Fortunately, there are enthusiast who have done most of the hard work already, hence showing what each trader should expect from its MT4.

Not to go into too much technicalities - standard MT4 platform could be upgraded in order to enhance trading performance and simplify day to day routines, all by incorporating key functionalities traders desire. After all what traders need is time to formulate and fine-tune trading strategy instead of navigating cumbersome online resources for much-needed functionality.

Below you will find a description of the most stand-out features (out of over 60 enhancements) of the handy MT4 build - MetaTrader 4 Supreme Edition, a version assembled with the help of few bright IT specialists and several demanding day-traders.

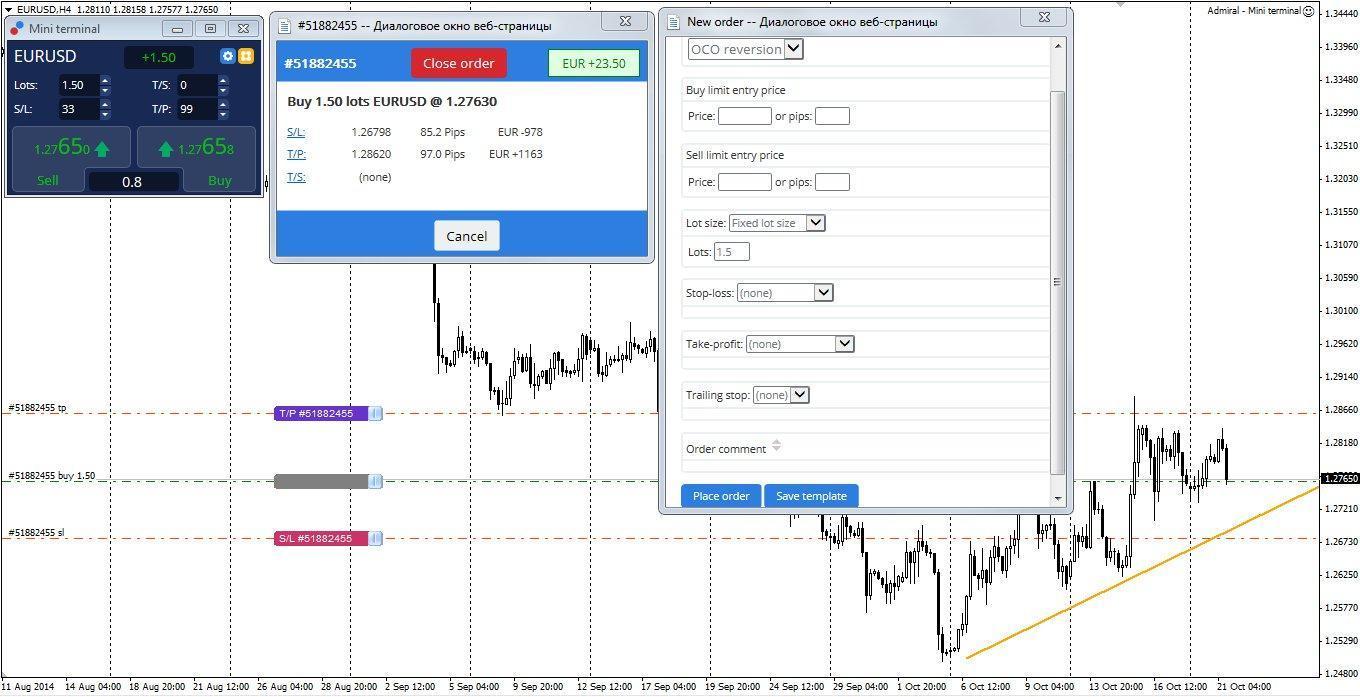

Mini Terminal

The Mini Terminal is an advanced version of the standard MetaTrader 4 one click trading feature, a compact window which enables you to do all the important trading tasks in a blink of an eye. Order and risk management has never been as straight-forward and flexible: setting stop-loss, take-profit and trailing stop, observing current spread - all in a single panel; chart trading; saving preferred trading conditions as a template; advanced order types and settings and many more!

For instance, chart trading allows you to amend order levels directly on charts in a fraction of a second. This feature comes really handy during fast market when your reaction has to be quick (yes scalping). Moreover, you can draw diagonal trend line which could be turned into stop loss and more features each trader would enjoy playing with.

Trade Terminal

The Trade Terminal enables you to monitor and place orders on multiple instruments at a glance. When it comes to managing several simultaneously opened positions and pending orders, this add-on is a do-everything tool, allowing you to multitask within a single frame, highlighting core idea of MT4SE - bridging convenience and effectiveness.Have you even tried to put yourself in the shoes of a professional trader or money manager? Now you are able to create your own Multi-Monitor experience undocking charts, news feeds, analysis tools or the Trade Terminal.

In case you don’t have multiple monitors, undocking feature comes handy to safely minimise the platform and perform other tasks while still keeping an eye on price movements.

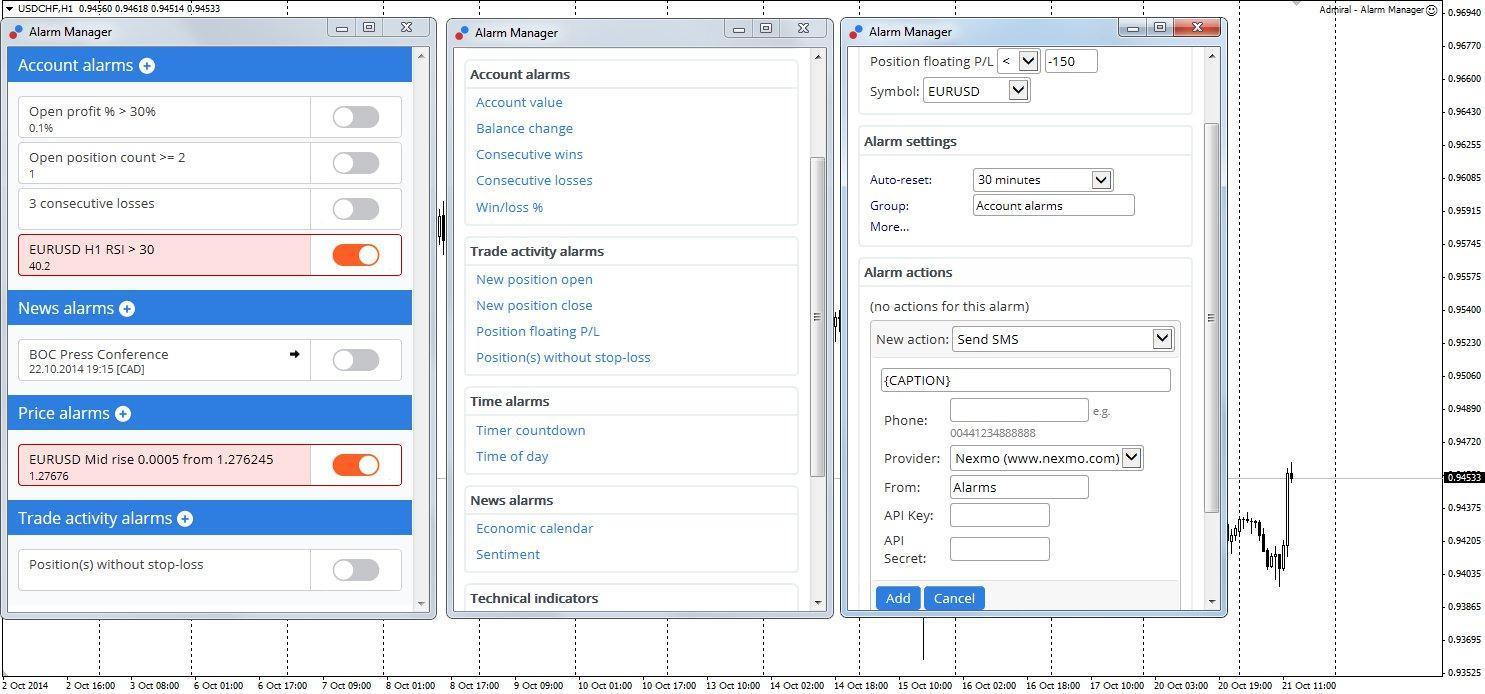

Alarm manager

The Alarm Manager lets you get all account & market notifications and construct an automatic actions when such events occur, automatically updating you via SMS, email or Twitter. Alerts can be set via the alarm tool which enables you to set triggers for multiple events concerning account criteria (margin, balance, profit, loss, etc.), news and sentiment, indicators, price movements, time and more.

Overall, Alarm Manager saves a lot of time and efforts so you can work with your strategy or take this well-required lunch break for once!

Correlation Matrix

This powerful add-on shows (in grid form) the correlation between symbols over a configurable time-frame and number of bars, e.g. the last 300 H4 bars. It brings a solid backup for your trading strategies and is an absolute necessity, given you trade 2+ instruments. Soon after launching MT4SE the Correlation Matrix will prove invaluable for you to plan trades and minimise risks.

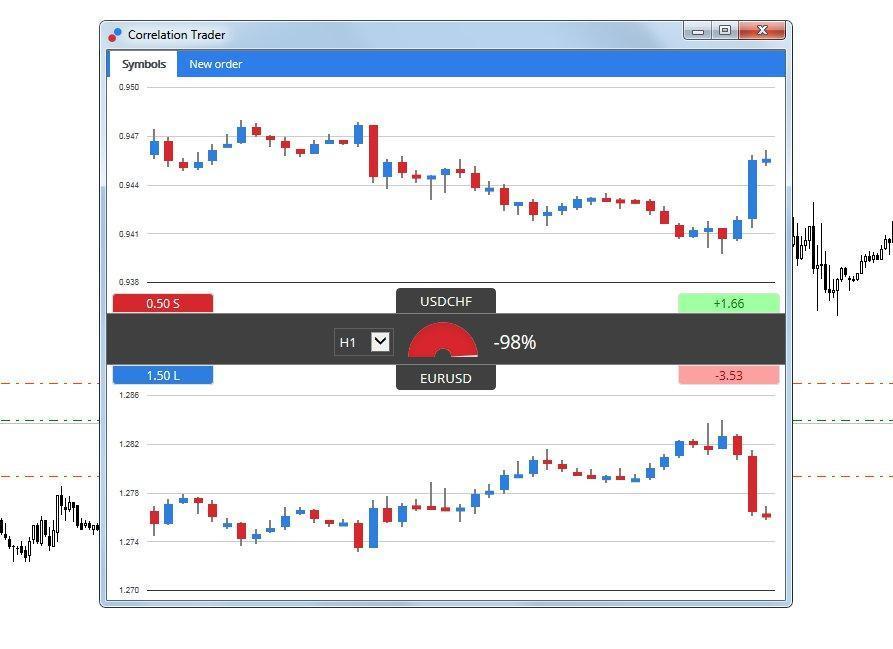

Correlation Trader

Shouldn’t come as a surprise, some pairs correlate better than others, so when currency pair moves in the same or opposite direction compared to another, it means they are strongly correlated; otherwise, correlation is weak or there is even no correlation at all.The Correlation Trader shows correlation between instruments in a form of charts. It helps you identify symbols with strong or weak, positive or negative correlations and fine-tune your trading strategies according to emerging differences in the analysed instruments.

Is there more to it? Of course!

There are more features to MT4SE, but only so much of an attention span the reader can handle - so we will leave you the liberty of discovering the rest of MT4SE.

Meanwhile, Let us know what is your favorite MT4 build and what is the feature(s) you value the most in MT4SE?

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.