- Many traders attracted to trading FX due to availability of leverage

- Clearly leverage can increase gains, but it also magnifies losses

- We take a look at the statistics on real traders to learn how we might use leverage effectively

Many traders are attracted to the FX market due to the wide availability of leverage: the ability to control a trading position larger than your available capital. And arguably for good reason; leverage can be an effective tool in allowing an investor to achieve desired returns on trading capital. Yet leverage magnifies losses and represents a key risk, and indeed our data and experience shows that it is often misused and leads to very large losses.

We studied 13 million real trades conducted by users of FXCM’s trading platforms to look for important insights into the use of leverage. Let’s start with what might be obvious: excessive leverage can lead to outsized losses. In fact, our data shows that there’s a fairly negative relationship between average leverage used and trader profitability.

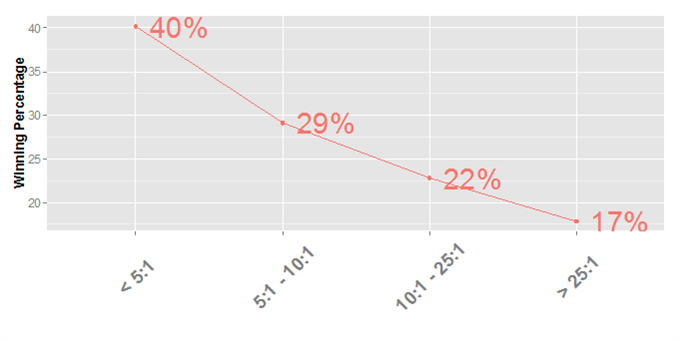

Percentage of Profitable Traders Grouped by Average Effective Leverage Used

Figure Data source: Derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across all currency pairs.

To understand Figure 2 we need to introduce the concept of Effective Leverage: Trade Size / Account Equity

As an example, a trader has $10,000 in her account and has opened a position in the USD/JPY with 100,000 units. 100,000 USD/JPY divided by $10,000 = 10:1 Effective Leverage.

Immediately we see a substantial difference in percentage of traders profitable as we vary Effective Leverage. Our data showed that 40 percent of all traders who used an average per-position Effective Leverage of 5:1 or lower turned a profit in the 12 months captured. If we move above 25:1, that ratio drops by more than half to a mere 17 percent.

The data suggests that using more and more leverage has made it significantly less likely that a trader is ultimately profitable. Why might this be the case?

In our first article on the Traits of Successful Traders, we highlighted the significance of trader psychology and why it could ultimately make the difference between profits and losses. Here we see a similar dynamic at play: using excessive leverage made traders less likely to ultimately turn a profit in a given trade.

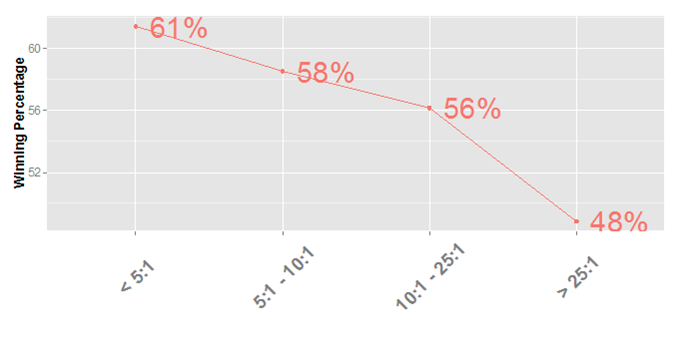

Trade Winning Percentage Became Worse as Leverage Increased

Figure Data source: Derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across all currency pairs.

Traders were considerably more likely to turn a profit on a given trade than a loss except when using over 25:1 leverage. The chart above shows that trades with leverage below 5:1 were profitable 61 percent of the time. On the opposite end, those with effective leverage above 25:1 were only profitable on 48 percent of all trades—a significant difference.

Excessive leverage can have key detrimental effects related to the mechanics of trading and a trader’s psychology. In terms of trade mechanics, using excessive leverage will give a trader has a smaller capital buffer against losses. If the trade initially goes against the trader there is a higher probability that the trader will run out of excess margin and receive a margin call. The trade does not have full room to draw down before it might ultimately move in the trader’s direction.

From a psychological perspective, controlling outsized positions can force a trader to act differently and less rationally than they would otherwise. In our first article we highlighted why natural human emotion might get in the way of trading success. With greater leverage comes greater individual risk on a trade—likely amplifying the effect of this key psychological bias. How might we look for a solution?

How Might we Fix This?

There are two inputs to the Effective Leverage equation: Trade Size and Equity. By varying either we can change the Effective Leverage used. What precisely might this mean? Let’s say that a trader opens an account with $10,000 in equity. A maximum of 5:1 or even 10:1 leverage would mean opening positions no larger than $50,000 and $100,000 at a time. Another way to manage Effective Leverage is the second input: Equity.

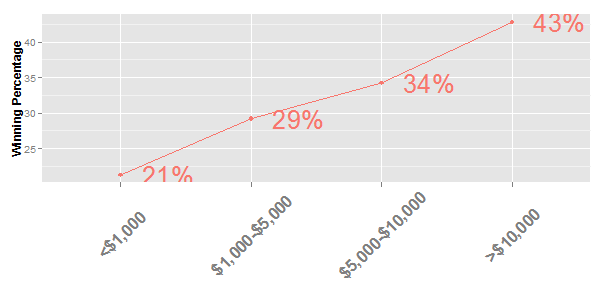

Given what we know about the relationship between trader profitability and Effective Leverage, it should be relatively little surprise to see a fairly clear link between average equity used and trader performance. At the low end, a mere 21 percent of traders with average equity $1,000 turned a profit in the 12-month sampling period.

Percentage of Profitable Traders Grouped by Average Trading Equity

Figure Data source: Derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across all currency pairs.

Those with more than $10,000 in average equity were more than twice as likely to be profitable at 43 percent. These stats look very similar to those on Effective Leverage and they’re almost certainly related. And indeed, those with under $1,000 in average equity used an average of 28:1 Effective Leverage, while traders with over $10,000 used an average of 5:1.

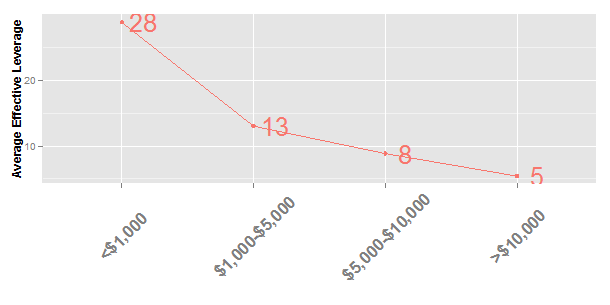

Average Effective Leverage Used by Average Trading Equity

Figure Data source: Derived from FXCM Inc. accounts excluding Eligible Contract Participants, Clearing Accounts, Money Managers, Hong Kong, and Japan subsidiaries from 4/1/2014 to 3/31/2015 across all currency pairs.

It makes sense that there’s a link between average Effective Leverage used an equity, but what does this ultimately mean for the trader? Put simply: know how much you expect to risk and set trading capital accordingly.

Manage Position Size and Equity According to Risk

In our first article we described a critical reason on why it’s so important to manage risk, and the takeaway was simple: always stand to gain at least as much as you stand to lose. In this sense we can manage trade size, equity, and ultimately Effective Leverage.

Let’s use an example to illustrate this point further. If a trader looks to open EUR/USDposition sizes of 100,000 units, each pip move in the EUR/USD will be worth $10. A Euro move from $1.1500 to $1.1600 would be a difference of 100 pips. In this example a 100,000-unit trade would generate a profit or loss of $10 x 100 pips = $1,000.

Keeping our profit target in pips and dollars constant, we get a sense from our data that we want to use Effective Leverage below 10:1 or even 5:1. Our 100,000-unit EUR/USD represents $115,000 (100k * EUR/USD at $1.15), and thus we would want at least $11,500 in equity to control such a position. Equity below this level or a position size above 10 times trading would put us into a very high-risk category and as such we’ll look to avoid.

We likewise saw that there was a positive link between account size and success rates. We can reasonably expect that many of those with greater account equity are those with more trading experience. And yet it’s difficult to ignore the fairly clear link between average Effective Leverage used and ultimate success rates.

Leverage used isn’t the only factor in ultimate trader success, but our data suggests that it can certainly work against the trader. And indeed many of our most successful traders operate on lower levels of Effective Leverage.

Editors’ Picks

EUR/USD struggles near 1.1850, with all eyes on US CPI data

EUR/USD holds losses while keeping its range near 1.1850 in European trading on Friday. A broadly cautious market environment paired with a steady US Dollar undermines the pair ahead of the critical US CPI data. Meanwhile, the Eurozone Q4 GDP second estimate has little to no impact on the Euro.

GBP/USD recovers above 1.3600, awaits US CPI for fresh impetus

GBP/USD recovers some ground above 1.3600 in the European session on Friday, though it lacks bullish conviction. The US Dollar remains supported amid a softer risk tone and ahead of the US consumer inflation figures due later in the NA session on Friday.

Gold remains below $5,000 as US inflation report looms

Gold retreats from the vicinity of the $5,000 psychological mark, though sticks to its modest intraday gains in the European session. Traders now look forward to the release of the US consumer inflation figures for more cues about the Fed policy path. The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the non-yielding bullion.

US CPI data set to show modest inflation cooling as markets price in a more hawkish Fed

The US Bureau of Labor Statistics will publish January’s Consumer Price Index data on Friday, delayed by the brief and partial United States government shutdown. The report is expected to show that inflationary pressures eased modestly but also remained above the Federal Reserve’s 2% target.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.