- Australian economy expected to have added 10,000 new jobs in January.

- Wages’ growth remains stagnated at 2.2% YoY and well below trend.

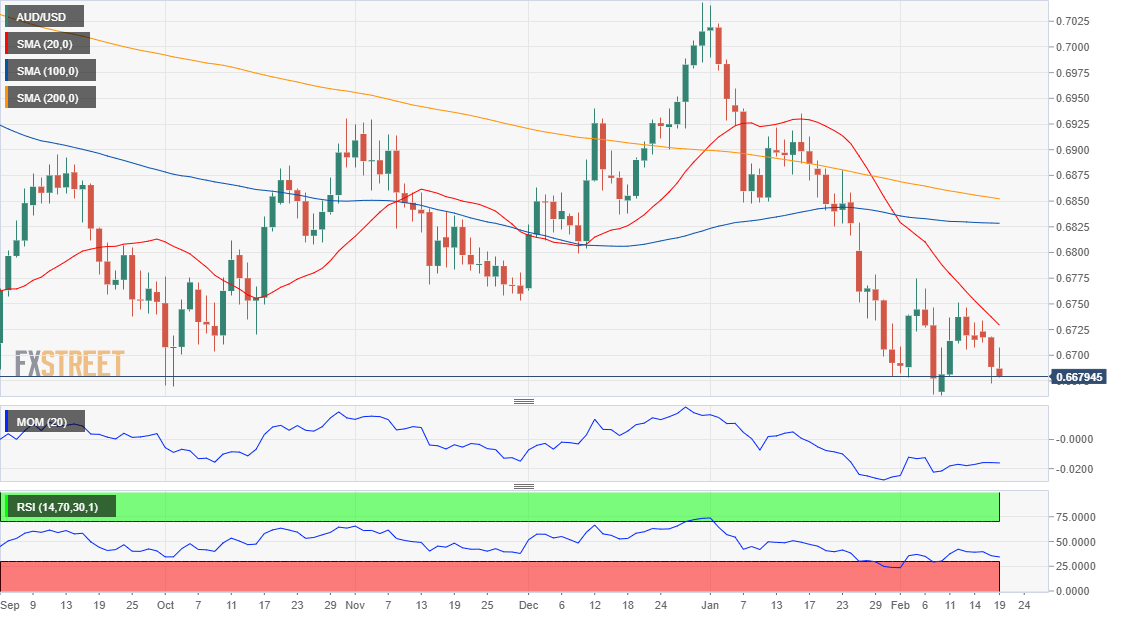

- AUD/USD at risk of breaking through an over one-decade low of 0.6661.

The AUD/USD pair is battling with the 0.6700 figure and not far from over a one-decade low of 1.0661 heading into the release of Australian employment data. The country is expected to have added 10,000 new jobs in January, after adding 28,900 in the previous month. However, all of these positions were part-time, as the country lost 300 full-time positions. The unemployment rate is seen ticking to 5.2% from 5.1% while the participation rate is seen steady at 66%.

Coronavirus hitting economic growth

The Australian economy has been performing decently in terms of growth, as the country’s GDP has been positive for almost three decades. Depressed inflation and stagnated wages’ growth, however, have forced the central bank to cut rates three times last year to a record low of 0.75%.

RBA´s Governor Lowe said that the economy was in a “gentle turning point” a couple of months ago, but then came the wildfires that affected millions of acres and would mean a sharp drop in GDP growth, as the losses are estimated in more than $100 billion. To top it all, China’s coronavirus outbreak is taking its toll on global growth.

The world’s second-largest economy has been adding stimulus to smooth the effects of having half country paralyzed in quarantine, but clearly, it was not enough. Big names such as Apple and Adidas have already warned they won’t be able to meet sales expectations due to shutdowns in China. Fear rules, and while there are temporal relief recoveries, the situation is far from over.

The RBA has acknowledged the risk of the outbreak in its latest meeting, opening doors for a rate cut.

Unimpressive wages’ growth

In the meantime, Australian wages’ growth remains stagnated. The latest quarterly Wage Price Index showed that wages were up by 0.5% QoQ and by 2.2% YoY by the end of 2019, matching the previous quarter figures, and well below average. Depressed salaries have been affecting household consumption. Cutting rates to boost consumption risks creating a bigger problem, the possibility of a borrowing bubble in times debt is at all-time highs.

The RBA would be in a much more comfortable place if the unemployment rate comes down to 4.5% and annual wage growth jumps above 3.0%, both had to achieve throughout this year, moreover with the current Chinese crisis.

AUD/USD possible scenarios

A better market mood ahead of the release is helping AUD/USD to stay afloat, although unable to run beyond the 0.6700 level. A critical support level comes at 0.6661, the low set this year and a level previously seen in March 2003.

The pair is heading into the release down for a fifth consecutive day, which somehow suggests that the market needs little to push it further lower. Large stops should be gathered below 0.6660, and once triggered, may spur a bearish run toward the 0.6600 level.

Upbeat numbers could trigger some profit-taking, leading to a bullish correction. However, it seems unlikely that the pair could sustain gains beyond the 0.6740 price zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.