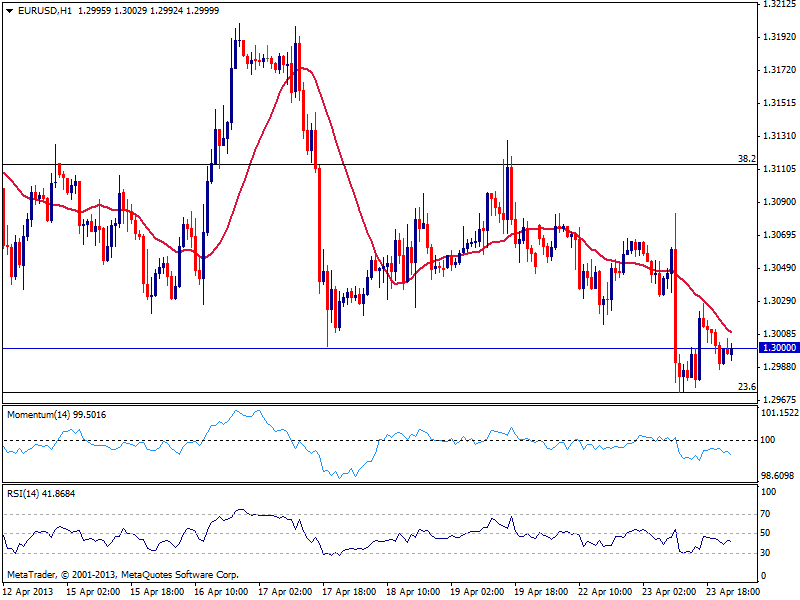

EUR/USD Current price: 1.3000

View Live Chart for the EUR/USD

Long day across the world this Tuesday, with another round of disappointing PMI’s in Europe, a bogus tweet reporting an attack to the White House, and overwhelming earning reports in the US that sent US indexes strongly up, erasing a good part of last week fall. And despite the strong risk appetite, the EUR/USD ends the day to the downside, having been unable to recover after PMI readings. The pair tested a low around 1.2970, which stands for the 23.6% of the 1.3710/1.2744 fall, with bounces then limited by a strongly bearish 20 SMA in the hourly chart currently around 1.3010. In the mentioned time frame, indicators head south below their midlines, supporting the negative bias, while the 4 hours chart technical readings are also heading lower in negative territory. Overall, recoveries up to 1.3040/70 area may be understood as selling opportunities, with a break below 1.2970 favoring a retest of key 1.2880 support.

Support levels: 1.2970 1.2925 1.2880

Resistance levels: 1.3040 1.3070 1.3115

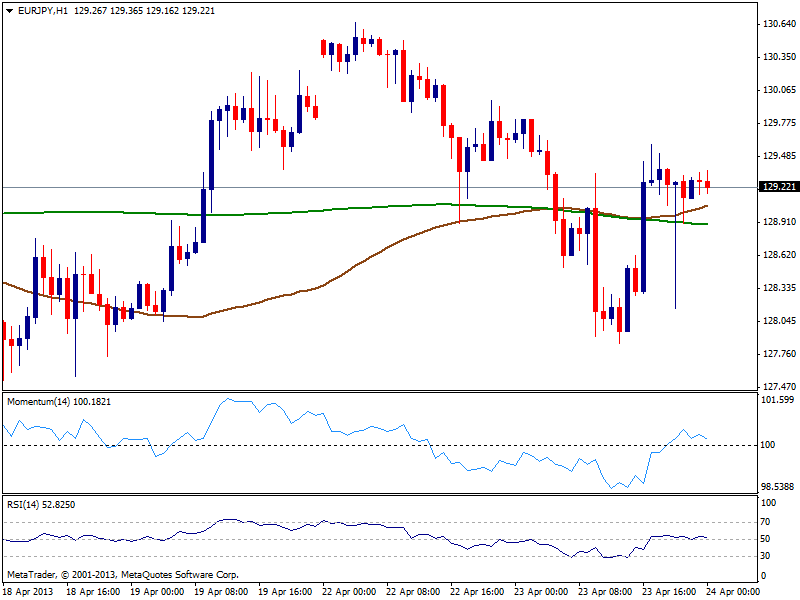

EUR/JPY Current price: 129.22

View Live Chart for the EUR/JPY (select the currency)

EUR/JPY ended up lower, as EUR weakness overcomes JPY one since early week. The pair however has managed to hold above the 129.00 area, although lacks upward momentum at the time being: the hourly chart shows indicators flat barely above their midlines, while price struggles just above 100 and 200 SMA’s. In the 4 hours chart a certain negative tone develops, although needs to be confirmed with steady losses below the 128.80 area, at least for today. Risk to the upside for current Asian session comes from the possibility of local share markets surging to fresh highs following their overseas partners; in that case, steady gains above 130.10 should open doors for and advance towards 130.60, while a break above this last should signal a retest of the 131.20/30 price zone.

Support levels: 128.80 128.20 127.60

Resistance levels: 130.10 130.60 131.30

GBP/USD Current price: 1.5235

View Live Chart for the GBP/USD (select the currency)

Pound lost its shine over the US session, as a recovery towards 1.5290 quickly attracted sellers, sending GBP/USD back towards the 1.5220 support zone. Entering Asian session, the hourly chat shows indicators heading south below their midlines, as 20 SMA gains bearish slope above current price. However, early bounce higher found support around 1.5190, a strong Fibonacci level that converges now with a daily ascendant trend line coming from 1.4830, March low. As long as above the level, the pair has little room for slides, yet once below, sellers should gain strength as buyers stops get triggered, sending the pair down towards 1.5150 first, ahead of 1.5100 later today.

Support levels: 1.5225 1.5190 1.5150

Resistance levels: 1.5260 1.5295 1.5330

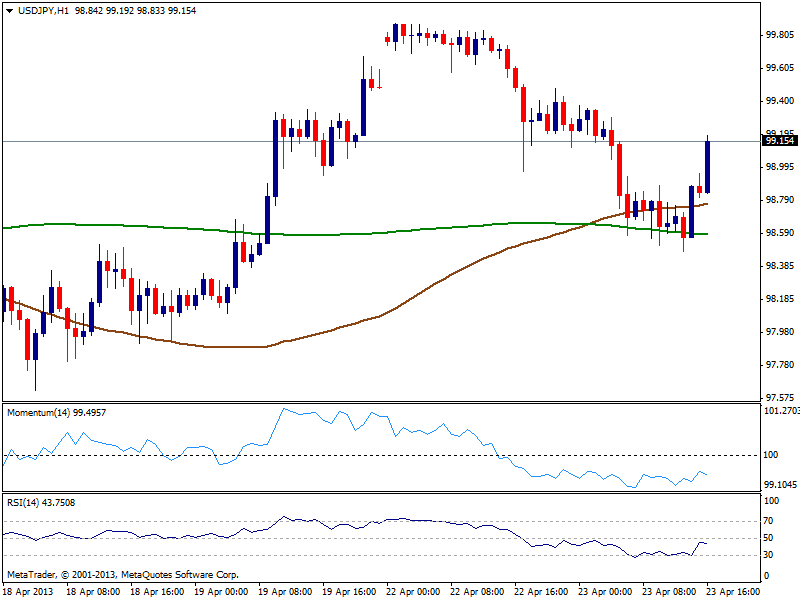

USD/JPY Current price: 99.15

View Live Chart for the USD/JPY (select the currency)

The USD/JPY was the most affected with the bogus news of a bomb in the White House, with the pair suffering a knee jerk down to 98.57 before quickly bouncing back to previous levels. While 100.00 continues to be “almost there”, market seems scared to extend price up to the level, showing demand decreasing as soon as price overcomes 99.00. Anyway, and for the short term, bias remains bullish according to the hourly chart, with price standing above 100 SMA and this last above 200 one, first time in over a week. Technical readings in the mentioned time frame hold in positive territory although beginning to look slightly exhausted to the upside, anticipating at least some consolidation before next move. Bigger time frames maintain a positive technical tone, supporting the general market idea of dips being buying opportunities. Steady gains above 99.50, should anticipate and approach to the elusive 100.00 area, while once above, the pair has scope to extend up to 102.00 this week.

Support levels: 99.00 98.60 98.20

Resistance levels: 99.50 100.00 100.35

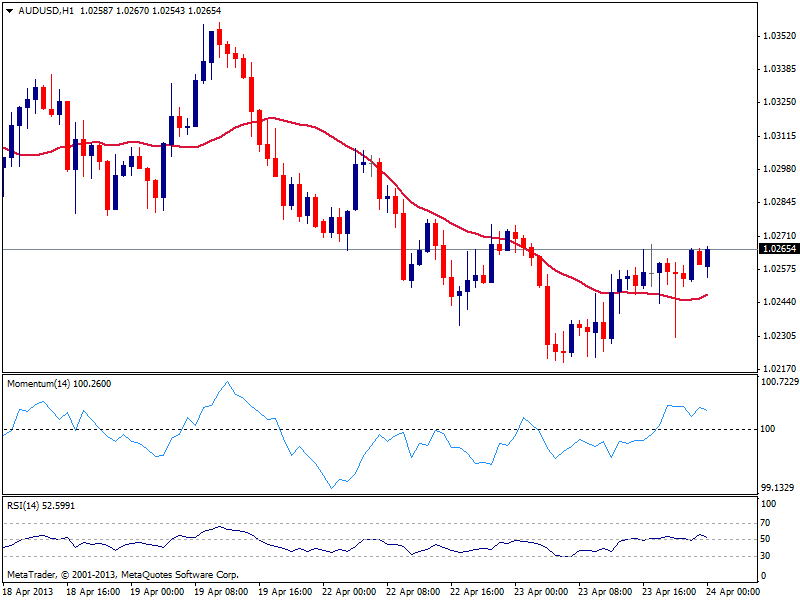

AUD/USD: Current price: 1.0265

View Live Chart for the AUD/USD (select the currency)

Having been as low as 1.0220, Australian dollar recovery against the greenback stalled at current levels, despite stocks soaring, reflecting the lack of buying interest around. The hourly chart shows price standing above a flat 20 SMA while indicators lose upward potential, holding in positive territory. In the 4 hours chart technical outlook remains bearish, with 20 SMA capping the upside around 1.0280: only steady gains above this last may see a stronger recovery in the pair, with immediate target around 1.0330 price zone.

Support levels: 1.0220 1.0180 1.0130

Resistance levels: 1.0280 1.0300 1.0335

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.