![]()

This week I would like to continue our look into the various methods of profit taking that we started two weeks ago with a discussion on steps to take after your trade starts showing profits.

As we talked about last time, taking a small loss on a trade can be easy as it is generally over quickly (when you use a stop-loss order) and we can move on to the next opportunity. However, students I work with often struggle with what do when they are in a profitable trade and need to manage it to its full capacity. Let’s face it, nobody ever wants to close out a winning trade when it is doing well, because winning feels good and you want to make as much as you can when the market is on your side. Then again, we don’t want to give back a solid profit and end up walking away from a winning trade when it turns back into a losing one either, or maybe just wind up breaking even. The simple solution to deal with our profit taking demons is to have a plan before you take the trade that details strategies for various outcomes as the trade develops. Making your mind up what to do when the trade is already underway is the worst thing to do as there will be far too many emotions involved. So as I say, we plan out what we are going to do before the market actually does it.

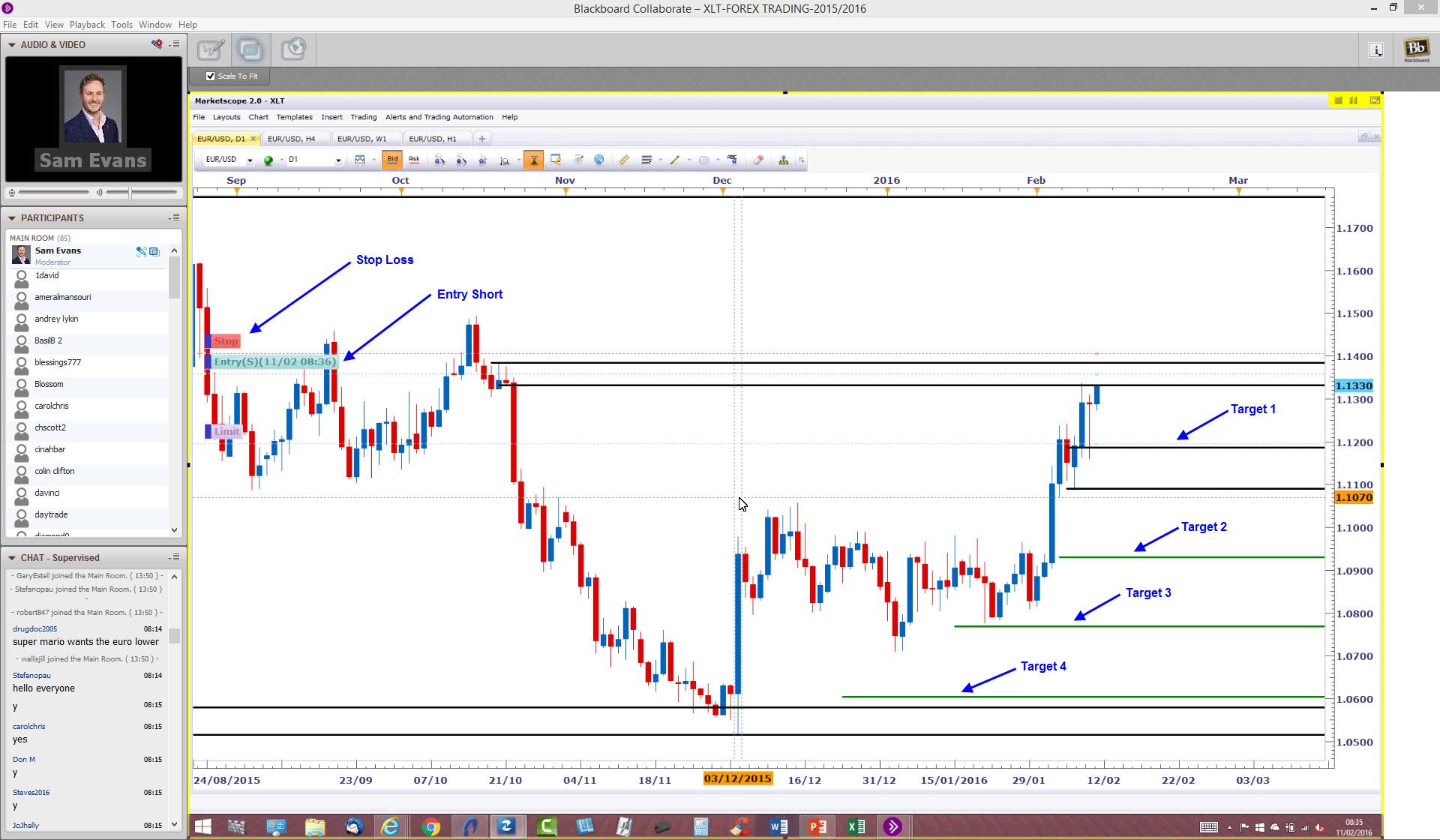

Now I will explore 3 different ways to take profits and the various implications of each. You may remember, in the last piece we looked at a trade setup that was planned in our live XLT Forex program, a short on the EURUSD with multiple targets. The setup looked like this when it was planned:

At the point of publishing the first article, the EURUSD had already fallen to our first target where it was stalling a little before making up its mind where to move to next. It looked like this:

Here are 3 different profit-taking scenarios. There is no right one to use, but rather each offers different outcomes depending on the individual’s trading style and temperament.

All In All Out

For some traders, the first target of 1.1105 offered a more than acceptable profit, when the original short on the pair was executed at the above supply zone in the region of 1.1362, allowing much more than a basic 3:1 reward to risk ratio. This option would have meant that we would have entered into the trade with our maximum position size at the level of supply and then exited the full amount allowing no other profit taking later at the lower level of demand. This method gives a healthy profit. However, due to no partial profits being taken it does require more mental solidarity because you either win or lose with nothing in between, which some newer traders can find challenging at first.

Scaling Out

The method of scaling out involves more than one profit target as the trader takes partial profits along the way as the trade moves further in the direction of profitability. Revisiting the above trading opportunity found in the XLT, you will see from the screenshot that I had drawn a total of 4 targets. After hitting the first target at demand, the EURUSD did in fact continue to the downside reaching more targets as you can see below:

Target number 2 was hit a few weeks later as the pair fell further, to as low as almost 1.0800, almost 200 pips more. Now of course, we could have still done an all in all out method but it would have been frustrating if the pair had reversed at the first target. Scaling out overcomes this by allowing us to take some profit off the table by closing out a portion of the trade at each subsequent target. For example, we could have taken off half of our trade at target one and moved the stop to breakeven, leaving us with a worst case scenario in which we are guaranteed to have made money and with zero risk on the remainder of the trade even if it retraces back to our original entry. This way we can allow the trade to continue to run with breathing space.

The only downside to this: you will never achieve the most powerful risk to reward ratios and will always compromise your profits because you are taking amounts off the table early and then leaving some to run. What you end up leaving running is a smaller amount of the original trade position which means you always make less money as it runs than you would have if the trade was still in its full size. It is easier on the emotions as it satisfies the need for profits and, as the risk is reduced early, the newer trader is more likely to allow the rest to run which gets them used to holding on for bigger moves as their skills develop over time.

Scaling In

This technique is by far the most profitable but is also the toughest on the emotions and is to be used by only experienced traders who already have a solid plan in place and a proven methodology. It involves adding to your original position you took at entry, only as the market moves in your direction of profitably. The result, if the trade is working out for you, is basically massive profits and by far the largest risk to reward profiles of all three methods. However, the negative is that as you add to the trade your average entry price becomes less favourable due the fact that you are buying more as it goes up or selling more as it goes down. Should the trade go in the opposite direction, your breakeven point becomes nearer to where you added in the trade thus giving you less wiggle room for a pullback. You must always have a final target in mind if using this technique, otherwise you run the risk of having a trade move nicely in your favour only to watch it retrace on you a small amount for you to be back at a nearer and newer breakeven point. Of course if it works, you will multiply your profits in a big way. It takes time to get your head around that but with some experience it could be worth the consideration.

So there we have 3 ways of profit taking to consider. As I said before, no one way is better than another but they do each have very different outcomes if used in a rules-based manner alongside our solid Core Strategy. The choice really lies with the trader and their own individual comfort levels and attitude to risk. I hope you found this useful.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

NZD/USD: All eyes on RBNZ guidance and new Governor Breman's debut

NZD/USD opened Tuesday at 0.60344, reached a high of 0.60520 and a low of 0.60044, and closed at 0.60480, down 0.22%. The pair is holding well above the 50-day Exponential Moving Average at 0.59041 and the 200-day EMA at 0.58545, with both averages rising and spaced roughly 50 pips apart, confirming the underlying bullish trend that began from the January low of 0.57110.

AUD/USD extends the bounce, focus back to 0.7100

AUD/USD adds to Monday’s optimism and approaches the key 0.7100 barrier ahead of the opening bell in Asia. The pair’s positive performance comes as investors keep assessing the hawkish tilt from the RBA Minutes and despite humble gains in the Greenback. Next in Oz will be the Westpac Leading Index and the Wage Price Index.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

RBNZ set to pause interest-rate easing cycle as new Governor Breman faces firm inflation

The Reserve Bank of New Zealand remains on track to maintain the Official Cash Rate at 2.25% after concluding its first monetary policy meeting of this year on Wednesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.