Today should be fairly quiet in Asia with very little on the economic calendar. Most attention will be on the Yen and comments from the new Japanese PM Abe in the weekend press where he started to lay out very aggressive plans for weakening the Yen and beating deflation.

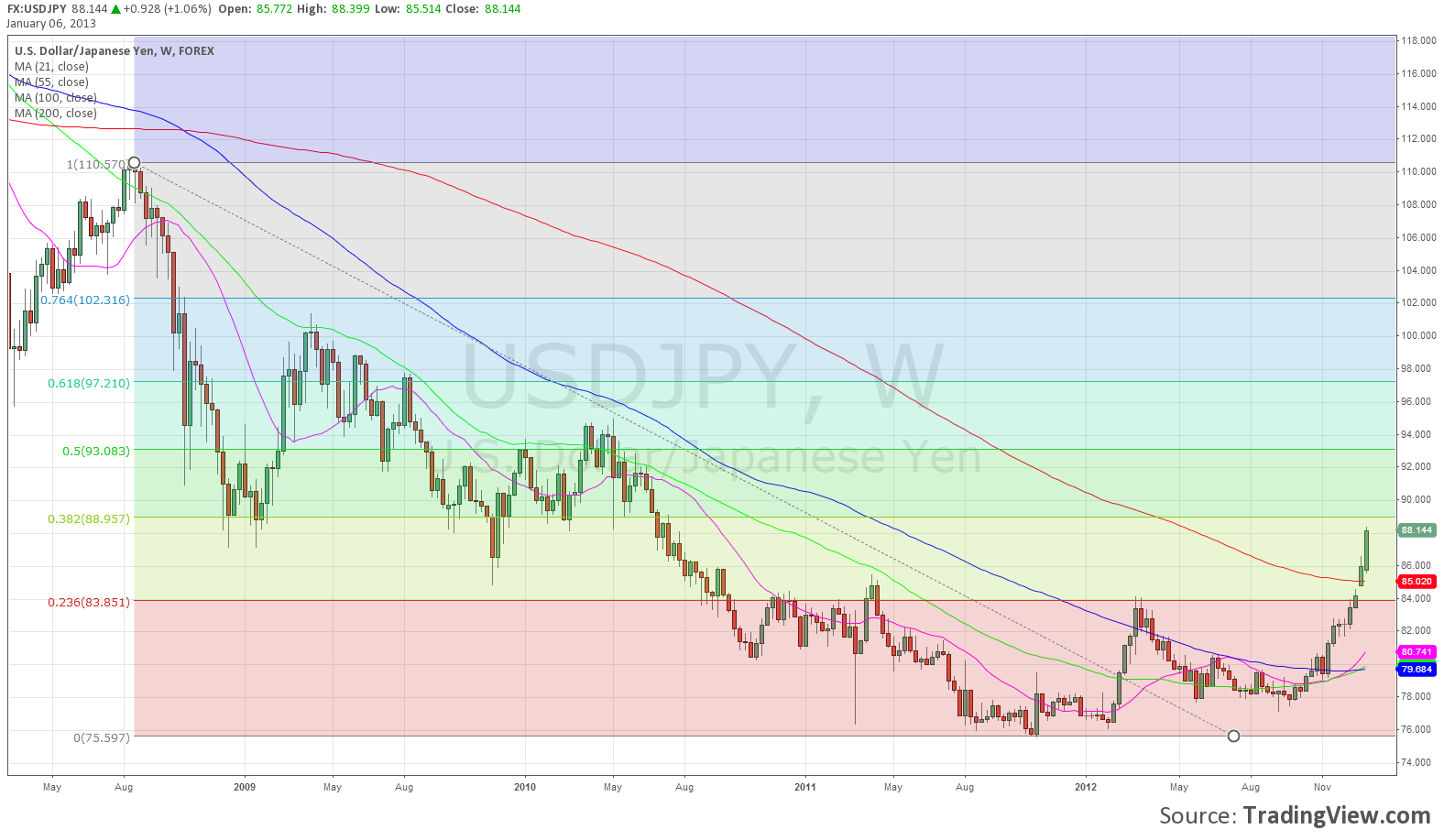

We need to look to the USD/JPY weekly chart (see chart) to find the next big technical resistance level but it is an important one. The 38.2% retracement of the big fall from 110.60 to 75.60 comes in just below 89.00 and this level should be respected. The market is of course very long already so decent sized pullbacks are possible at any time and the important levels to watch will be those that attract ‘trailing stops’. I’m guessing that they will now start below 87.30.

EUR/JPY is also in a very steep uptrend but with a top now formed on the daily chart below 116.00, (see chart) retracements are certainly possible. Even a modest pullback to the 21-day MA would take us back to 111.00 so I prefer the sell-rally strategy intraday with stops clearly above 116.00. Much will depend on how the market reacts to the Abe comments from the weekend.

EUR/USD still looks modestly constructive overall (see chart) but short-term moves will depend a lot on what happens in EUR/JPY. If the cross suddenly starts to

retrace then EUR/USD could easily fall back towards 1.2800 without endangering the medium-term outlook. Keep your trading hat on here and don’t get carried away with big fundamental views, as we will remain at the mercy of cross flows and sentiment.

The same applies to AUD/USD, which is stuck in a 1.0350/1.0550 holding range while the markets try to figure out whether it’s Asian growth, risk sentiment, interest rates or something else it should be focussing on? Once again, range trading is still the best option here.

The GBP and CHF aren’t really moving away from the EUR to any great degree so everyone will remain a Yen trader for now!

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.