When it comes to trading and markets, at Online Trading Academy we tend to think different than conventional wisdom. The reason for this is we are focused on reality based trading and investing. One of the things I am always fascinated with his how we are taught to do certain things and how we learn, specifically when it comes to anything that has to do with competing. In the United States for example, we compete for jobs, money, better this and better that… Have you ever realized that in the biggest democracy in history, our school systems don’t teach classes on how to compete? In capitalism, there is typically a winner and, unfortunately, a loser, yet people in this country are rarely taught in school how to compete or think differently. In fact, it’s the opposite. The natural education path of our school systems train everyone to think the same way. This is bad news for those who have herd mentality blinders on and great news for those who focus on the simplicities and opportunities of competition. It all begins with thinking different. If you bring herd mentality mindset to competing in the trading markets, you will likely hand your account over to those who think different and think the markets properly.

The books that teach conventional Technical Analysis tend to teach it the same way which offers little to no edge. Be careful taking the same action the masses do in the markets, they are not the ones who consistently profit. This does not mean throw all your conventional information out the window. Instead, let me help show you some different ways to use some conventional tools.

Trend Analysis

Most people know all about assessing a trend. Typically, people look to see if the market in question is making higher highs and higher lows for up-trends or lower highs and lower lows for down-trends. Others use moving averages to determine whether they are sloping up for up-trends or down for down-trends. These are the two most popular ways to asses a markets trend. Thinking different, another way to assess trend is to look at the pivot lows in up-trends and pivot highs in down-trends. Let’s take the up-trend for our example. Looking back at recent prior data in any market on a price chart, it is easy to see what the current trend is. What is equally important is to assess how healthy the current trend is and when and where it may end. One way to do this is to measure the distance between the lows of the pivots that make up the up-trend. Notice the uptrend in the chart below, the distance between the pullbacks (pivot lows) is decreasing as the trend moves higher. This means the trend is becoming weak and is likely to end soon. The logic behind this is that a strong trending market does not pullback often. If it does, it is not a strong trending market anymore. Keeping with our constant supply and demand theme, remember that a trend on any time frame is really a supply and demand imbalance moving back into a price level of temporary balance. This is a larger time frame chart but the assessment can be done in any market, and any time frame. Lastly, take a look at a current chart of the S&P or any major equity index market on a weekly/monthly chart, they are strongly suggesting a weak market.

Moving Averages

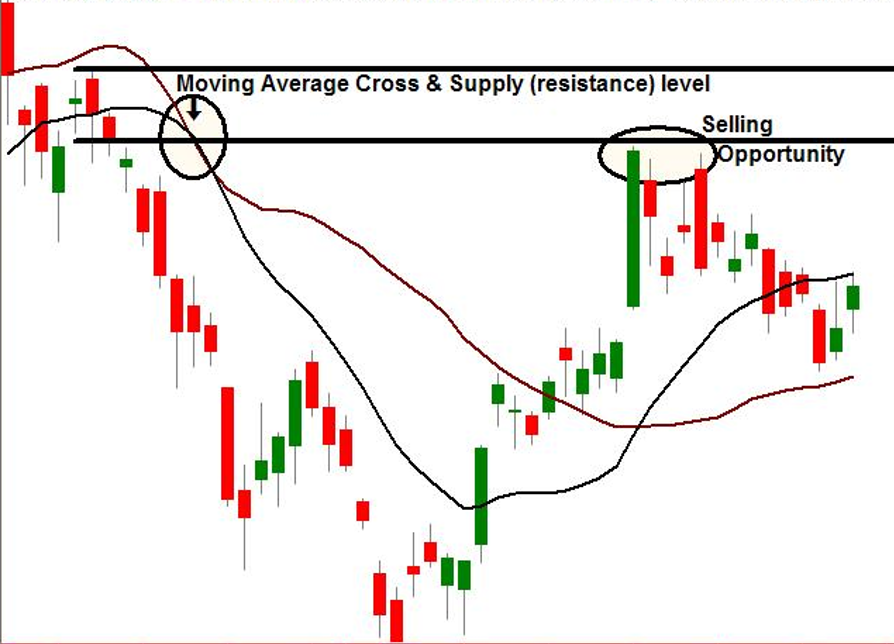

Moving averages (which I don’t use) are another common piece of conventional Technical Analysis (which I don’t use). The two ways most traders use them are first, to determine trend by looking at the slope of the moving average. Second, they use the moving average cross to time an entry (buy or sell signal) into a position or an exit out of a position. This technique is very flawed in that moving averages by definition will lag price; they have to. Adding any tool that lags price to the execution portion of your trading plan adds risk and decreases profit zone and we don’t want that. Again, instead of thinking the same way as your competition, let’s take a slightly different view of moving averages in a way that may help us gain an edge over our competition. Notice in the chart example, I have circled the moving average cross. Moving averages cross because there has been a relatively strong move in price. At the origin of a strong move in price, demand and supply are out of balance. Price levels where demand and supply are out of balance is where we typically find low risk, high reward and high probability trading opportunity. So, try identifying moving average crosses in the past and let that lead you to investigate the price action in that area. Chances are high that you will find a key demand or supply level there. In other words, when you find a moving average cross above or below current price, look slightly to the left of the cross and investigate the price action as that is where the origin of the strong move likely was, which means a demand / supply imbalance.

These are two examples of how you can take conventional Technical Analysis, look at it and use it slightly different than your competition in hopes of attaining an edge. While I don’t use these two examples in my own trading, I make sure that my tools and strategy are VERY different from my competition, almost opposite, but most importantly “reality” based. The purpose of today’s piece was to encourage you to think different and not follow the herd and their very flawed thought process.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.