“The U.S. apartment sector is still the best and the brightest of all property types.” This is according to Peter Muoio PhD, chief economist for Maximus Advisors. Dr. Muoio goes on to say, “If the apartment sector were a train, it would be moving down the tracks at a good speed with plenty of continuing momentum. From an owner’s perspective, this is a very solid place to be. The current conditions allow owners to not only increase rental ranges but also improve the profile of their tenant base because there’s not a lot of choice for renters.”

Reis (provides data and services to the commercial real estate market) data shows nearly 39,000 units of absorption over the past 12 quarters. It has also forecast vacancies to hit a bottom of 3.8 percent by the end of 2016.

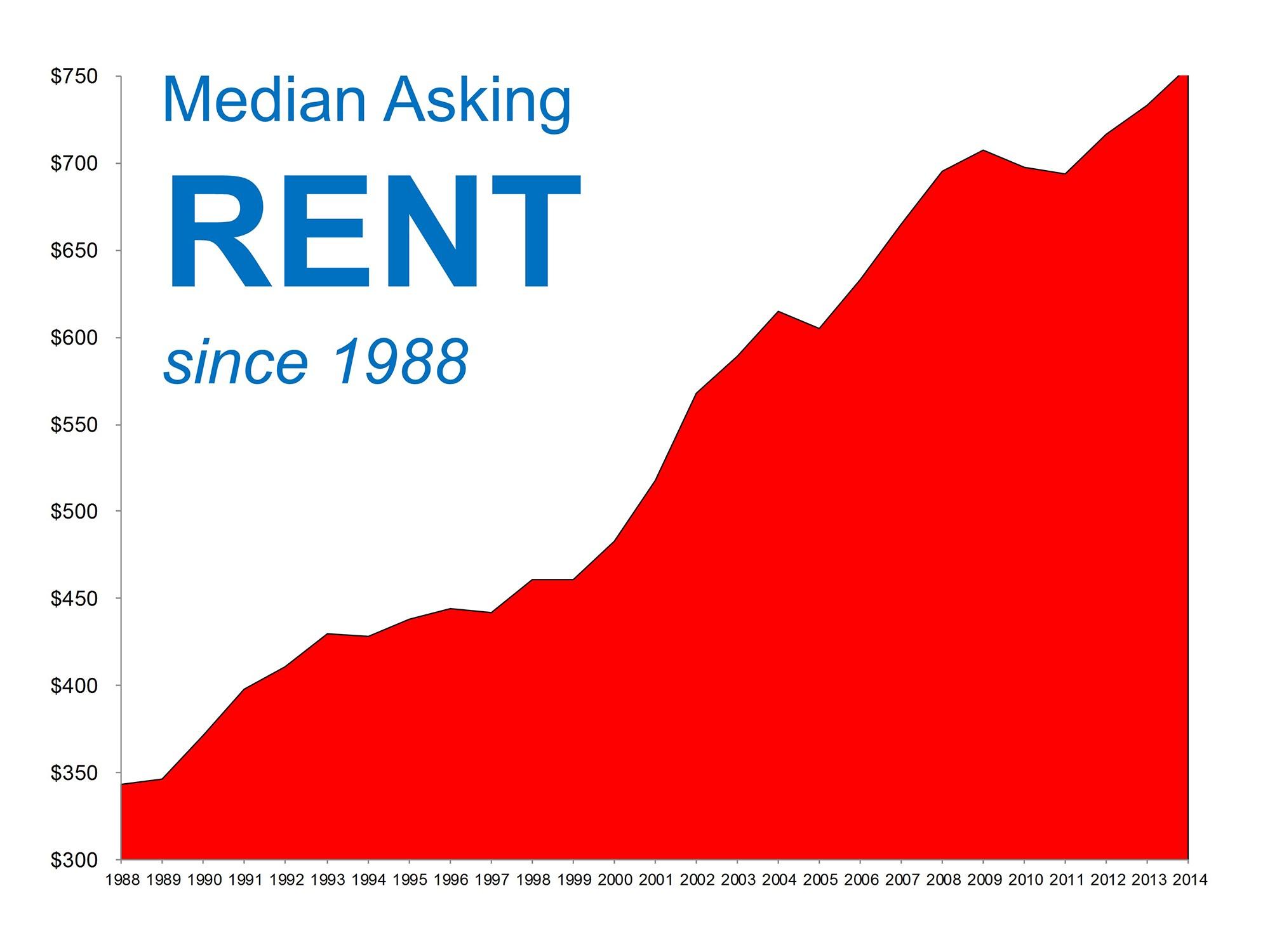

There are more units being rented (higher demand) which in turn increases rents. In fact, according to Dr. Muoio, effective rents are now nearly 10 percent above their pre-recession peak.

Where is the demand coming from? It’s coming from slowly increasing household formation. We continue to see improvement in the job market and consumer confidence increasing. This leads to household formation. The demand is coming mostly from the Millennials and Generation Y (Millennials and Generation Y are children of baby boomers). This segment is around 80 million people with most in their 20’s and early 30’s, the prime time for establishing households.

“We continue to view this large cohort of young adults as a key source of demand for apartments over coming years…” Muoio says.

So, you may not be in the position to invest in units right now, but there are several ways for you to capitalize on this rental boom. One of them may be as simple as renting out your current home.

Here is the scenario– you are considering moving up to a larger home or downsizing and you have equity and a down payment for your next home. So, you retain your current home as a rental and purchase the new one as your residence. Why would you considering doing this?

To move into the rental market slowly

The loan on your existing home will remain an owner occupied loan which is financially the most advantageous

Continue to build equity in the existing home and a new home

This strategy will also benefit you from a tax perspective. What was your home will now be an investment which means that now the interest on the loan is deductible, improvements will be deductible and you can depreciate the property. You need to check with you tax accountant about the legality of the deductions for your individual case.

You may also consider starting a partnership to purchase rental units. It is the perfect storm – prices on units are still reasonable, interest rates are low, rents are increasing and demand is high.

Want to know where the best places to purchase rentals are? According to Realty Trac these are the top 10 rental markets:

10. Hernando County, Florida • Annual gross rental yield: 17.29% • Vacancy Rate: 5.1%

9. Pasco County, Florida • Annual gross rental yield: 17.30% • Vacancy Rate: 8.9%

8. Columbia County, Florida • Annual gross rental yield: 18.42% • Vacancy Rate: 11.3%

7. Wayne County, Michigan • Annual gross rental yield: 19.88% • Vacancy Rate: 8.9%

6. Spalding County, Georgia • Annual gross rental yield: 20.35% • Vacancy Rate: 12.3%

5. Putnam County, Florida • Annual gross rental yield: 22.63% • Vacancy Rate: 6.3%

4. Howard County, Indiana • Annual gross rental yield: 24% • Vacancy Rate: 6.6%

3. Duplin County, North Carolina • Annual gross rental yield: 24.4% • Vacancy Rate: 8.8%

2. Clayton County, Georgia • Annual gross rental yield: 26.88% • Vacancy Rate: 16.9%

1. Edgecombe County, North Carolina • Annual gross rental yield: 41.57% • Vacancy Rate: 11.1%

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.